Tip 6

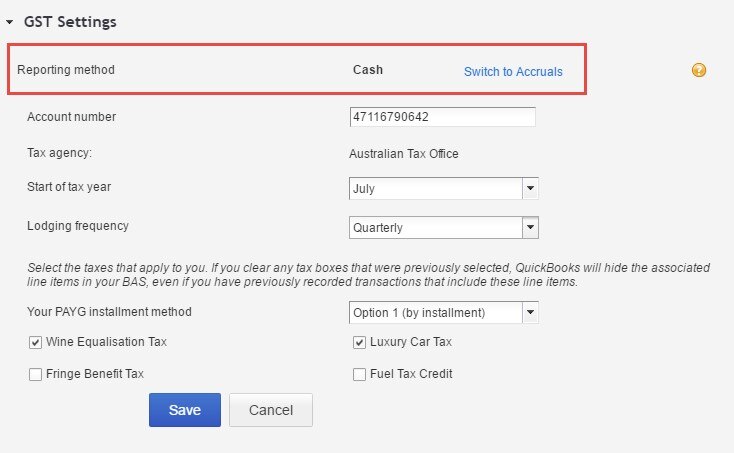

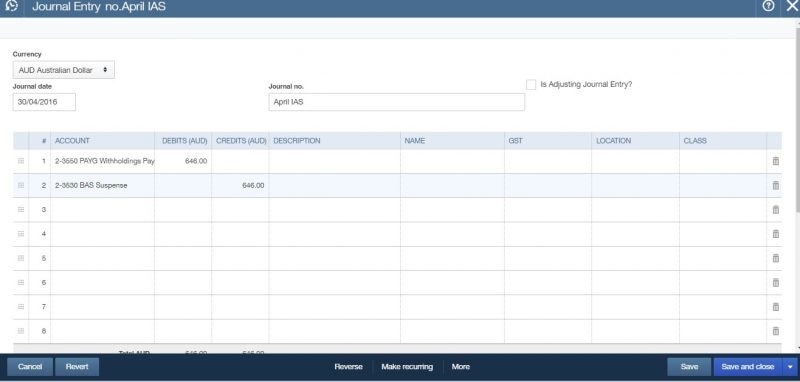

Instalment Activity Statement – Monthly reporting for PAYG.

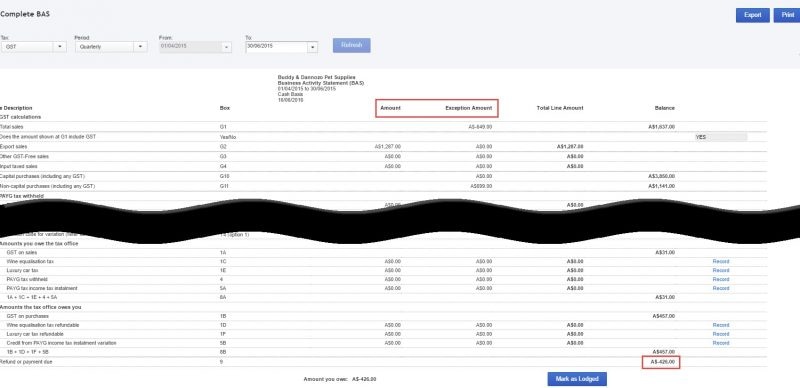

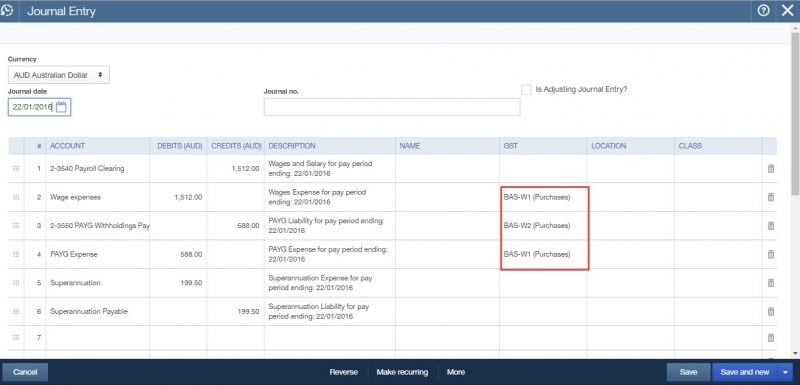

The PAYG Tax withheld total salary (W1) and Amount withheld (W2) in the BAS Summary and BAS Completed worksheet is picked up from the journals created upon completing a payroll. See below for a completed pay run journal:

FYI: W1 and W2 refer to fields within the BAS Statement, the term is quite familiar to any GST registered business.

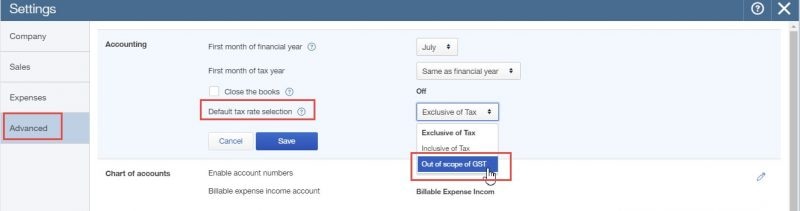

QuickBooks Online will push through these figures and if BAS is run each quarter, this will have the total amounts in both W1 and W2 for the entire quarter. One way you can reduce these is to go into the journals that are produced for the payruns for the previous two months and change from W1 and W2 to Out of Scope (Purchases).