What is Profit and loss?

Profit and loss (Definition)

The profit and loss are the difference between your company's revenue and its expenses that determines its profit (or loss). It can also be defined as the difference between the money you bring in and the money you spend. Depending on the nature of your business, your earnings will be determined by the amount of money you make from sales to customers. The following expenses must be to generate a profit for your company:

- Wages

- Cost to make a product

- Cost to provide a service

- Advertising

- Utilities

- Insurances

- Licences

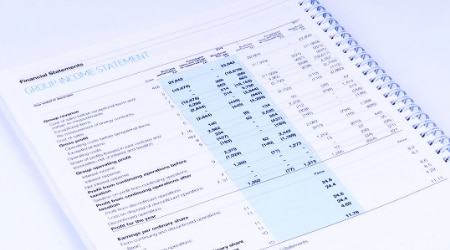

You need to keep track of these figures through a profit and loss statement, which will help you determine if the business is doing well (profit) or failing (loss).