In order to get the attention of serious investors, it’s important to have realistic financial projections incorporated into your business plan. Projections can be tricky to calculate as you try to anticipate expenses while also predicting how quickly your business will grow. With a quick outline and some forethought, though, you can easily get a handle on your business’s financial projections.

Understanding financial projections and forecasting

What is a financial projection?

In its simplest form, a financial projection is a forecast of future revenues and expenses. Typically a financial projection will account for internal or historical data and will include a prediction of external market factors.

In general, you’ll need to develop both short-term and mid-term financial projections, neaing short-term projections account for the first year of your new business, normally outlined month by month, while mid-term financial projections typically account for the following 3 years of business, outlined year by year.

Why is financial projection important?

A financial projection is important because it gives you insight into how your company will perform in the near future. The projection is important to business owners as well as potential investors because it predicts whether the business will grow and be profitable.

What’s the difference between financial forecasting and financial projections?

What is financial forecasting and how does it differ from financial projections? Although financial forecasting and financial projections are sometimes used interchangeably, they have different meanings.

Your business can use financial forecasting to predict future business performance, provided that everything stays the same. The demand for your product is the same, and your business operates in exactly the same way. A financial forecast can be used alongside a financial projection to evaluate how a company will perform in 1 or more potential futures.

What is an example of a financial projection?

A financial projection creates a “what if” scenario, where something about your company or industry is different in the future. For example, if your business is closed on the weekends but you wanted to know what would happen if you changed your schedule to be open 7 days a week, that would be a financial projection.

If you think there’s a chance that the demand for your product or service will increase in the future, creating a financial projection with that in mind will benefit your financial planning to account for that potential outcome.

If the weather report says that based on current information, you should expect an inch of rain on Monday, but you plan for a scenario where you get 14 inches of rain, it’s no longer a regular forecast—it becomes a projection.

What are the 5 advantages of financial forecasting?

The main advantages of financial forecasting include the ability to attract investors, determine business viability, plan for future expenses, reduce financial risk, and measure and improve your business. See additional details on each advantage below:

- Attract investors: Sharing a financial forecast is essential to attracting potential investors. Being able to project where your company will be in six months or a year is important to attract investors or secure bank loans.

- Determine business viability: If the financial forecast doesn’t look promising, it can inform the business owner that the business plan needs to be improved.

- Plan for future expenses: By understanding when sales may be lower or cash flow will be reduced, you can determine when business loans or additional investments will be needed.

- Reduce financial risk: Forecasting allows you to take a broad view of your business and understand where resources are being wasted, so they can be repurposed or limited.

Measure and improve your business: With each subsequent financial forecast, you can continually improve and more accurately predict your future performance.

What do financial projections include?

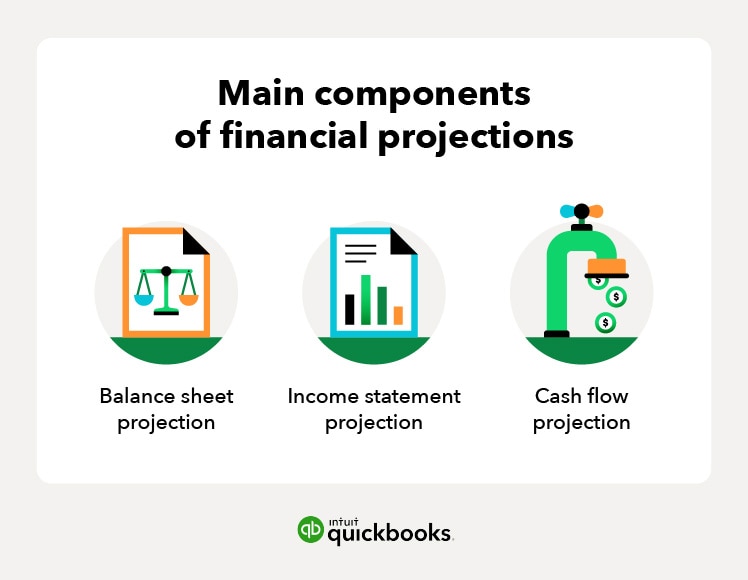

All financial projections should include 3 types of financial statements: the income statement, balance sheet, and a cash flow projection.

1. Income statement

An income statement shows your revenues, expenses, and profit for a particular period. If you’re developing these projections prior to starting your business, this is where you’ll want to do the bulk of your forecasting. The key sections of an income statement are:

- Revenue: This is the money you will earn from whatever products or services you provide.

- Expenses: Be sure to account for all of the expenses you will encounter, including direct costs (materials, equipment rentals, employee wages, your salary, etc.) and general and administrative costs (accounting and legal fees, advertising, bank charges, insurance, office rent, telecommunications, etc.).

- Total income: Your revenue minus your expenses, before income taxes.

- Income taxes: Money your business pays to the government.

- Net income: Your total income after income taxes.

2. Cash flow projections

A cash flow projection can help you decide if it’s a good time to invest cash into your business, or if it’s time to save. Cash flows can also demonstrate to a loan officer or investor that you are a good credit risk and can pay back a loan if it’s granted. The 3 sections of a cash flow projection are:

- Cash revenues: This is an overview of your estimated sales for a given time period. Be sure that you only account for cash sales you will collect and not credit.

- Cash disbursements: Look through your ledger and list all of the cash expenditures that you expect to pay that month.

- Reconciliation of cash revenues to cash disbursements: This one is pretty easy—you just take the amount of cash disbursements and subtract it from your total cash revenue. If you have a balance from the previous month, you’ll want to carry this amount over and add it to your cash revenue total.

Note: One of the key pitfalls of working on your cash flow projections is being overly optimistic about your future revenues. Be realistic in your estimates, and be prepared if they fall slightly short.

What is a cash flow projection example?

Cash is going to flow in and out of your business every month. Calculating how much money you expect to come in, versus how much money you expect to go out is a cash flow projection. This is calculated by totalling your accounts receivable and deducting it from your accounts payable, plus any cash on hand,

For example, if you have $2,000 in cash from the previous month and expect to spend $10,000 this month on expenses while earning $15,000, your cash flow statement for this month would be $7,000.

Cash flow projection = beginning cash + total accounts receivable - total accounts payable

3. Balance sheet

The balance sheet will present a picture of your business’s net worth at a particular time. It is a summary of all your business’s financial data in 3 categories: assets, liabilities, and equity.

- Assets: These are the tangible objects of financial value owned by your company. Assets can include anything from cash to real estate, all the way down to office furniture and supplies.

- Liabilities: These are any debts your business owes to a creditor. Liabilities can include upcoming payments for materials, bank loans, interest payments for a loan, payroll and payroll taxes, and mortgages.

- Equity: The net difference between your organisation’s total liabilities minus its total assets. If your business has $1 million in assets and $900,000 in liabilities, then the equity is $100,000.

Note: You’ll want to be sure that the information contained in the balance sheet is a summary of the information you previously presented in the income statement and cash flow projection. This is the place to triple-check your work—potential investors and creditors will be looking for any inconsistencies, and that can greatly impact their willingness to extend your company a line of credit.

To complete your financial projections, you’ll want to provide a quick overview and analysis of the included information. Think of it as an executive summary, providing a concise overview of the figures you’ve presented.

How to create financial projections

Before you start, collect all of your financial records. If you’re creating a projection for a brand-new business, use data and research on your industry. Keep in mind that although the projection is an estimate, the more data you use, the more reliable your estimate will be.

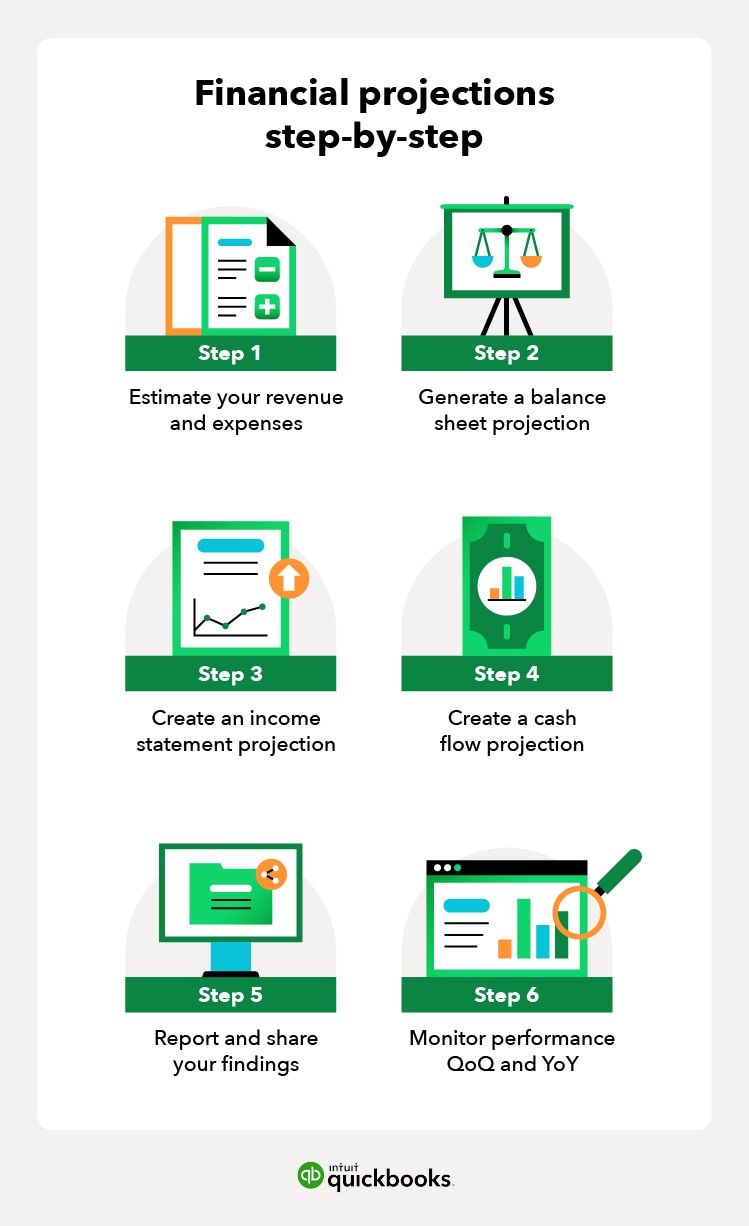

The steps for creating a financial projection include:

- Estimate your revenue and expenses

- Generate a balance sheet projection

- Create an income statement projection

- Create a cash flow projection

- Report and share your findings

Monitor performance

1. Estimate your revenue and expenses

Determine how much money you’ll be spending to operate the business (read more about how much money you need to start a business). This includes payroll, rent, utilities, cost of materials, and more. Likewise, calculate how much revenue you expect to earn from your product or service.

2. Generate a balance sheet projection

If you haven’t already, create a balance sheet that includes all of your company’s assets, liabilities, and equity. Take note of upcoming expenses or payments and any expected increase in the value of your assets.

3. Create an income statement projection

Creating the income statement projection is simple. Also known as the profit and loss (P&L) statement, you just deduct your expenses from your revenue. If your expenses exceed revenue, look for ways to reduce costs or increase sales. Your projected income statement will show you how much net profit you’ll have after you’ve deducted all of your expected expenses.

4. Create a cash flow projection

Estimate how much cash will be collected and spent, and how much surplus cash you expect to have on hand at the end of each month. Having surplus cash is related to the ongoing health of your company, and having it on hand will help in the event of any unforeseen expenses.

5. Report and share your findings

Compile your financial data and historical data into a repeatable report format that works well for your organisation. Consider including charts and tables when explaining copious amounts of numerical data—it will provide a much cleaner and engaging presentation than just paragraphs of numbers and figures.

Once your projections and report are complete, you can share them with your team members and external parties. These can include:

- Organisation leadership

- Investors

- Creditors

- Other important members of your business

Sharing these projections with the right people is essential because they act as a bill of health for your company and help keep your leadership team in the loop.

6. Monitor performance

Periodically compare your projection to your company’s actual financial performance. Most organisations like to look at previous and upcoming quarters as well as year-over-year comparisons together with yearly projections. Make adjustments where needed and continually improve your projections to make them more reliable.

Creating realistic financial projections

As with any business reporting, it’s important to be as realistic as possible when preparing your financial projections. You don’t want to over or underestimate the revenue your business will generate. It’s a good idea to have a trusted friend or business partner review your financial projections. Also be sure to check out all of the online resources available — it’s best to learn from people who have created projections before.