What you’ll learn

- Business Accounting and Accounting Key Terms

- Understanding Financial Statements

- Bookkeeping and Record Keeping

- Cash Flow Management

- Accounting Software to simplify your tasks

Course details:

What you’ll learn

Understanding your company’s financial position is integral to its success. One tool that can help you is financial reporting, which is an objective way to assess your company’s financial health. Financial reporting results in a financial statement, which can indicate whether your company is bringing in a profit or heading towards trouble. Let’s dive into the basics of company financial statements and how to use them.

Financial statements are reports that explain a company’s financial performance and profitability for a certain period of time. There are three basic financial statements: balance sheets, income statements (or profit and loss statements), and cash flow statements. Business owners use other financial reports, such as the statement of retained earnings, less frequently.

Financial statements are important because they let stakeholders—such as shareholders, creditors, and regulators—understand a company’s overall financial performance and health. Public companies are required to publish their financial statements in an annual report. Typically, financial statements provide information about a business’s:

Most importantly, financial statements help business owners better understand their bottom lines and make smarter business decisions.

Because financial statements serve as fundamental sources of financial information, you need to apply basic accounting principles to ensure accuracy and consistency. You can prepare financial statements using three principles.

An original or historical cost of accounts can help you prepare financial statements. Typically, you record prices and assets you purchase at different times at the original cost.

Using accounting conventions makes your financial statements comparable and realistic. For example, the principle of consistency requires accountants to apply standards consistently year after year.

Your financial statements are based on personal judgments and Estimates to avoid overstating assets and liabilities.

Now that you understand the concept of financial statements, let’s look at the various reports that make up financial statements.

In the world of financial reporting, there are many tools business owners can leverage to get the job done, but in general, the business owner utility belt holds three important tools:

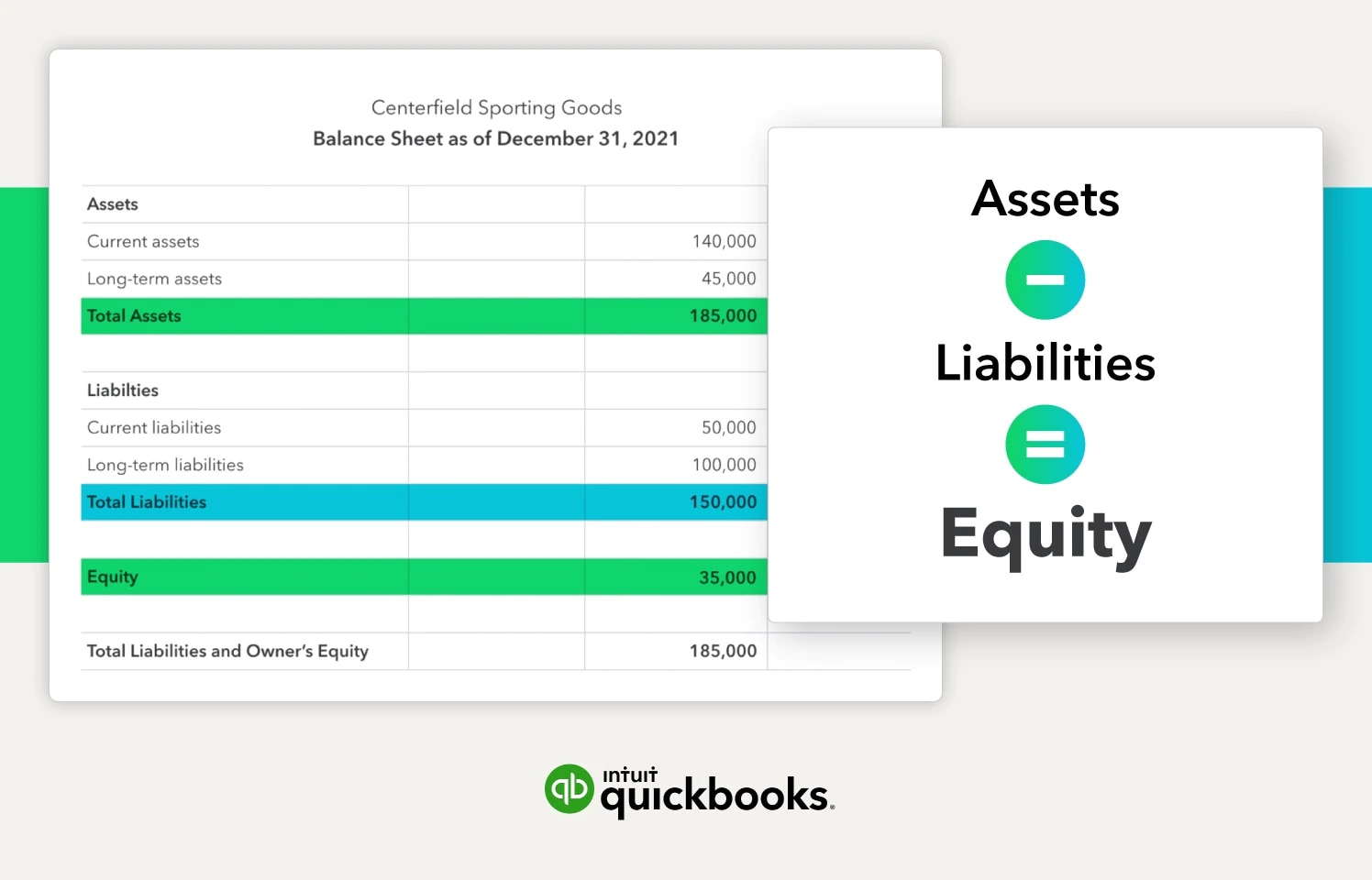

A balance sheet (or statement of financial position) is a financial statement that lists a company’s assets, liabilities, and equity balances. It showcases a business’s financial position at a particular point in time. A balance sheet provides information for three categories: assets, liabilities, and shareholders’ equity.

The balance sheet formula drives the three components of the balance sheet. The formula subtracts liabilities from assets to determine equity. The formula follows:

Assets – liabilities = equity

The double-entry accounting system requires the accounting equation to stay in balance as transactions post. Balance sheet accounts calculate working capital and other important ratios.

Review the balance sheet for Centerfield Sporting Goods as of December 31, 2021. Total assets ($185,000) equals the sum of total liabilities ($150,000) plus equity ($35,000).

How is a balance sheet connected to an income statement?

An income statement connects to the balance sheet through the net income account. A company can generate its income statement using the income statement formula, which subtracts revenue from expenses to determine net income. The formula follows:

Revenue – expenses = net income (net profit)

Income statement accounts are known as temporary accounts because the account balances adjust to zero at the end of each month and year. However, balance sheet accounts are permanent. The ending balances carry from one month to the next.

At month-end, the books close, and all revenue and expense accounts adjust to zero. The net impact of the income statement activity posts as net income on the balance sheet and increases the equity balance.

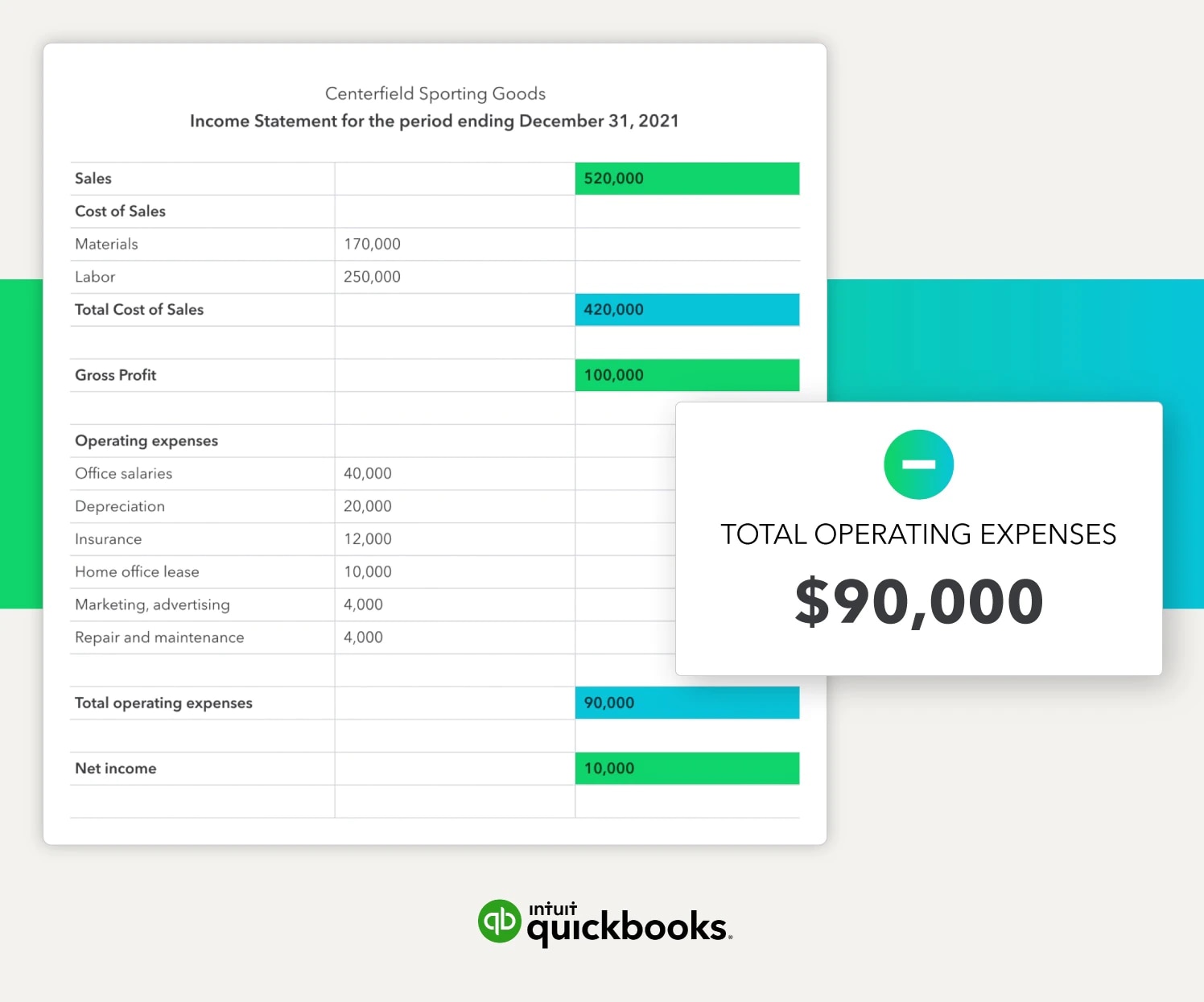

An income statement shows a company’s revenues and expenses for a period of time. It provides information relating to returns on investments, risks, financial flexibility, and operation capabilities. The income statement formula generates an income statement. Most companies produce a multi-step income statement, which documents how a firm produces net income.

How does a multi-step income statement differ?

In a multi-step income statement, you first find your gross profit and then your operating income for a period of time.

Assume, for example, that you’re a small furniture manufacturer, and that you’re creating a multi-step income statement for May. Most of your business activity will flow through gross profit.

Your material, labour, and overhead costs post to the cost of goods sold account. In May, you sold $1,200,000 in furniture, and your cost of goods sold (material and labour costs) totalled $900,000. So you made a $300,000 gross profit.

But you also incurred expense line items—advertising costs, sales commissions, and home office costs—to operate your business in May. Let’s say those expenses totalled $170,000 for the month. You can subtract your $300,000 profit from your $170,000 expenses to find your $130,000 operating income for May.

Operating income vs. non-operating income

You can generate operating income from day-to-day business activities. In May, furniture sales produced $130,000 in operating income. Your company also earned non-operating income, including $2,000 in interest income and $4,000 from an equipment sale. So your net income for May now totals $136,000.

Your business must produce a majority of its net income from operating income activities because operating income is sustainable. Non-operating income is inconsistent and unpredictable. No company can rely on it to produce annual profits.

Review the Centerfield company’s income statement for the period ending December 31, 2021. Sales totalled $520,000, and the cost of sales totalled $420,000. So their gross profit was $100,000. And Centerfield had operating expenses of $90,000. That gave them $10,000 in operating income for the period. Since the company did not generate any non-operating income, its operating income was its net income balance.

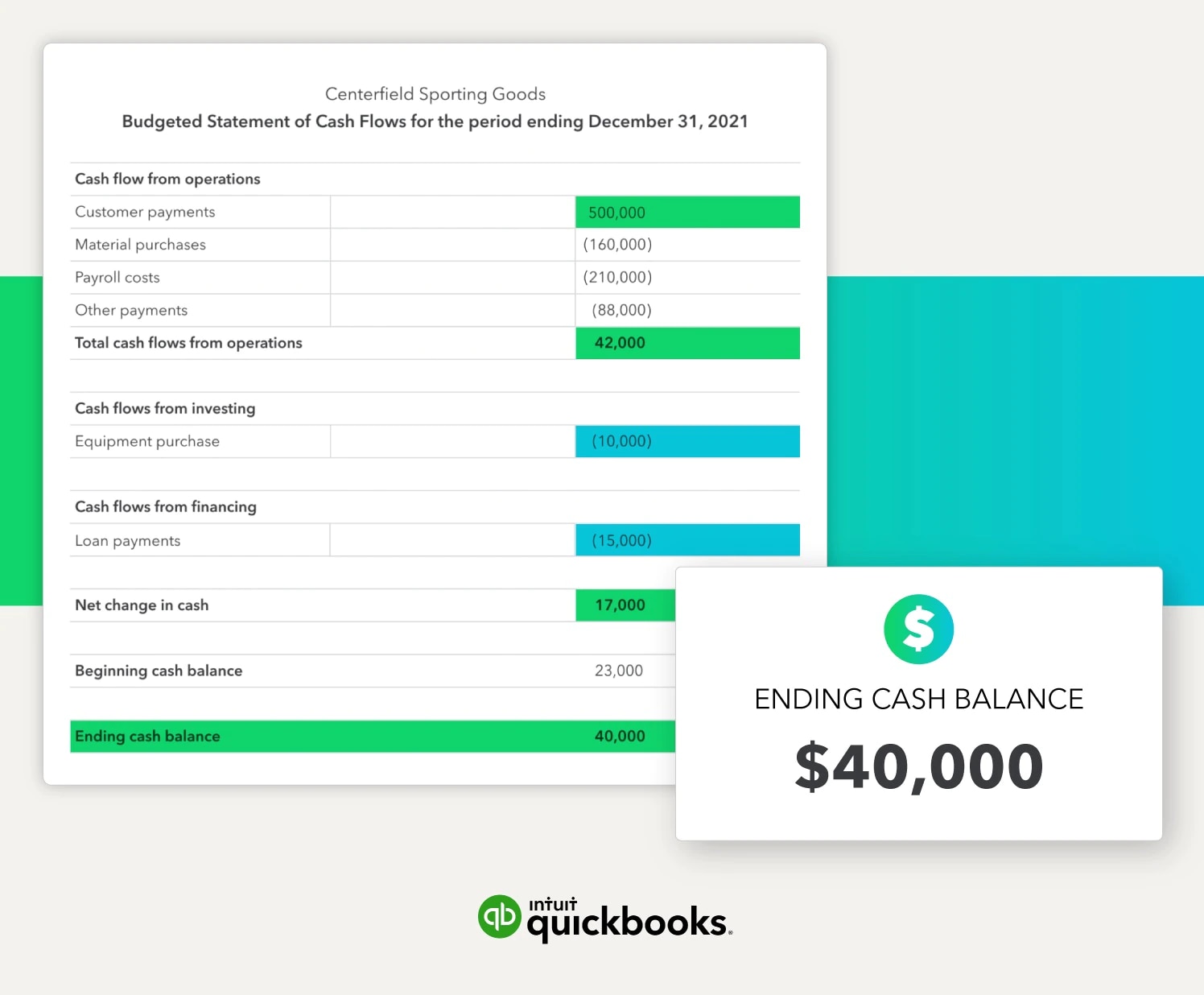

The cash flow statement (also called the statement of changes in financial position) documents a company’s cash inflows and outflows. Cash flow separates into three categories.

Most of the cash activity in a business takes place in the operating category. When an accountant generates the cash flow statement, they should identify the investing and financing transactions first. All remaining cash activity is in the operating category.

Review Centerfield’s statement of cash flows for the accounting period ended December 31, 2021. Note that the ending cash balance ($40,000) equals the cash balance in the balance sheet.

How a statement of cash flows is connected to the balance sheet

The statement of cash flows adds all cash inflows and outflows to find the net change in cash for a period. The cash flow statement’s ending cash balance should equal the ending cash balance in the balance sheet.

Ultimately, the best way to increase the accuracy and dependability of your financial statements is to automate the process wherever possible. Using accounting software, for example, leverages technology to handle all the number crunching.

So no more late nights sifting through piles of receipts and punching keys on the adding machine calculator.

Another way to maintain accurate financial statements is to choose your accounting conventions and stick to them. It can be extremely frustrating when trying to compare current performance to previous years only to be lost in the milieu of different categorisation methods or accounting methods.

On the other hand, there are a few ways in which you can make financial statements inaccurate or ineffective.

A financial statement is an important part of your financial accounting system. Making one of these common mistakes can affect the accuracy of your financial statements and business decisions.

1. You’re not including comparative data.

Including prior-year, prior-month, or budgeted amounts makes it easier to see if actual amounts meet expectations.

2. You’re not reflecting reality.

Financial statements should always reflect the true financial condition of a business. Consider having your financial statements reviewed by a third party to identify inaccuracies.

3. You’re not revising procedures to reduce discrepancies.

If you identify an error or discrepancy in your financial statements, take the time to revise your accounting procedures.

4. You’re not auditing your financial statements.

Financial statements are only beneficial if they’re accurate. Don’t generate a financial statement just for the sake of having one. Read the statement, address any discrepancies, and use it to understand your business’s financial health better.

Accountants & Bookkeepers

Free accounting tools and templates to help speed up and simplify workflows.

© 2026 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

By accessing and using this page you agree to the Terms and Conditions.