It’s nice to see you in the Community, nathanmarkelectr.

I’m here to help and ensure the transaction is properly entered in QBO. We’ll have to select the Record payment option, so the paid tax bill will not be categorized as an expense under Banking.

With just a few clicks you can accomplish this task.

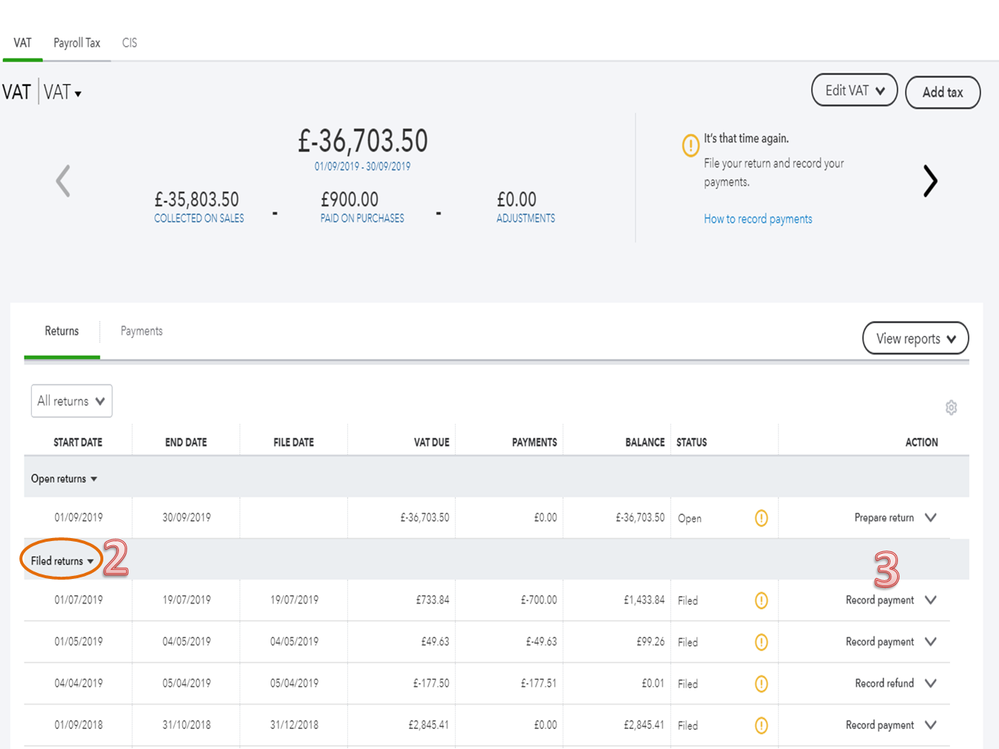

- Click on the Taxes menu on the left panel to choose VAT.

- On the VAT Centre, tap the Returns tab and go to the Filed returns section.

- From there, check the tax bill and then hit the Record payment link to open the Record VAT payment page.

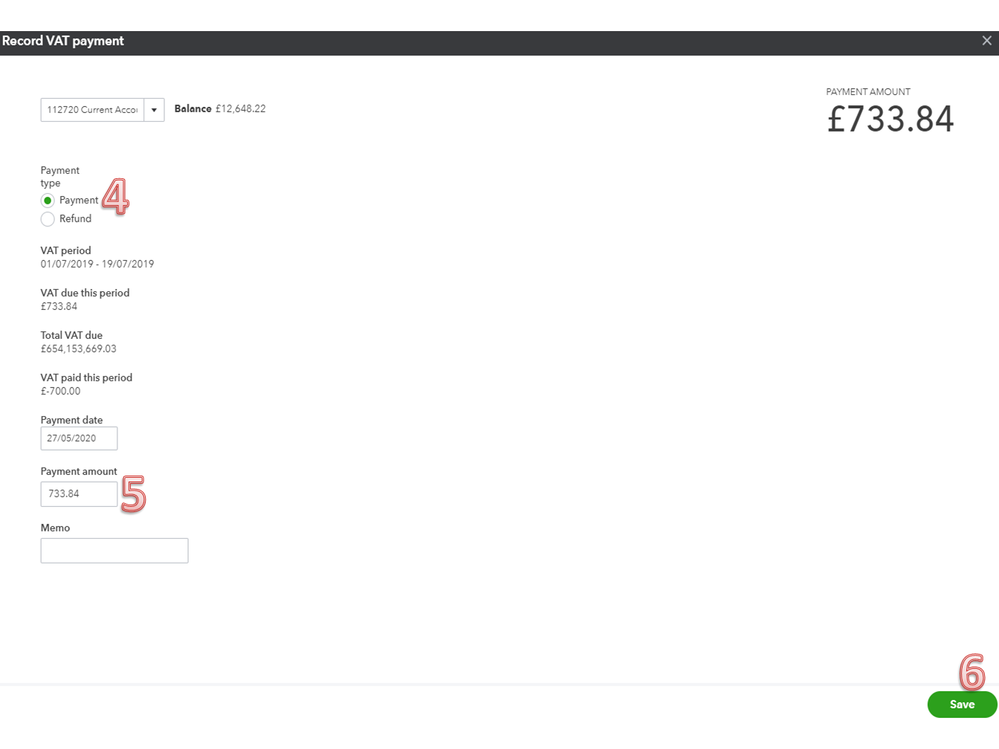

- Review the information and mark the radio button for Payment.

- Enter the amount in the Payment amount field box.

- Hit Save to record the transaction.

I'm also attaching screenshots to visually guide you.

For additional resources, you can bookmark the Record a VAT payment or refund guide. It contains a video for visual reference as well as instructions on how to enter a tax payment and refund.

If there’s anything else I can help you with, click the Reply button and add a comment. I’ll get back to assist further. Enjoy the rest of the day.