Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I over paid an invoice which created a credit amount on the suppliers account. The supplier refunded the difference to my bank account which I can`t match to the supplier to clear the credit amount. Help appreciated!

Hi Flixton, you can match this to the refund in your bank by following the steps below:

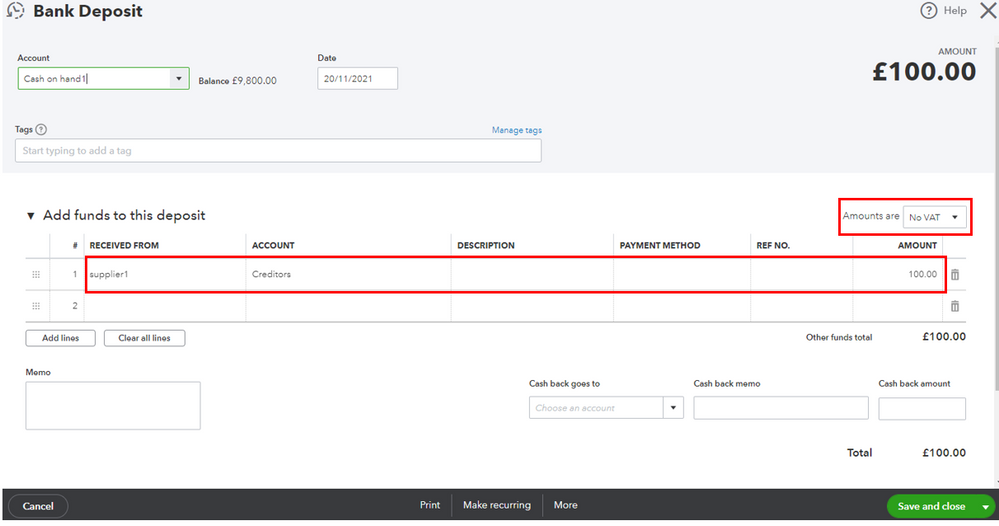

1) Click + New > Bank Deposit

2) Select the correct bank account on the top left corner, and the date when the money hit your account

3) Scroll to 'Add funds to this deposit' and set the 'Amounts are' to 'No VAT'

4) Under Received from choose the correct supplier, under Account choose creditors, enter the refund amount & save

5) Go to the Supplier's page and select New transaction > Cheque

6) Tick the deposit against the credit payment and save

7) Match the deposit against the transaction on your banking screen

Get back to us below if you have any Q's. :woman_technologist:

I’ve tried this and it comes up with a error of: I must set a transaction amount, which doubles the payment

I appreciate you for going through the steps shared by my colleague above, Flixton.

I'll make sure you'll be able to match the deposit to your supplier credit. All you have to do is to record a bank deposit and post it to Creditors account (Accounts Payable A/P). This way, you'll be able to match it on your Banking page. Let me show you how.

Then, match the deposit on your Banking page.

You can also utilize this article for more details about the process: Record a customer refund or supplier refund in QuickBooks Online.

Once you're all set, you might want to check out this link for guidance in reconciling your accounts seamlessly: Reconcile an account in QuickBooks Online.

If there's anything else you need help with about deposits and refunds, let me know in your reply. I'm always here to back you up anytime!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.