Thanks for reaching out to the Community,usertom.

Based on the scenario, let’s manually pay the invoices and deposit the payments. On the Bank Deposit page, we’ll have to enter the fees to net off the amount. I can help show you the process.

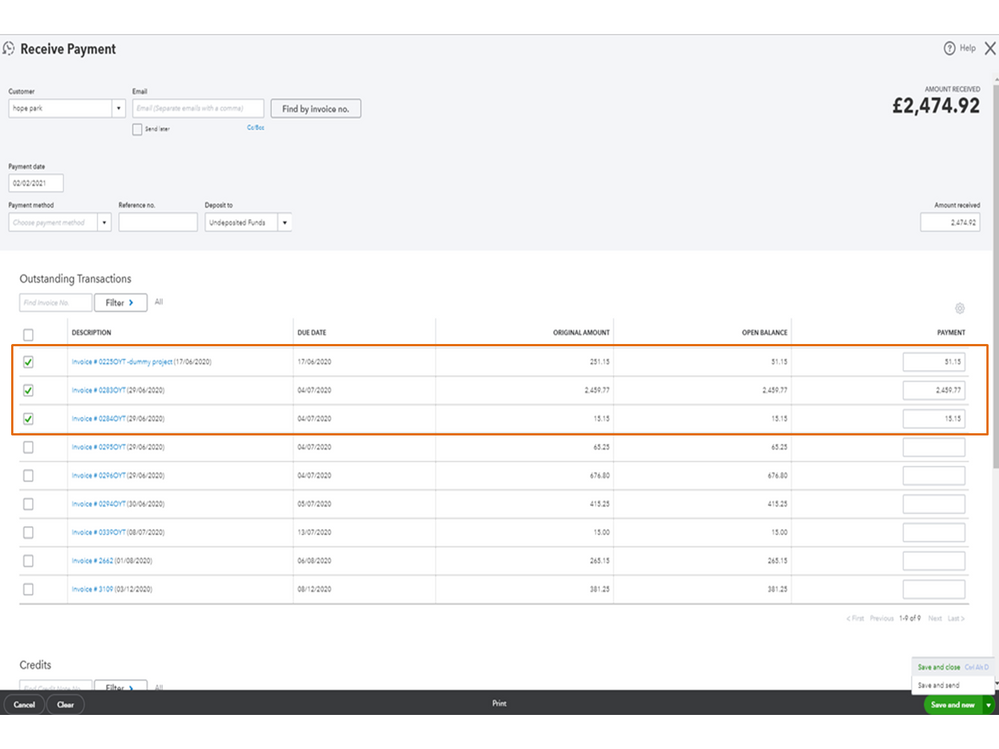

To record the payment:

- Tap the Customers menu in the upper right and pick Receive payment under Customers.

- Enter the payor’s name in the Customer field.

- Fill in the remaining field boxes with the right information.

- Click the Deposit to drop-down to select Undeposited Funds.

- In the Outstanding Transactions section, tick the boxes for the invoice/s you’re recording the payment.

- Click Save and close.

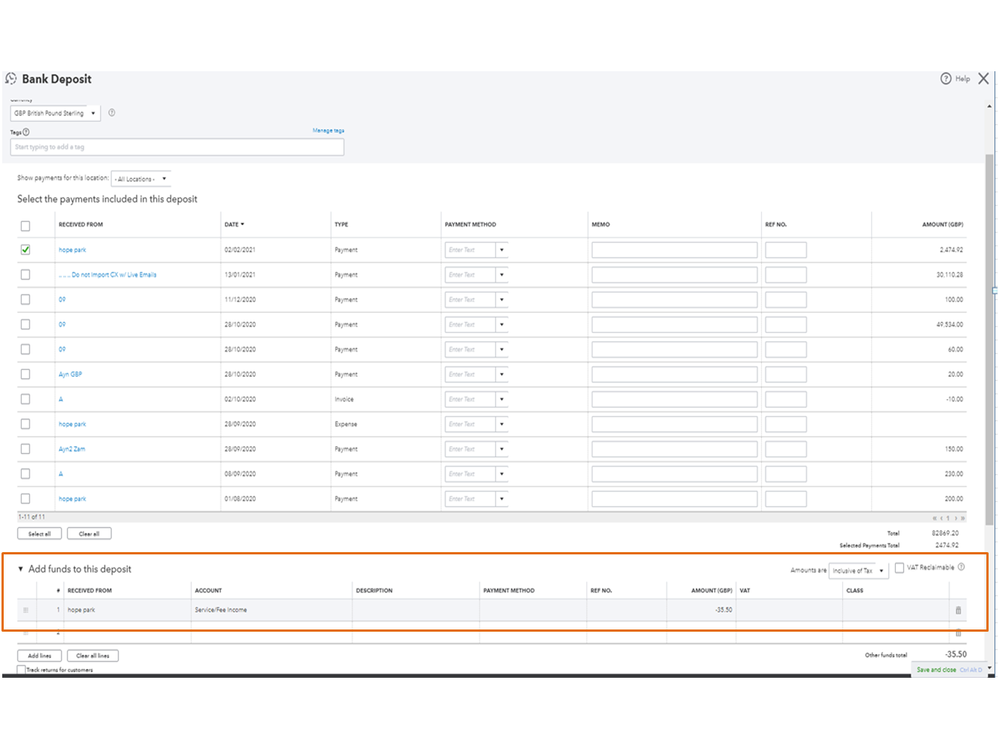

To deposit:

- Go to the New menu at the top and select Bank deposit under Other.

- In the Select the payments included in this deposit section, mark the box for the payment you wish to record.

- Navigate to the Add funds to this deposit column.

- In the first line, select the expense account used in tracking bank or credit card fees and enter a negative amount in the Amount field.

- Make sure the deposit matches the net bank deposit amount.

- Press the Save and close button to record the transaction.

If you’re unable to create the fee item, follow the recommended steps in this article: Add service fees manually to invoices.

Once done, you can match the downloaded bank transactions to the deposit. I've included an article to help you in the future. It outlines the complete steps on how to combine transactions in QuickBooks with a bank deposit, input a partial payment for an invoice, etc: Record and make bank deposits

Feel free to post a comment below if you have additional questions. I’ll get back to answer them for you. Enjoy the rest of the day.