Thanks for choosing QuickBooks Online (QBO) to manage your industry, @new2business. I appreciate you for providing in-depth details of your concern about documenting this money-out transaction and the returned amount. I'm glad to share the steps on how you can track this properly.

In QBO, we can record an expense for some equipment that you've hired. Then, create a bank deposit for the same amount that went back into your bank account.

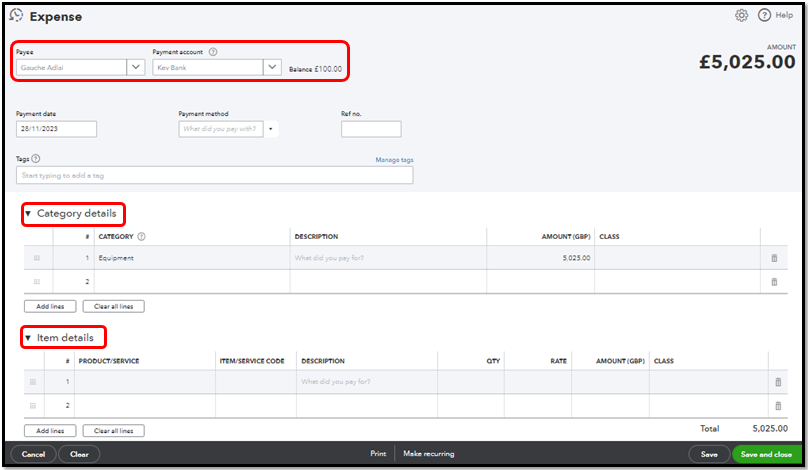

Here's how to create an expense:

- Click the + New button and pick Expense.

- Choose the supplier in the Payee field.

- Select the account you used to pay for the expense in the Payment account field.

- In the Category dropdown, select the expense account you use to track expense transactions. You can also enter specific products and services in the Item details section to itemise the expense.

- Enter the Amount and VAT.

- Complete the necessary fields, and hit Save and close.

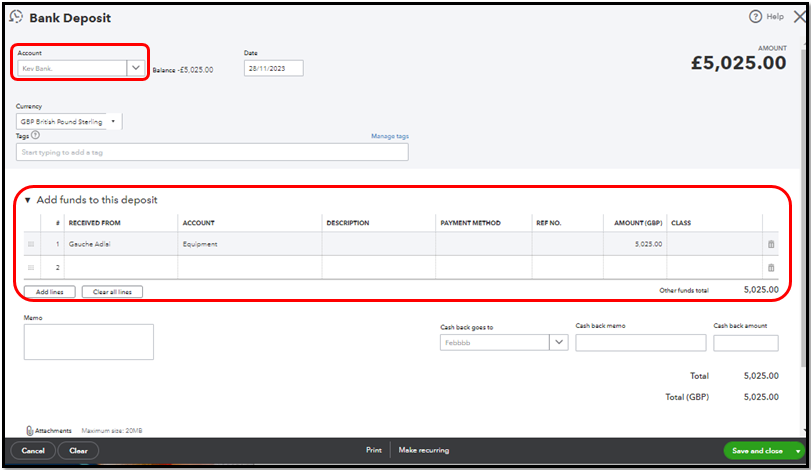

Once done, follow these steps to record a bank deposit:

- Click the + New button and then Bank Deposit.

- Go to the Add funds to this deposit section:

- Enter the amount refunded by the supplier and choose the same Category/Account you selected on the expense transaction to offset the amounts.

For more details about this process, refer to this article: Enter supplier credits and refunds in QuickBooks Online.

Furthermore, if your bank is connected to QBO, make sure to match it to these entries when they show up in the For Review tab so they won't duplicate your transactions. Check out this article to learn more about doing it: Categorise and match bank transactions in QuickBooks Online.

Our door is open 24/7 if you still need further assistance recording a cancelled purchase transaction. You can also post here again if you have any additional QuickBooks-related concerns. We'll be more than happy to have you here again. Have a nice day, @new2business!