Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I don't seem to be able to match these as the amounts are not the same. I keep getting duplicate entries- 1 for the full payment made and another for the paye amount that has been processed through payroll. Is there any way around this as or do the bank transactions for PAYE and dividends need to be made seperately? Some have already been processed so I am trying to go back and reconcile them and the current account balance is out.

I appreciate you for explaining the detailed scenario in your bank transactions, @cooganjill. Specifically, your payroll entries that keeps on getting duplicates, and you want to match them since it creates discrepancies in your records. I am here to help you clear things up.

To answer your question, you cannot match bank transactions that have different amounts. Since you already have an entry for this undertaking, you do not need to go and separate the bank transactions for PAYE and dividends.

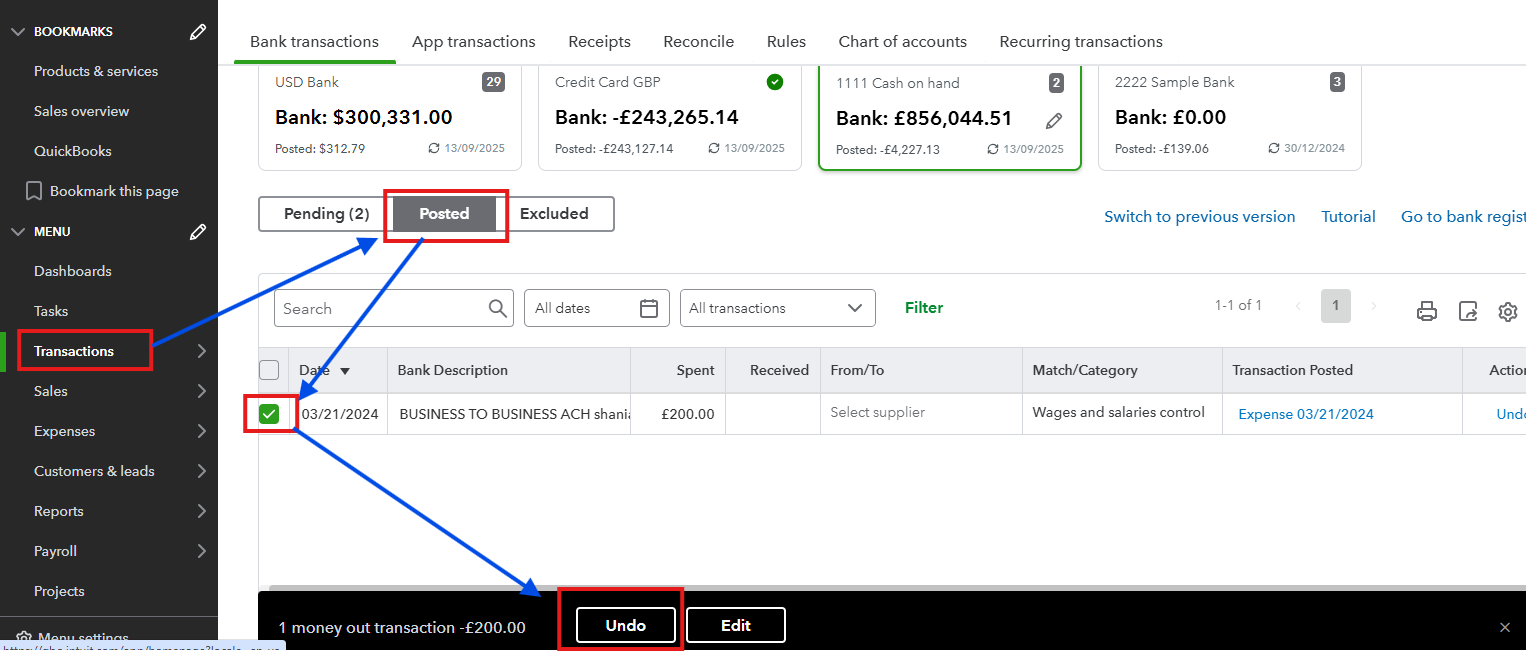

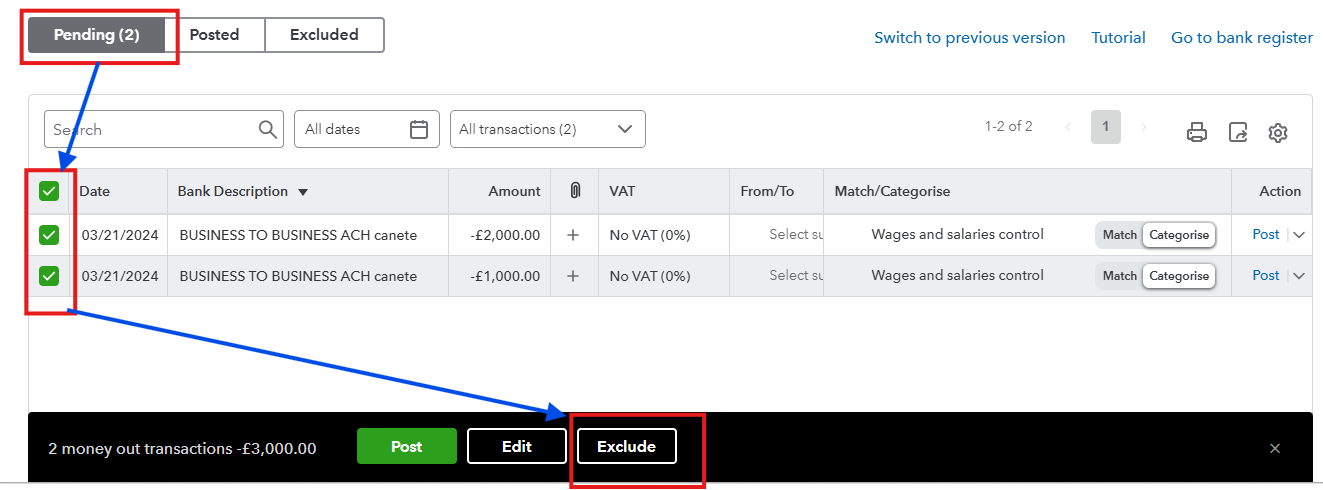

You can keep the balance of your book by excluding the duplicate entries. This option will clear up the excess amount that creates the imbalance in your account.

Additionally, QuickBooks will avoid redownloading them since they are in the Exclude section, and they will see it as existing in the system, but it will not affect your book.

Here's how:

I also recommend reaching out to your accountant on or before doing this to make sure your book will not be damaged and avoid excluding correct entries.

Having a balanced account will make sure the accuracy of your financial flow and generate correct data. Leave a comment below if you need additional assistance. Have a good one.

Thanks for the info Bryan. It is the PAYE entry in the books that I need to delete/exclude. The bank transaction is the total amount for PAYE and dividends and that shows in the books which is fine. Then there is a 2nd entry in the books from QB payroll for the PAYE amount. I thought by not reconciling these PAYE entries they would not be deducted from the balance but they are still being deducted. Can I do a journal entry to reverse them maybe? I've tried clicking on them to edit but it doesn't allow me.

All advice very much appreciated!

Jill

Yes, Jill. You can consider creating a journal entry to reverse the duplicate transaction.

However, please note that making adjustments to payroll-related transactions requires careful attention to avoid errors and to ensure they do not affect your year-end reports.

For this reason, we recommend collaborating with your accountant or bookkeeper before proceeding. They will ensure that the adjustments made are accurate, verify that your PAYE balance and payroll calculations are correct, and assist in properly reconciling your accounts.

If you have any questions or require additional assistance, please don't hesitate to leave a comment below.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.