Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Many of our QuickBooks customers issue invoices to their customers and take deposit, but wasn't quite sure how they can map their processes into QuickBooks. Here's a guide on how some of customers run their businesses on QuickBooks, let us know if it helps you!

Step 1: Set up invoice to receive deposit

Step 2: Create the invoice and send to your customer

Step 3: Receive and account for deposit

Deposit is paid by cash and banked into bank account

Once you have deposited the amount in your bank account, enter the record in QuickBooks.

There is one more step to account for your deposit correctly in QuickBooks - match your bank transaction to deposit transaction in QuickBooks.

Deposit is paid by bank/credit card payment

Step 4: Receive outstanding payment for an invoice

By cash

By bank or credit card

How to manage my Undeposited Funds?

If you have received cash and allocated your deposit or outstanding payment(s) to undeposited funds account, you'll need to allocate them to a bank or cash account when you're ready, for them to appear correctly in your books.

Hi Esther Y

Thank you for the interesting article.

I think if a customer make a payment for an existing invoice usually a business account the payment against that invoice.

But if a customer actually make a payment as a deposit (or advance) before finishing the work to invoice and there is no invoice how should we account it? I added it as a deposit from transferring from Bank (from Banking window) but it is not appearing in Customer account (Sales>Customers). So if a customer make many advance payments it is very difficult to track them.

Hi jova

We have enclosed an article that explains how to deal with pre-payments from customer. The first part of the article explains the process if you do not wish to account for VAT on the amount received and the second half of the article explains the process if you do wish to account for VAT.

Hi John C

Thank You.

My doubt is this: If we follow either of the methods, when we check Customer Transaction List will that Deposit show? (Before 2. Enter the Invoice step or 3. Enter Sales Receipts step)

Hi there, jova.

Yes, the deposit will show up in the Transaction List by Customer report. Just make sure that the following information is selected in the deposit page:

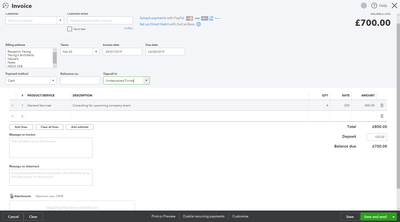

Please see this sample screenshot for reference:

If you any additional comments, please let us know in the comments below. Thanks.

I am not talking about the transaction report. I don't think anyone wishes to run a report each time they generate an invoice. I am talking about the Customer screen, when we email a statement will this deposit appear? When we check the balance due from the customer will this deposit appear below screenshot?

Hi jova

If you are not accounting for VAT and allocate the deposit to the debtors account the deposit will appear on the customer screen before you create the invoice. When you then create the invoice and want to allocate the deposit to the invoice select receive payment on the invoice and ensure the deposit is selected, save. When you have created the deposit it will only appear on a customer statement if you select Balance Forward or Open Item in the Statement Type, it will not appear if you select Transaction Statement.However once you have selected receive payment on the invoice and allocated the deposit the statement will show the amount received.

If you are accounting for the VAT the amount will show as a sales receipt when you create the sales receipt. When you create a customer statement the amount/sales receipt will only show on a transaction statement as received. When you then create the invoice the invoice will show on a transaction statement, with a zero balance, as well as the sales receipt/amount received.

Thank you for the reply, I was trying to get an answer for this for a long time.

Thank you very much.

Hi jova

You are welcome, if you require further assistance please let us know, have a great new year.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.