Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Help Us Make Things Better

Here at QuickBooks we really care about what our customers think. So much so, that we've created a survey where you can have your input and shape the way we provide services to you in the future.

Coronavirus Support

For every completed survey, we'll be donating $1 to the World Health Organisation (WHO) to support the battle against COVID-19.

Click here to complete the survey.

Hi

Need your help with the followings :

1) Customer issued credit note, paid online, payment gets downloaded to bank transactions. what is the easy way to allocate the refund to credit note ? down loaded transaction does find the match or does not automatically match with credit note. QB STRANGLEY creates zero entry when credit note allocated through the bank payment MANUALLY !!

2) transactions having different classes can not be imported with classes. is there any way to import classes as well ?

3) when new supplier is created, it just allow to link the overheads accounts but does not let link the cost of sales of accounts !! any solutions ?

4) VAT details report : does not let filter the data with classes if repost is needed class wise.

at so many places QB online needs improvements to save accountants time. sent emails or feedback many times but QB does not seems to be wanting to improve. Let see now !!!!

thanks

This is the right place to get the answers you're looking for, @Pjyani.

In QuickBooks, you can use the credit note to reduce the customer's balance on their next invoice. Some customers prefer this option instead of a refund. Refer to this article for more information about credit notes: Create and apply credit notes or delayed credits in QuickBooks Online.

To clarify, are you trying to give a refund to your customer? You can use refund receipts if a customer asks for a refund for an item or service.

On the other hand, if you'd like to refund your customer to settle their open credits and overpayments, check out this link for the detailed steps: Refund a customer's overpayment or credit.

You can also check this article for additional info: Handle a customer credit or overpayment in QuickBooks Online.

Second, you can only add classes to transactions after importing them to QBO. Adding classes to the transaction or the individual line items after import will ensure that your transactions track class as you'd like them to.

Third, the cost of sales is only affected when you sell inventory items on invoices or sales receipts. When you set up your inventory item in your Inventory List, QuickBooks automatically adds two accounts to your company file's Chart of Accounts:

Check out our blog about how to calculate and record COGS for more insights.

Lastly, there are only a few reports that allow you to filter the data with classes. These include the following:

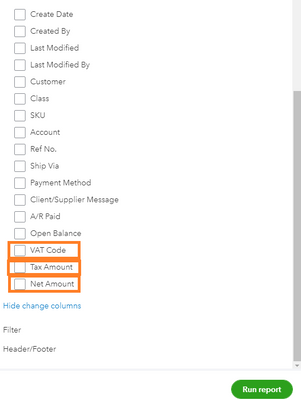

I'd suggest running the desired reports. Then, add the columns, that include VAT information, such as the VAT Code, Tax Amount, and Net Amount columns.

You can read the write-up about running reports by class for more information. Additionally, to see the complete list of available reports for your QuickBooks Online version: Reports included in your QuickBooks Online subscription.

You can also export them to Excel to help give you the flexibility to use them. Simply click the Export icon and select Export to Excel.

Feel free to leave comments about this for our product development team through the Feedback feature accessed in the Gear icon in the upper right of your account. You can check out this article which also outlines the steps: How do I submit feedback?.

Keep in touch with me here should you have any additional questions or concerns. I'm always available to help

Dear Liera, thank you for your prompt reply. Please see the issue I face every time with the customer refund. I have attached screen shots for your information.

- Customer overpaid, overpayment refunded online, transaction got down loaded automatically in Banking. Now issue arises here as QB does not match automatically with the customer overpayment as it would do with suppliers bills. Even after looking for transaction in "find match", it does not list down the overpayments from customers as it would do the suppliers bills. To post refund (see screen shot 1), I have to select the transaction type, then customer name, and the category, finally it gets posted to customer account (Screen shot 2). Now to match the refund with overpayment, I have to enter the refund manually as New-Suppliers-Cheque- select customer payee and enter the relevant required details. Once this manual entry is done, it matches itself automatically with the downloaded refund laying in banking section. once I match both the transactions, the refund gets posted to the relevant customer account. The problem does stop here. Both refund transactions appear in balance column in customer account, unfortunately both do not get squared off, which distorts open balance and overdue balance in the right hand side corner as well as customers' dues report. Again to square both transaction each other, I have to select the next unpaid invoice if any there, receive payment, then select the refund entries with zero amount in "AMOUNT RECEIVED" button, save it, BUT here it creates zero amount entry in customer ledger account (see screen shot 4). If there is no unpaid invoice in the customer account after these both refund entries, then as far as i know there is no option to square off.

Please help me out what steps I am missing or where I am going wrong. This issue eats up my lots of time when there are many refund entries with customers overpayments.

Thanks

Thanks for getting back to us, @Pjyani.

Since you're still getting the same results after recording the refund in QuickBooks Online (QBO), I highly suggest contacting our Phone Support team. They have tools such as screen-sharing (remote access) that can pull up your account in a secure environment and check the cause of this issue. They can also perform some troubleshooting steps if necessary.

Here's how to reach them:

For more insights about processing customer refunds in QBO, check out this article: Record a customer refund in QuickBooks Online.

Please leave a comment in this thread if you have any additional questions. I'll be more than willing to help. Have a good one!

Dear FritzF

thank you for your reply but do you think they know ? Not at all this is not first time I have been brought to this point ! leave it !!! QB does not have solution for this problem and there some more issues as well where QB online eats up our time. It is going backward rather than going forward.

I have already started moving my clients from QB to other accounting software.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.