Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'm glad you came here, dereknelson3.

You've made the right choice in using QuickBooks to help you with paying CIS deductions for subcontractors. It's my pleasure to guide you through the whole steps.

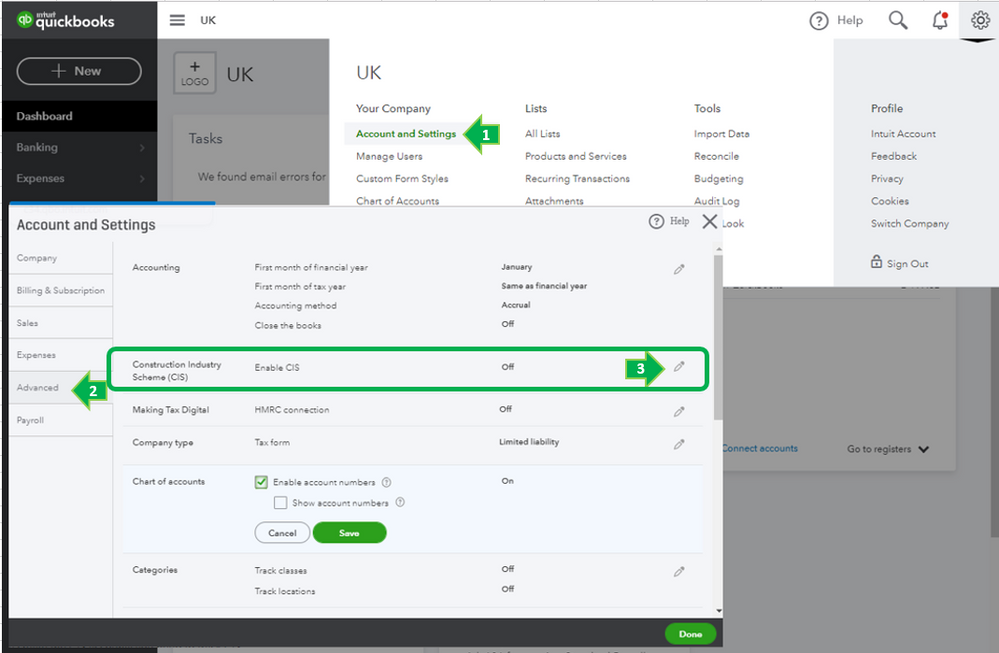

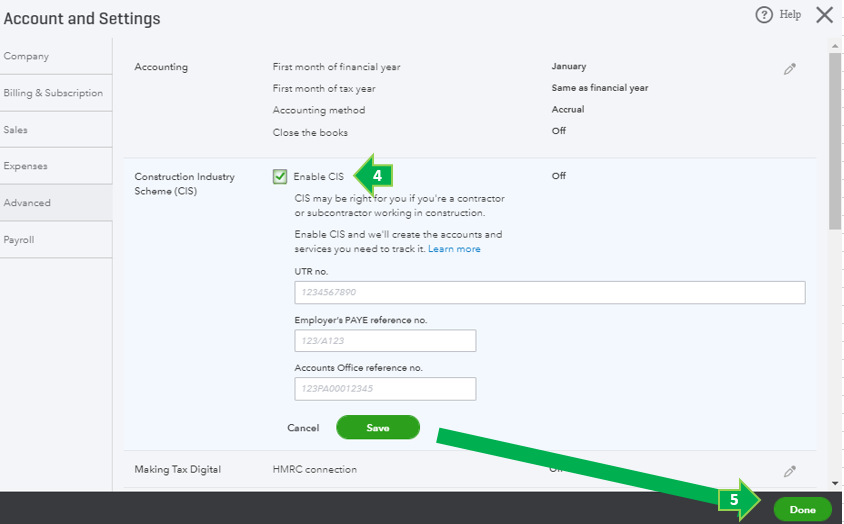

To turn this on, you can follow the steps below:

Once CIS is enabled, QuickBooks tracks deductions from the CIS transactions you created.

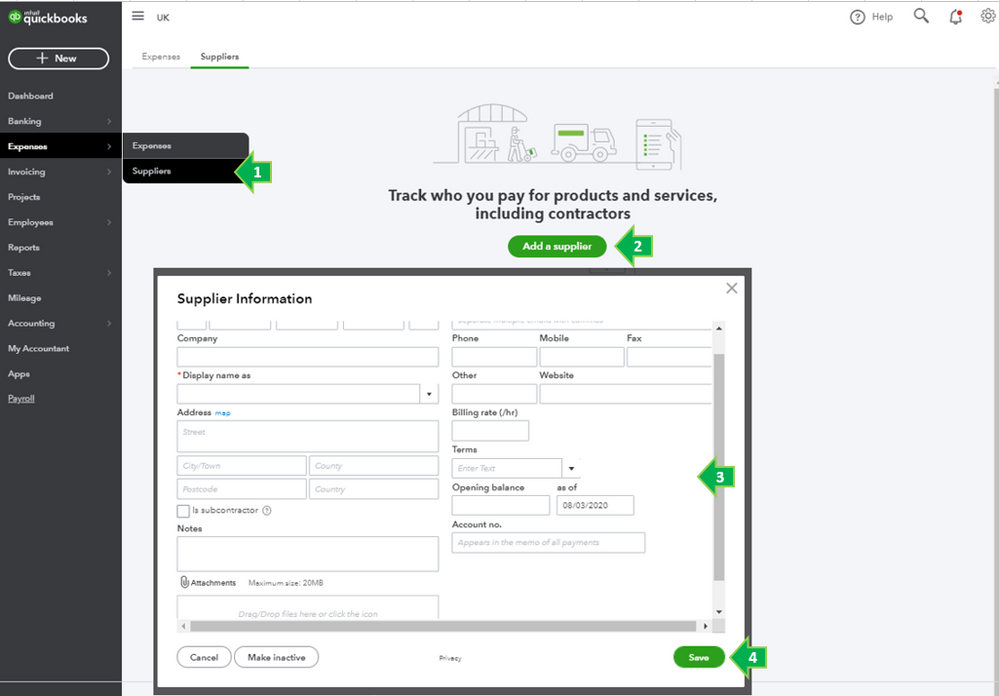

In case you haven't added a subcontractor, here's how:

When you're all set, you can start paying your subcontractors by creating a bill or expense.

Here's how:

All you need to know about Construction Industry Scheme (CIS) in QuickBooks is discussed in this article: CIS in QuickBooks.

If there's anything else that I can help you with, please let me know in the comment section below. I'll be always around ready to help.

Hi thanks for your reply, I don’t seem to have the settings icon at top right , I do have it on the left of my screen but it doesn’t give me those options you gave me , I’m using an I pad, is it different on a pc

Welcome back to the Online Community, @dereknelson3.

Yes, setting up the CIS feature is different using the mobile version. You’ll have to open the company file using a browser to activate it.

To accomplish this task, enter this link in your browser: https://c14.qbo.intuit.com/app/. When your account is open, I recommend following the steps provided by my peer @Charies_M.

For additional resources, check out the Already using CIS in QuickBooks article. It provides an overview of how to create a CIS invoice.

Stay in touch if you have any other concerns. I’m always ready to assist further. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.