Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi there,

I was wondering if anybody could possibly help at all please?

I currently have a full-time job, i get paid monthly into my bank and work sort all my tax out etc, so that simply already comes off my monthly wage.

However, i also have a little side business on the go.. it's a website (Football betting tips) - Which people sign up to via PayPal - So these payments are recurring payment's which come through PayPal.

I already have my account linked up to PayPal, so i can categorize my payments (Business Payments, Personal etc)..

But i was hoping the IntuitQuickbooks app would help me calculate my tax or help me when it's time to file my tax return online.

Does anybody know how to add my full-time job details in (which i pay tax for monthly) & also my secondary job, which i need to do a tax return for?

Any help would be appreciated.

Thanks, Sam.

Solved! Go to Solution.

I appreciate adding more information about your concern, Sam1994.

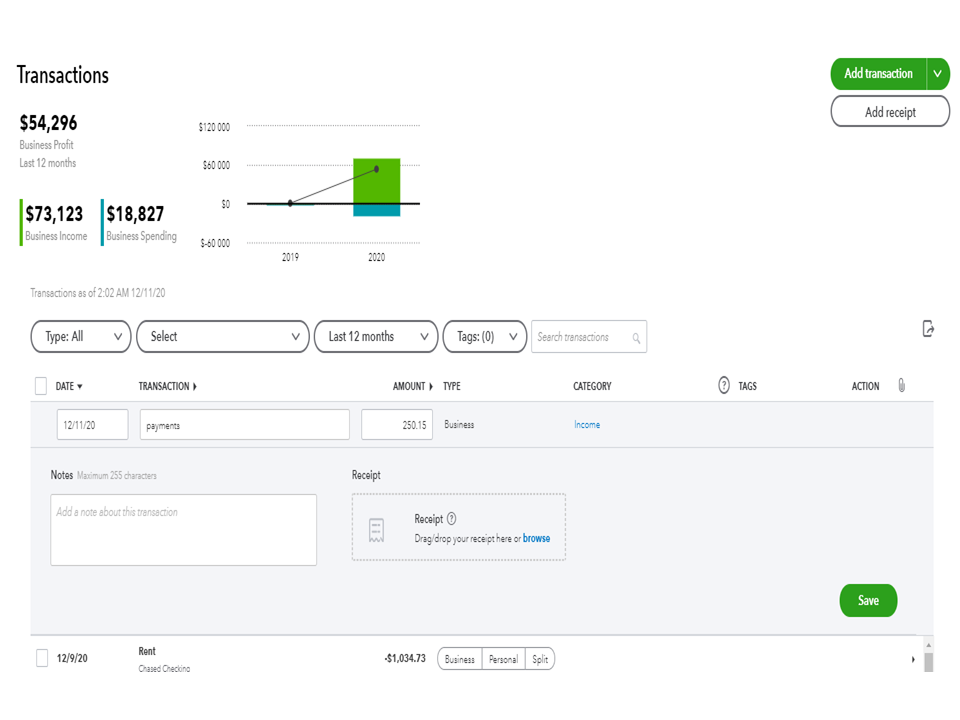

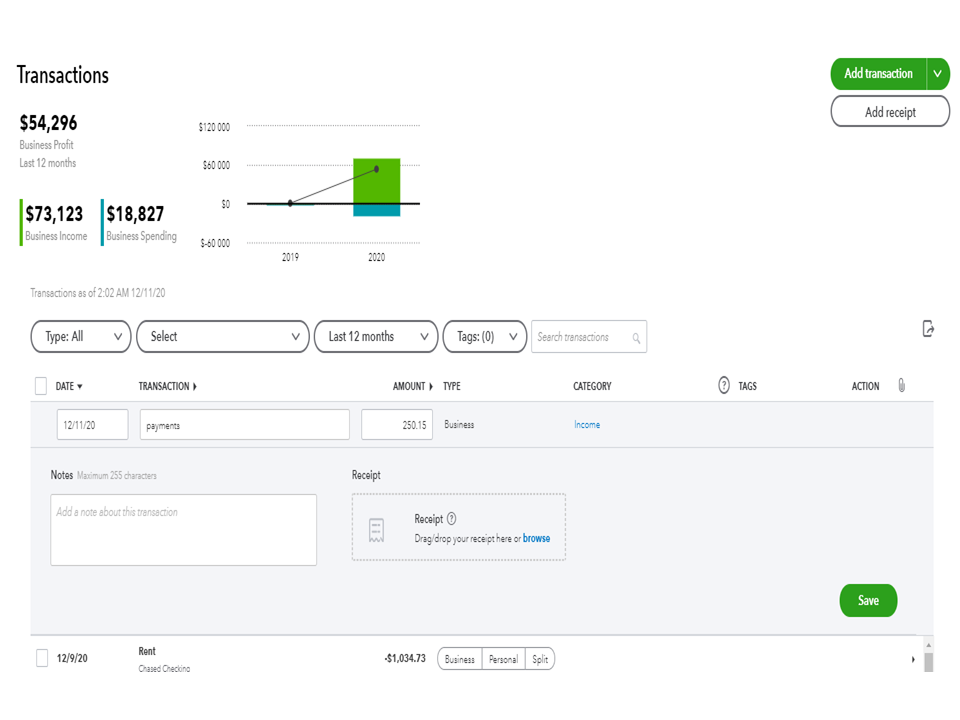

Based on the details provided, record the actual income through your Tax Profile in QBSE. This helps us in identifying your tax bracket. Then, input the payments on the Transactions page as income.

To add your full-time job transactions:

If you would like us to go into more detail into each section on the tax profile page we can do that just reply below.

Here’s how to input your business entries.

For your other concerns, the program helps in preparing the HMRC Self Assessment. It automatically calculates your income, minus expenses based on the information you’ve uploaded to QuickBooks. However, VAT isn’t automatically included so you’ll have to take account of that. Click here for detailed information and then go directly to the Frequently asked questions section.

Let me share the following articles for future references.

Don’t hesitate to post a comment below if you have any clarifications or additional questions. I’ll be right here to help and make sure you’re taken care of.

Hi Sam, your post has come through as both QuickBooks Accountant and QuickBooks Self Employed which product are you looking to enter the information into?

Self employed please, thanks

I appreciate adding more information about your concern, Sam1994.

Based on the details provided, record the actual income through your Tax Profile in QBSE. This helps us in identifying your tax bracket. Then, input the payments on the Transactions page as income.

To add your full-time job transactions:

If you would like us to go into more detail into each section on the tax profile page we can do that just reply below.

Here’s how to input your business entries.

For your other concerns, the program helps in preparing the HMRC Self Assessment. It automatically calculates your income, minus expenses based on the information you’ve uploaded to QuickBooks. However, VAT isn’t automatically included so you’ll have to take account of that. Click here for detailed information and then go directly to the Frequently asked questions section.

Let me share the following articles for future references.

Don’t hesitate to post a comment below if you have any clarifications or additional questions. I’ll be right here to help and make sure you’re taken care of.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.