Hello there, @dcreme.

Thanks for laying out the details of your concern here in the Community. I'll provide some steps on how you can handle this deposit transaction in QuickBooks Online (QBO).

When receiving bank deposits from your customers in QBO, you need to link them to an invoice. This way, it keeps your records accurate and helps you avoid mistakes when it comes time to reconcile your accounts.

If you've already recorded a bank deposit, we can find it and edit it so that we can link it to an invoice with the correct customer. Here's how:

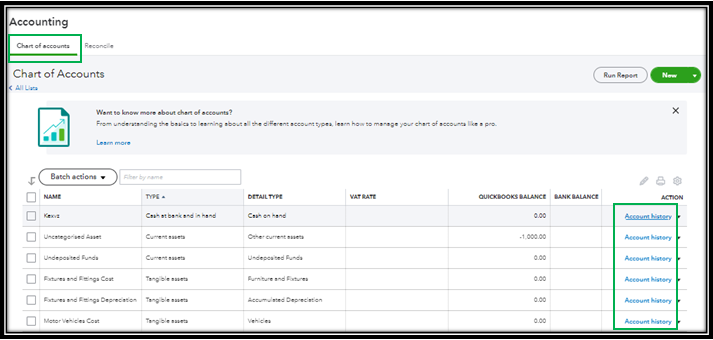

- Go to the Gear icon and select Chart of accounts.

- Find the account you deposited the payment to and select Account history.

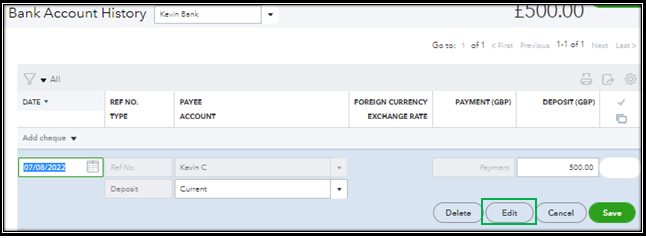

- Find the correct deposit, then select Edit.

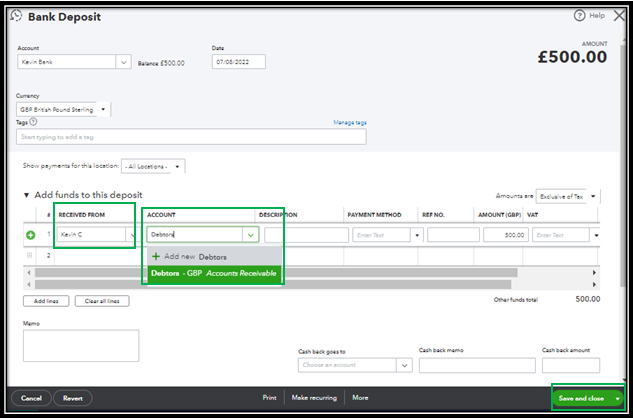

- In the Add funds to this deposit section, find the deposit.

- Choose the correct customer from the Received From ▼ dropdown.

- Select Debtors (Accounts Receivable) from the Account ▼ dropdown.

- Click Save and Close.

However, if you haven't created a bank deposit yet, just follow the steps outlined in this article to record one: Record and make bank deposits in QuickBooks Online.

After recording or editing your bank deposit, simply follow these steps to apply the deposit entry to your invoice with the correct customer:

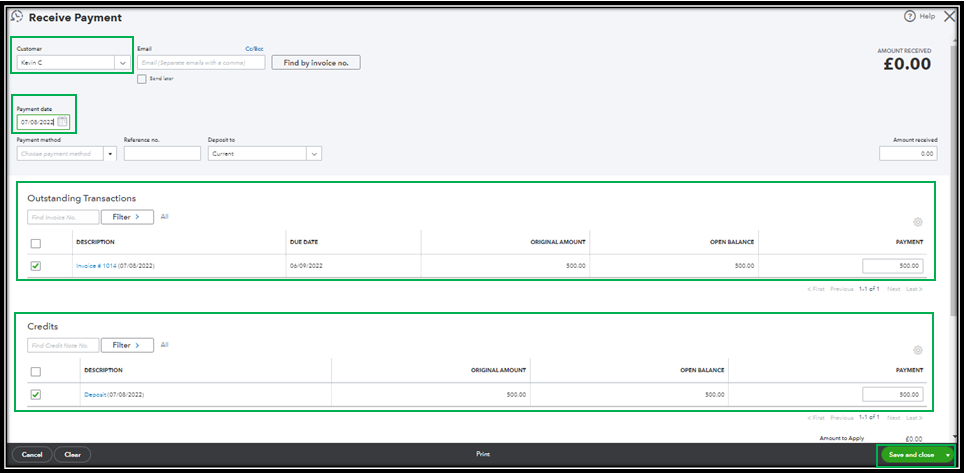

- Click the + New button, then choose Receive payment.

- Choose the Customer from the ▼ dropdown. This displays all open invoices and outstanding credits for your customer.

- In the Payment date field, enter the day you received the payment.

- Select the invoice you need to mark as paid from the Outstanding Transactions section.

- Under Credits, select the deposit.

- Tap on Save and Close.

Additionally, check out this article to learn more about how you can effectively manage your income, expenses, and any possible errors accordingly. For the step-by-step guide, you can refer to this article: Learn the reconcile workflow in QuickBooks.

Please let me know how these steps work out and if you have any follow-up questions. Just let me know in the comments below. Have a great day!