- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and Payroll

- :

- Annual leave accrued in advance at the start of a new annual leave year & carrying over balances

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Annual leave accrued in advance at the start of a new annual leave year & carrying over balances

Good afternoon,

I have a problem with leave allowances and balances when we roll into a new annual leave year.

The new annual leave year starts for my employees on 1st April each year.

We started using Quickbooks in April last year, so we entered their annual leave balances manually.

However, now we have just rolled into a new annual leave year, I was expecting their new annual leave allowances (accrued in advance plus leave balances carried over from the previous year) all to have appeared on their Leave Balances record but they haven't.

How do I do this?

Example:

Employees are entitled to 252 hours per year, which they receive in advance and the leave they take is taken against this figure.

Employee A had 54 hours as a leave balance at 31/03/2021

Employee A took 9 hours on 02/04 & 9 hours on 05/04 (in the payrun period (fortnightly) which I have just run today.

I was expecting Employee A's leave balance to show:

54 hours as at 31/03/2021

252 hours added (automatically) at 01/04/2021

-18 hours as of 05/04/2021

Leaving a total balance today of 288 hours, however, it only shows 36 hours as the 252 hours has not been added automatically.

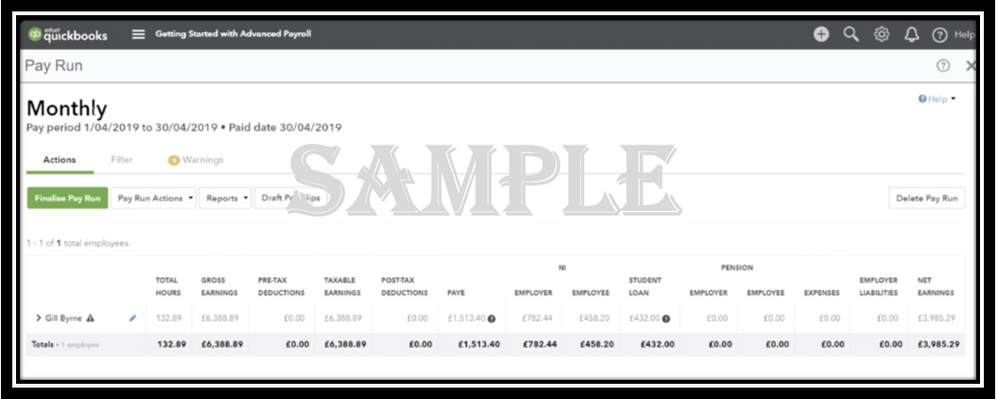

I have attached a screenshot of the leave allowances for Employee A.

Do I need to change the "Leave Year Should Start on Date" to 01/04/2021 for each employee for this to work? And do so every year?

Many thanks for your help and advice in resolving this.

0 Cheers

7 REPLIES 7

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Annual leave accrued in advance at the start of a new annual leave year & carrying over balances

Hello TomY78, Thanks for your question and the screenshot attached. If the leave should start on 01/04/2021 can you change that in that section yes, does the 252 then add for employee A?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Annual leave accrued in advance at the start of a new annual leave year & carrying over balances

I've changed the leave allowance template, as I realised I can't change it on the individual employee.

However, that hasn't added the 252 hours to each employee. Any other ideas how or when the 252 hours will be added??

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Annual leave accrued in advance at the start of a new annual leave year & carrying over balances

Thanks for joining on this thread, @TomY78.

I appreciate you for editing the leave allowance template in QuickBooks Online. Let's get your template resolve by doing some basic troubleshooting steps.

Sometimes, full of cache can prevent you to save the data. To start log in to your account through incognito. These browsers won't collect any cache and cookies.

Here are the shortcut keys:

- Google Chrome: Ctrl + Shift + N

- Safari 11 or newer: ⌘ + Shift + N

- Mozilla Firefox: Ctrl + Shift + P

- Microsoft Edge: Ctrl + Shift + P

Once logged in, re-edit the leave allowance template and add the 252 hrs to each of your employees to verify if it's already performing adequately. If you're able to do so, go back to your regular browser and clear the cache to speed up your browser. Using other supported browsers is a good alternative too.

If the issue keeps going, I'd recommend manually edit the leave balance on the Pay Run page.

Also, you're always free to reach out to our Customer Care Team. They have tools capable of pulling up your account in a secure environment and send a ticket to our engineers for investigation.

Here's how:

- Go to the Help menu, then click Contact Us.

- Type your concern in the box and tap Let's talk.

- Click Start a chat.

- Complete the required data and submit the request.

Please reach to them within business hours to ensure we can cater to your concern quickly.

I'm adding this article to provide you resource links on how to effectively manage your payroll and employees in the program: QuickBooks Online Standard Payroll hub.

Let me know how it goes in the comments below. If you have other payroll concerns or questions about managing your employees in QBO. I'm just around to help. Take care always.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Annual leave accrued in advance at the start of a new annual leave year & carrying over balances

Hi TomY78, did you ever get a satisfactory answer to this? We are having the same problem for all employees who accrue the year's balance in advance.

We have found that for those staff who accrue based on hours worked (e.g. temp staff), their leave accrues correctly - but any permanent staff who have the year's balance available up front, we have serious problems with QuickBooks not actually adding it.

Our finance assistant is being driven mad by this as she is constantly being hassled by people needing to know their accurate leave balance (and line managers needing to know what they can approve). If you found a sensible solution I'd love to know, as QB's helpdesk has not been able to provide us with an answer yet!

We do have a few workaround options but one of the reasons of us moving to QB was that it was supposed to manage annual leave for us!

Many thanks

Su

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Annual leave accrued in advance at the start of a new annual leave year & carrying over balances

Hello Susanwarren, thanks for posting on this thread, could you reach out to the team on chat who will be able to set up a screen share with you so they can look deeper into this issue you are having currently.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Annual leave accrued in advance at the start of a new annual leave year & carrying over balances

"We have found that for those staff who accrue based on hours worked (e.g. temp staff), their leave accrues correctly"....could this be the answer I seek? Set up all staff to accrue holiday on hours worked rather than adding in their yearly entitlement? The only adjustment would have to be when holiday is carried over from one financial year to another??

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Annual leave accrued in advance at the start of a new annual leave year & carrying over balances

Hi John - sorry it's taken me a while to reply, I was half hoping that QB would give you an answer, and also working on our own solution. Hopefully this will help you, if you haven't already solved it:

1. Once you run a pay run where a leave category accrues anything, you can't change how that category accrues - i.e. if your Category "Annual Leave" is set to accrue in advance, you can't then change it to accrue going forward, and vice versa.

2. You can get around this with the use of Leave Allowance Templates and Rule Sets - set up the Category in the way that works best for most people (ours is set to Not accrue in advance), then use Leave Allowance Templates per person to set their specific options - such as Accrue in advance, the rate of accrual, the max allowance and whether the balance rolls over etc.

3. Be aware that "Accrues ongoing" will roll over at year end - the leave will keep accruing until a max is reached (if set), or will just keep accruing. If you want their balance to reset at year end you need to set it to Based on a leave year, then set how much allowance can carry over. We have set ours to 0, and we manually adjust any carried over leave as it has to be approved by a manager, instead of automatically allowed.

4. Put the start date of the leave year on each person's template as something in the past (e.g. 1/01/2022 or earlier) - you should not need to reset this yearly. The leave will adjust in the pay run where that date (1st Jan) is paid. I have found that any date other than the 1st of a month will accrue in the following month's payrun (e.g. if you set the template to 2nd Jan, it will accrue leave in the pay run covering 1st Feb onwards) - this seems to be a bug as QB will say you can set the date to anything you like and it will accrue in the pay run for that date, but that's not the case.

5. Use Rule Sets per person for anything else, such as accruing leave on overtime (if you have staff set to use timesheets for overtime only) as this will not be covered by the normal accrual. Give me a shout if you want help on rule sets, I've got pretty good at them now!

6. Set your initial balances in a pay run by using Actions > Adjust Leave - you can input negative amounts if you need to reduce the leave (e.g. if the pay run has the full year's allowance and you want to pro-rata it).

Admittedly we haven't yet reached the end of 2022 and I've only just redone all of our leave system, but based on my testing beforehand, this will work and the balances will be correct going forward for all staff (as long as my payroll clerk doesn't touch the Leave Category). I'll know for sure whether I've got it all right at the end of Jan.

We have some staff who accrue fully up front, some who accrue up front but also accrue on overtime, and some who accrue based on every hour logged in a timesheet - so whatever your setup is for staff, you should be able to use the above to good effect, as I'm pretty sure we have covered every option! The only thing we don't have is staff with set hours who accrue as they go without using a timesheet, but I did my testing on that as well and the above setup worked there, too.

Good luck - and I really hope this info proves useful for others as well. QB would do well to incorporate this to their guides, as not everyone's setup is as basic as they like to make out.

0 Cheers

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...