Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have an employee who has reached his maximum allowance for SSP, but payroll is still generating a payment to him when I understand it should be £0?

Solved! Go to Solution.

Hello, @grahamjburley.

Let's try to isolate this unexpected behaviour by accessing your account using an incognito/private browser for possible browser-related.

Here are the corresponding hotkeys you can use:

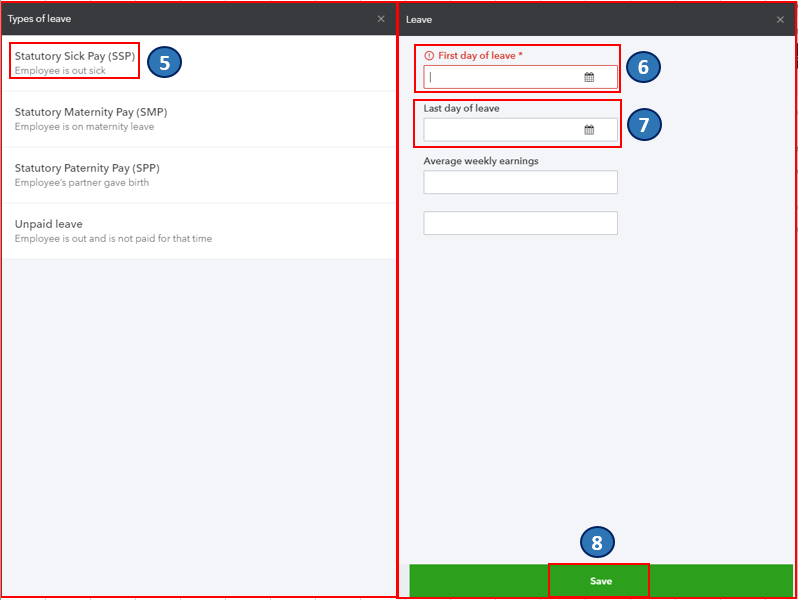

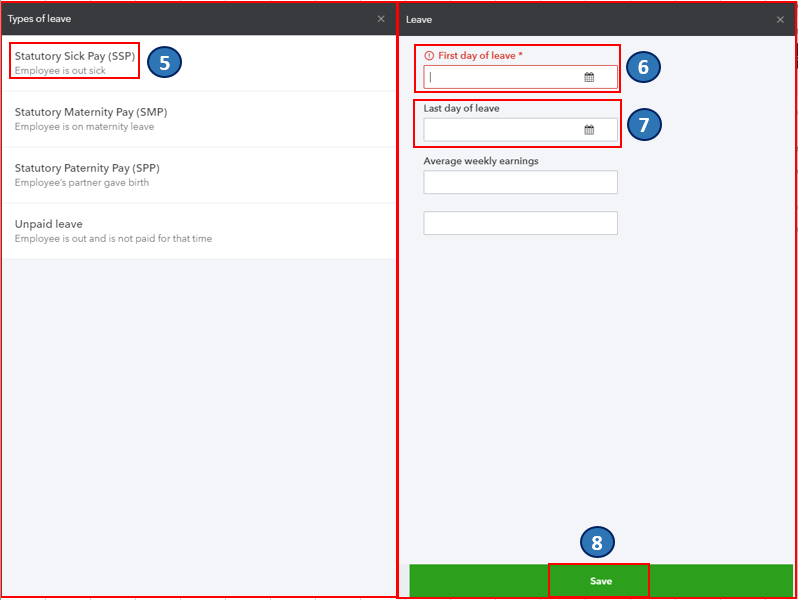

Once logged in, let's first make sure that your employee's information is set up properly. Here's how:

Once reviewed, let's try to run payroll again. If it calculates your employee's payroll correctly, you can clear your browser's cache and cookies. The stored browsing history can get corrupted and could cause unexpected behaviour. You can read through these articles for more guidance in managing your employees and payroll:

Post again here if you have other questions. I'm just a few clicks away.

Hello grahamjburley,

When your employee reached the maximum allowance for SSP, you can no longer pay them with SSP and will be prompted in the View Log page. Employees qualifying days pattern can be set up in Employee Details, Pay run Defaults, and Standard Work Week. Then, you can click on Advanced to edit the days your employee works. You can use this link for reference: Statutory Sick Pay (SSP) in QuickBooks Online Advanced Payroll.

Meanwhile, SSP is paid the same way as you pay the wages in QuickBooks Online Standard Payroll. As an employer, you will be responsibl efor paying the SSP to employees who meet the qualifications. You can use this link for reference: Statutory Sick Pay (SSP) - employer guide.

To know more about it you can browse these articles:

Keep us posted if you need additional assistance with this. Have a great day!

Hi James,

I am using Standard payroll and have just started using this in the new tax year. The employee in question started their SSP period before hand and despite putting the correct number of days it is still putting the SSP in.

Graham

Hello, @grahamjburley.

Let's try to isolate this unexpected behaviour by accessing your account using an incognito/private browser for possible browser-related.

Here are the corresponding hotkeys you can use:

Once logged in, let's first make sure that your employee's information is set up properly. Here's how:

Once reviewed, let's try to run payroll again. If it calculates your employee's payroll correctly, you can clear your browser's cache and cookies. The stored browsing history can get corrupted and could cause unexpected behaviour. You can read through these articles for more guidance in managing your employees and payroll:

Post again here if you have other questions. I'm just a few clicks away.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.