Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Ensure to double-check the employee's profile to confirm the P11D benefit is linked, ALD19. Let me walk you through the process below.

It is important that employee records are active and properly set up for the new benefit year. If a record is incorrectly linked or missing information, it may not display correctly.

Please see the steps below on how to check:

If there is no benefit shown, you can add it to the employee's profile and then attempt to complete the P11D again.

On the other hand, if the benefit is there and still does not carry forward, I recommend reaching out to our Live Support Team. They have the necessary tools and resources to further investigate the root cause of the issue. Please be guided with our support hours to ensure that we can assist you promptly.

Here's how you can contact them:

Additionally, to ensure your payroll is organized, visit this article for steps to confidently start the new tax year: Year-end guide for QuickBooks Online Advanced and Bureau Payroll.

By following the outlined steps, you can ensure that all employee benefits are properly tracked and reported, helping you stay compliant with tax regulations. If you have follow-up questions, feel free to add on this thread.

I don't consider this to be an improvement. I thankfully only have 9 employee records to download P60s for. Why can't I produce them as a combined list OR as individuals according to what suits my needs? I can produce my monthly payslips as one document. Why not the P60? I would be livid having to do them one at a time if I had any more employees to produce them for.

This does not seem to include the P60 forms for 2025!

I also find it ridiculous that the resolution to the issue of P60 forms not feeding into Workforce is that it is working as planned and that all forms have to be manually entered to each employees file. If the P60 forms could be bulk downloaded to send/post to the employer to distribute or were available to email directly from CORE it may be valid, but when Workforce is described as the place to obtain payroll information for employees it is completely non-functional

I have submitted my last FPS for 2024/25 year end but there was no box asking if it was my last submission which is required by HMRC so please can you let me know how I now do this. I have never had a problem with this in previous years. Thank you.

HMRC automatically identifies your Final Payment Submission (FPS), Jane. There's no box to check that indicates this is your last submission. Allow me to provide further details about this.

When processing payroll, it is recommended to submit the FPS promptly to avoid any delays in reporting. Once you have submitted it, HMRC will automatically recognize it as your final submission for the tax year.

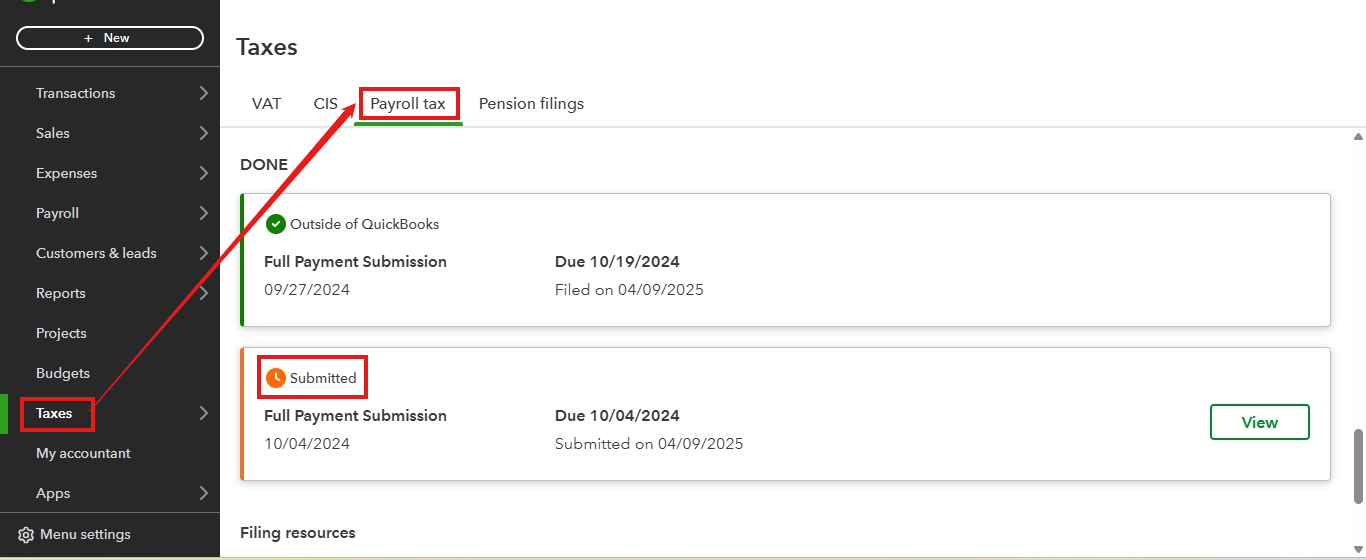

You can also check if your submission for 2024/25 is completed. If you're using QuickBooks Online Payroll Core, you can follow these steps:

On the other hand, if you use QuickBooks Online Advanced Payroll, you can see this material for the steps: Check submission status.

Additionally, to learn how to close your previous financial year and prepare for the new one, you can explore this article for guidance: Year-end guide for QuickBooks Online.

We're committed to helping you ensure compliance with all regulatory requirements and position your business for a strong start in the new fiscal year. If you have follow-up payroll questions, feel free to leave a comment below.

Hi

I have read the sections on how to submit final payroll reports to HMRC. However, I just cannot get it to work. Basically, on 31 March 24 I submitted the last employee payslip and submitted the FPS as usual (which has been accepted by HMRC).

However, now I am trying to submit a FINAL FPS to HMRC as end of year, but nowhere on Payroll Core does it show me an option to submit and tick a YES to indicate that this is my FINAL FPS. I am now panicking as I realise I only have until 19 April to send this final payroll report to HMRC.

If you have submitted your FPS for month 12, the 'final' field should have been flagged in there.

Let's submit your Full Payment Submission (FPS) to HMRC, JohnW1958. I'll outline the complete process below for your convenience.

When submitting the final FPS in QuickBooks Online (QBO) Core Payroll, please set up your payroll information and ensure your payroll data are correct.

Here's how:

Once done, create and run payroll before submitting an FPS. Please follow the steps below:

Once done, HMRC will recognize it as your final submission for the tax year. You can also check out this article for the complete process: Submit an FPS to HMRC in QuickBooks Online Core Payroll.

Moreover, as you prepare to close out the previous fiscal year and prepare for the upcoming one, I suggest exploring our Year-end Guide to gain comprehensive instructions for a seamless transition.

We're always here to help you meet all regulatory obligations and ensure your business is ready for the coming fiscal year. For additional questions about payroll or FPS submission, please comment below.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.