Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hello Community users:waving_hand: Just popping in to add some help to this post. In the case that the pension default account as dividends it is a case of mapping the journals to resolve this. To do this we have included a link here. Feel free to add any comments or questions to this thread.

Hello there, Kirsty79,

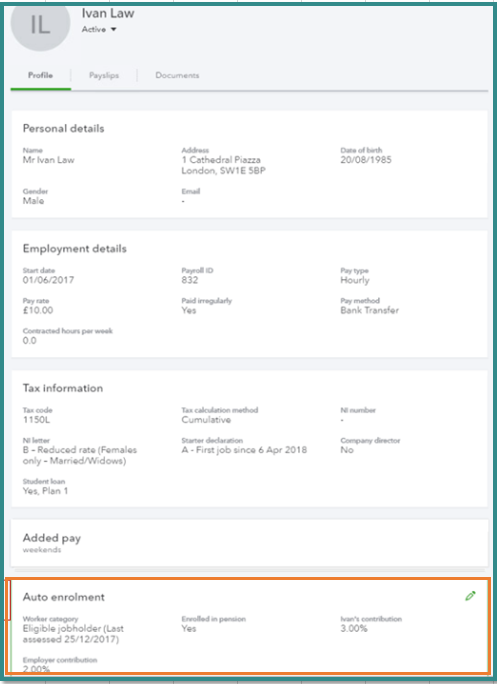

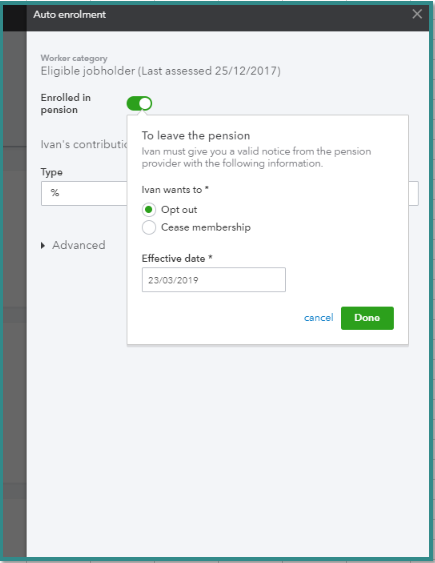

Let's stop pension contribution by opting out this method on your employee's profile. To do so, the following step shown below will guide you through:

You can refer to this article to learn more about the process provided above: Auto Enrolment for workplace pensions in QuickBooks Online Payroll.

Also, to learn more about running payroll in QuickBooks, you can read through these articles:

Don't hesitate to post again if there's anything else you need concerning payroll. I always have your back.

Thank you and stay safe!

This is not going to work as they are in the pension scheme and each month they get a salary which should have pensionable earnings coming off and dividend which shouldn't. Any further ideas?

Thanks for the clarification, @Kirsty79.

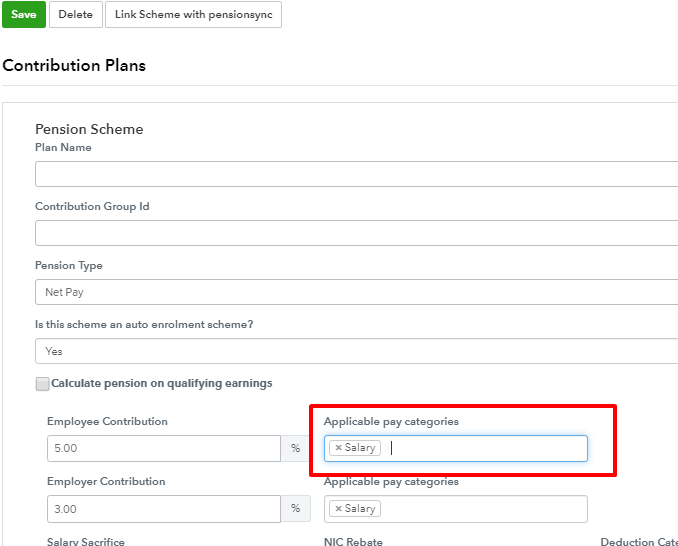

You'll want to go to your payroll Settings and stop the Pension contributions being taken from dividends from there. Let me guide you how to do it in your QuickBooks Online (QBO) account.

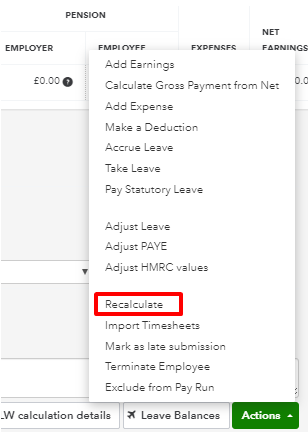

Once done, recalculate the payroll of the employee to ensure the calculation is correct after making these changes. Here's how:

Also, do check our QuickBooks Online Advanced Payroll Hub page for more insights in managing your employees's payroll accordingly.

Let me know if you have other concerns or questions. I'm always here to help you anytime. Have a wonderful day!

Thank you for reply

In the Applicable Pay Categories section Salary is already there and Pension isn't so I guess this still does not solve my problem. Dividends also not selected.

Thanks for clearing things out, Kirsty79.

I want this issue about pension contributions gets resolved. In order to move forward, I suggest contacting our QuickBooks Care Support.

I also recommend sharing the link of this thread to the representative so they become aware of the troubleshooting steps that you've already taken.

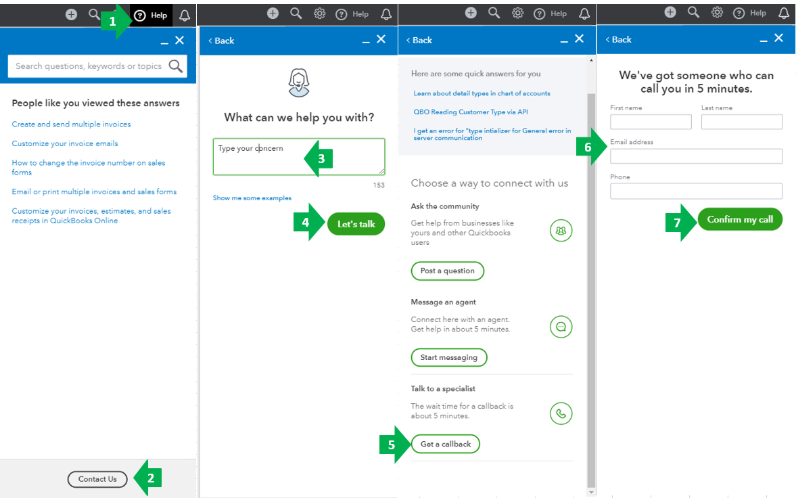

Here's how to contact us:

Get back to me if you have other concerns. I'll be around to answer them all for you. Keep safe and have a good one!

Hello Community users:waving_hand: Just popping in to add some help to this post. In the case that the pension default account as dividends it is a case of mapping the journals to resolve this. To do this we have included a link here. Feel free to add any comments or questions to this thread.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.