Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We are hoping to move over to QB for our Payroll, having previously used a Payroll bureau. I am trying to run parallel runs for January - March, with a hope to taking over in April. However, I can't get the tax to tally up with what our Payroll bureau have given us. I have checked and double checked the year to tax figures and am not sure what else I could try. I am only a maximum of £11 out but don't want to progress to the next month if the figures aren't right for January? Any tips would be very gratefully received.

Solved! Go to Solution.

Thanks for your response, LizaM1.

I appreciate you checking all the necessary payroll data to single out the issue. Let’s try some new steps to ensure your payroll records are correct.

You'll have to check the Payroll Settings and see if the Employer NI relief is properly set up.

Here's how:

If it’s correct, we'll have to trace where the issue is stemming from. The Community is a public space and we're unable to access account information for security reasons.

I recommend you get in touch with our QBO Payroll Team for further assistance. Here's how:

Once they’ve identified the cause and find a resolution, our support team will guide you through the steps to take care of the problem on your tax figures.

That should get you on the right track

Let me know how it goes after contacting them by leaving a comment below. I want to make sure everything you're all set with this concern.

Hello LizaM1,

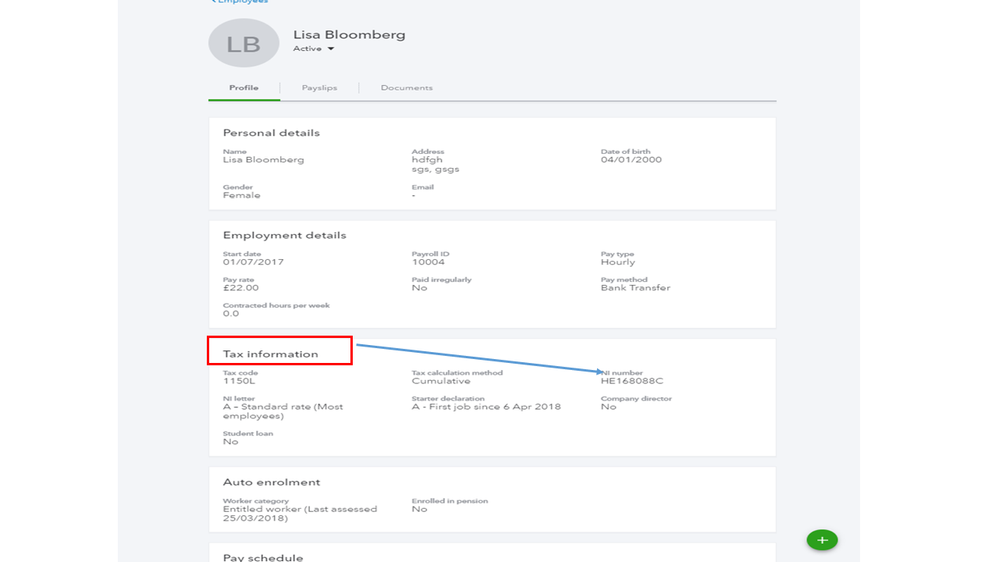

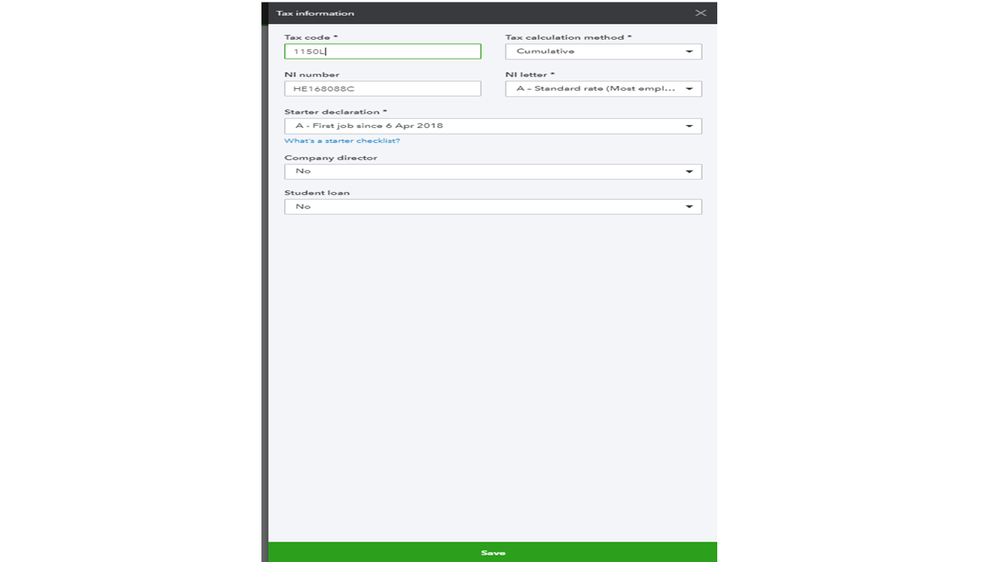

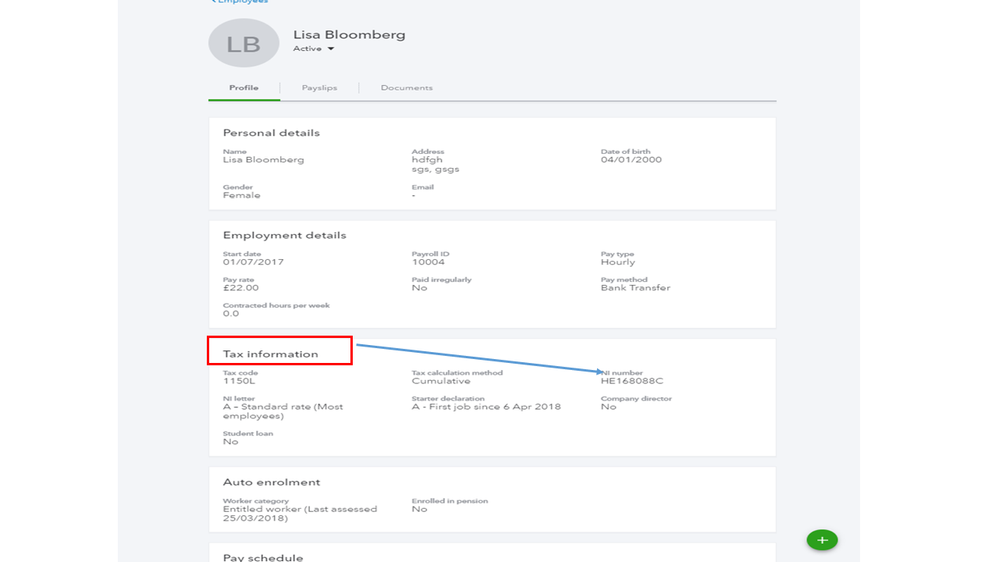

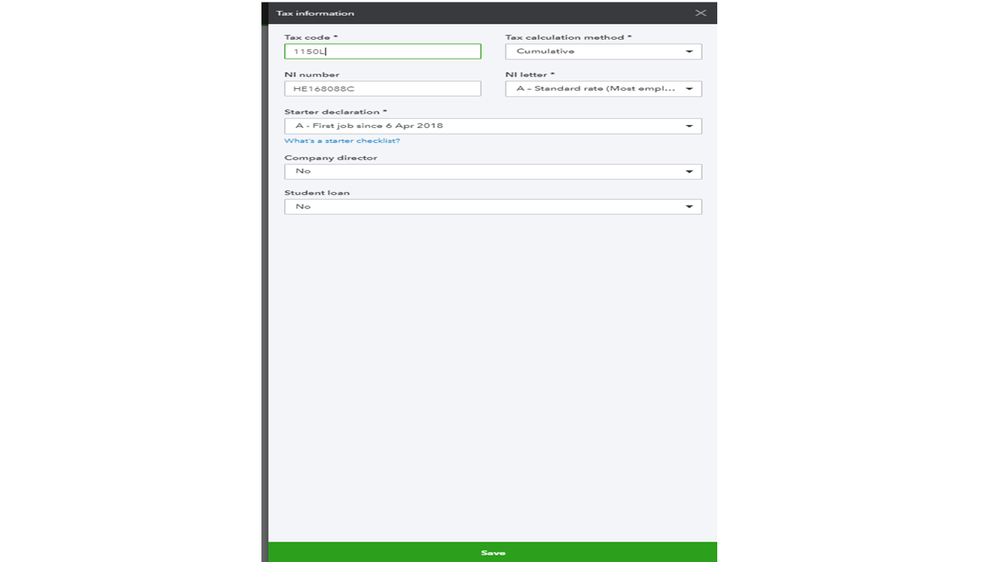

Have you checked all employee's tax codes are correct? And all other year to date figures entered, other than tax?

Thanks,

Talia

Yes, I have checked the Tax codes and the NI, Tax paid and total pay YTD figures too.

Could you also confirm that the tax basis/calculation method is correct, i.e. cumulative/week month 1?

Thanks,

Talia

Yes I believe so

Thanks for your response, LizaM1.

I appreciate you checking all the necessary payroll data to single out the issue. Let’s try some new steps to ensure your payroll records are correct.

You'll have to check the Payroll Settings and see if the Employer NI relief is properly set up.

Here's how:

If it’s correct, we'll have to trace where the issue is stemming from. The Community is a public space and we're unable to access account information for security reasons.

I recommend you get in touch with our QBO Payroll Team for further assistance. Here's how:

Once they’ve identified the cause and find a resolution, our support team will guide you through the steps to take care of the problem on your tax figures.

That should get you on the right track

Let me know how it goes after contacting them by leaving a comment below. I want to make sure everything you're all set with this concern.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.