Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a leaver in the next pay run who I have terminated and turned red - all good!

How do I add the redundancy payment? Should I add a pay category with a fixed rate that is exempt from PAYE and NIC?

Thanks ![]()

Solved! Go to Solution.

Hello ALKS,

Welcome to the Community page,

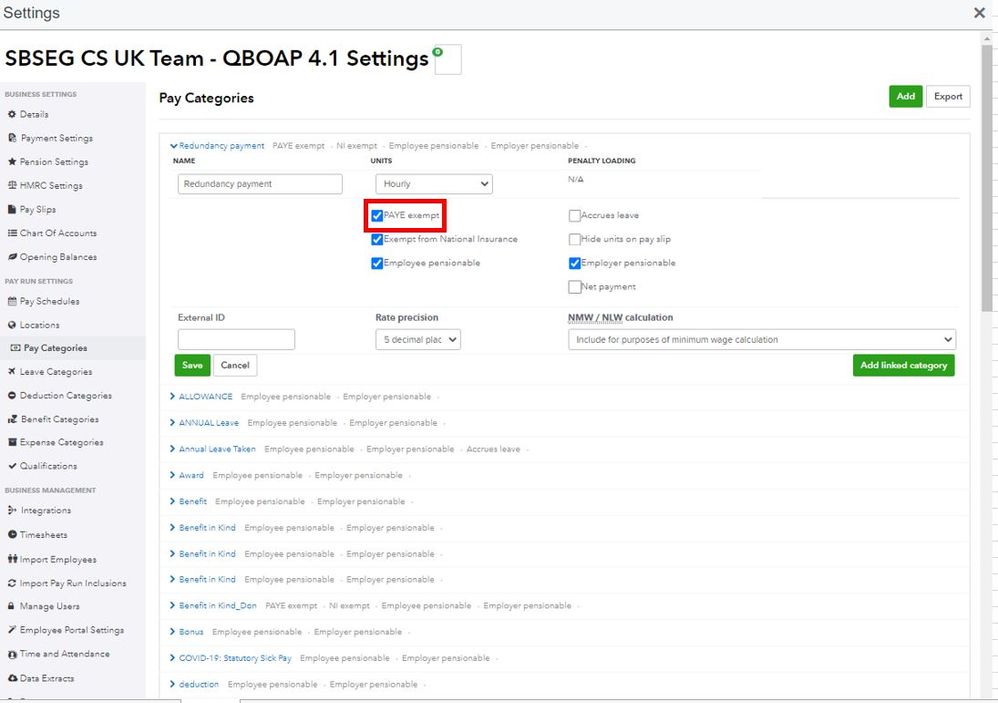

Yes you will need to add a new pay category for redundancy pay with a fixed rate and exempt from PAYE and NIC.

Once it is been added you will then be able to run the payroll. However, unless they get more than 30k when it becomes taxable then you would need to have a second category for the difference.

Hello ALKS,

Welcome to the Community page,

Yes you will need to add a new pay category for redundancy pay with a fixed rate and exempt from PAYE and NIC.

Once it is been added you will then be able to run the payroll. However, unless they get more than 30k when it becomes taxable then you would need to have a second category for the difference.

Thank you!!!!

:smiling_face_with_smiling_eyes:

How do I stop the pension Amount deduction relevant to redundancy pay only?

Hi there, @isaacstaff.

You'll have to override the employee rate for the pension to zero it out. This way, QuickBooks will only calculate the redundancy pay on your employee's paycheck.

Here's how:

Once done, QuickBooks won't calculate the pension amount deduction when you process your payroll.

After this transaction, you can enter the pension rate again to ensure it'll calculate on your next payroll.

I'm adding this article to learn more about setting up deductions: Getting started with deductions.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day.

Thank you for your reply which was all understood, however, i do have pension applicable to some of the usual salary also as redundancy and salary is being paid in final pay this month so cannot zero out pension which is applicable on the salary part of the payment.

Hi Isaacstaff are you using pensionsync? In our case it automatically recognised that pension was not deducted from the redundancy pay. I don't think I had to change any settings to do this. Make sure you use two different pay categories for Salary (NIC and PAYE deductable) and Redundancy (NIC and PAYE non-deductable)

Hi,

I've created a Redundancy payment type with a fixed amount under payroll, but when it's applied to the relevant employee it's showing Tax and NI charges. How do I exempt this payment from PAYE in QBO please? Thanks in advance.

Hello @Cordelia,

Thank you for posting here in the Community. I can help you with your concern about the redundancy payment in QuickBooks Online.

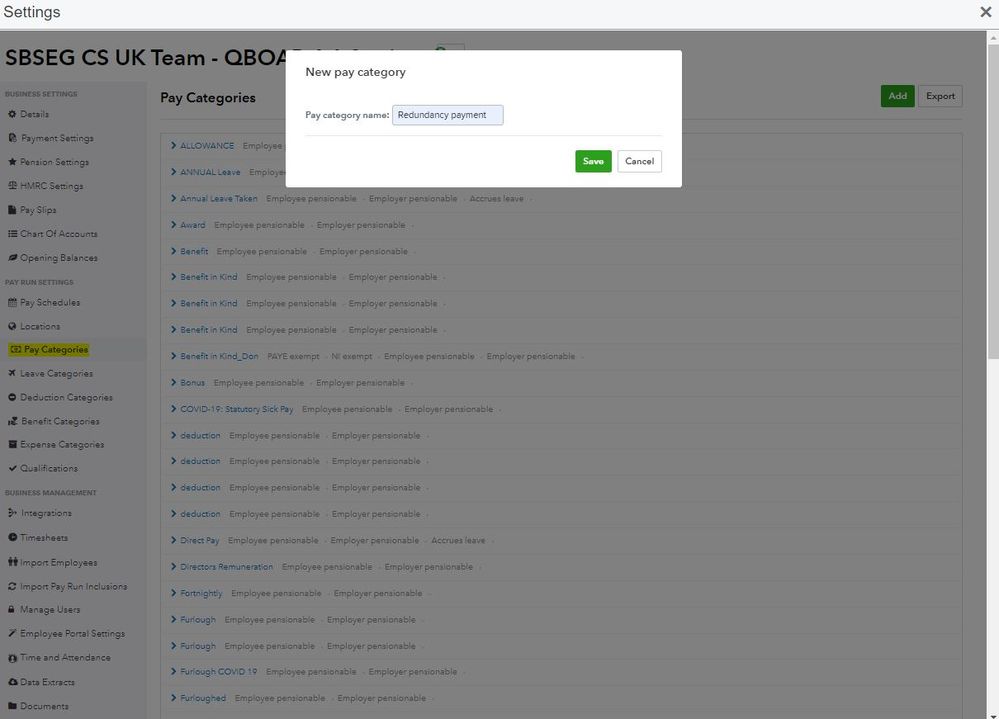

I suggest you create another pay category for the redundancy payment. There should be boxes you can untick for taxes you don't want to calculate in the pay run.

Here's how:

Once done, you can proceed with entering the payment. You can include the category through the earnings section of the pay run.

Additionally, you can visit this article to learn more about how to terminate an employee or cancel a termination in QuickBooks: Terminating an employee.

Keep us posted if you need anything else regarding your payroll or processing redundancy payment. Have a great day.

This instruction is not working for me. I can not find the payroll settings option with such a detailed view. Can you please provide more info specific to quickbooks online advanced?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.