I know a way so you can pay yourself a wage from your business profits in QuickBooks, pesk.

If you're in a sole proprietor business, you can use the owner's draw to process the payment for yourself. You can utilize this account to track withdrawals of the company's assets to pay an owner. Then, generate a regular cheque for this specific transaction.

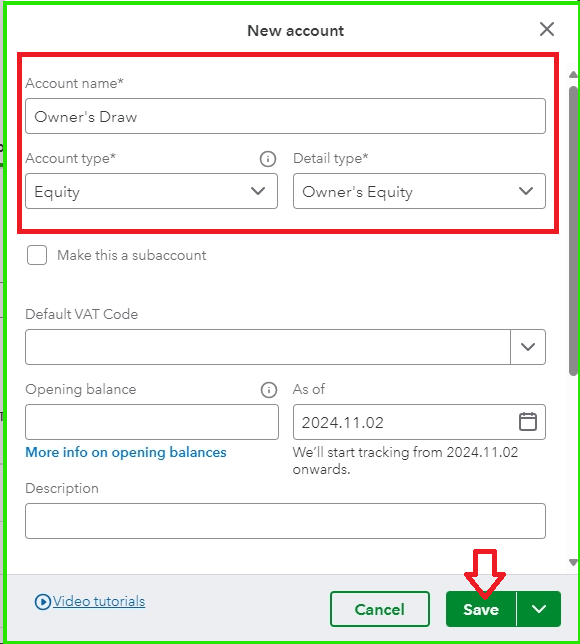

To start, let's create an equity account for the owner's draw:

- Go to the Gear icon menu and click Chart of Accounts.

- Click New and select Equity as the Account Type.

- After that, choose Owner's Equity as Detail type.

- Enter an Account name and double-check everything.

- Once done, hit Save.

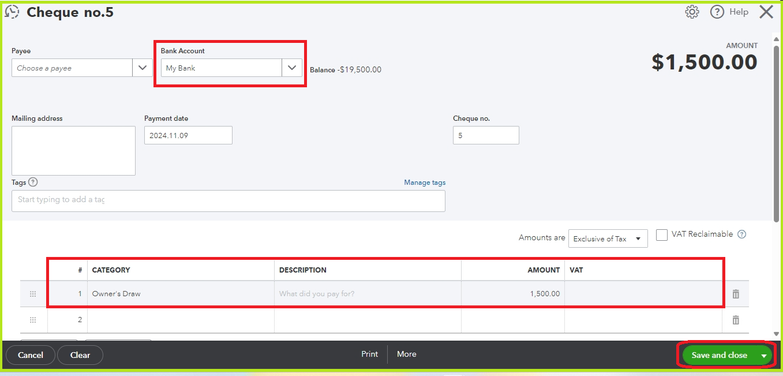

Following that, here's how you can use the account to pay your wage:

- Navigate to the + New menu and select Cheque.

- Pick the Bank Account from which your wage will be withdrawn.

- From the Category details section, choose the owner's draw account you've previously generated as the Category.

- Enter the Amount and complete the rest of the page.

- Once ready, hit Save and close.

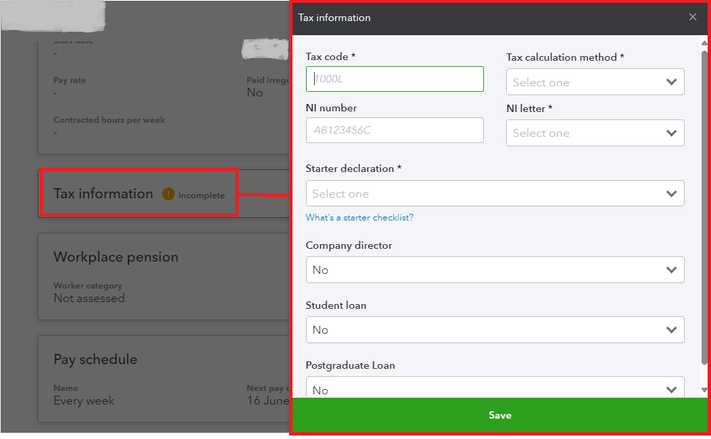

However, if you're not a sole proprietor and have an active QuickBooks Payroll service, you can set yourself as an employee. This way, you can process the amount using the feature:

- Go to Payroll and then Employees.

- Select Add an employee and enter the Legal first and last name.

- Untick the Invite employee to enter their personal details section and then Add my employee.

- Input your Basic info, Pay details, and Tax details.

- After setting up, click the Tax information field and modify it accordingly.

- Complete the rest of the Profile and include yourself when paying your company's workers.

For more tips on handling this, please browse this article: Salary or Draw: How to Pay Yourself as a Business Owner. You may also seek assistance from an accounting professional to manage this transaction, their categories, and the associated taxes accordingly.

Additionally, you can run various payroll reports (Standard or Advanced) to ensure you pay yourself accordingly or pull up financial reports to gain a comprehensive insight into your business and bookkeeping.

If you need additional assistance paying yourself in QuickBooks, tick the Reply button. I'll ensure to take care of you accordingly.