Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi,

Sorry for yet another question! We've completed our first pay run in QBO Advanced payroll after migrating from QBDT. We set the payment method to manual as pay the employees via internet banking. If we look at the bank account via chart of accounts the payroll payments do not show up. Is there a further step we need to take so that the payroll payment is deducted from the bank account in QBO?

Thanks,

Phill.

Solved! Go to Solution.

Hi there, @PhillB

Yes, you're correct. Add each payroll payment as a cheque using the payment liability account.

It also depends on you if want to use the same liability account or separate them. Follow these steps on how you can assign a liability account for each payroll item:

Please add another reply below if you need anything else.

A supplemental question to this, we'll also need to make payments to HMRC for the payroll liabilities and to the pension company for the pension contributions, how are they made please as they don't appear to have been recorded to the bank account ledger within QBO automatically?

Hello there, PhillB,

QuickBooks Online Advanced Payroll automatically configure your chart of accounts to post payroll costs into their correct account. You can check more about that on this article: Benefits of QuickBooks Online Advanced Payroll (QBOAP).

Furthermore, for payroll liabilities, you can set up HMRC Settings. Just go to Payroll Settings > HMRC Settings. You will need to fill in your tax office number, your tax office reference and the accounts office reference.

Check this article for more information: QuickBooks Online Advanced Payroll Hub. You'll see related articles on how to use QBOAP.

Let me know if you have other questions, I'll be happy to help.

Hi Mary,

Thanks very much for your reply. What you say is what I expected, but doesn’t seem to be what has happened. We have run payroll but the amount paid to employees has not be posted against the bank account. How do we get QB to post the payroll amount to the bank account please?

Thanks,

Phill.

Hello there, PhillB,

After completing your pay run, your next step is to create a check or expense in QuickBooks Online. This is to record the payment and reflect it on your bank register. Just make sure you select the bank account used to pay the employee.

I'm glad to show you how:

If you have a lot of cheques to write, it is easier to either enter them from the Account history, or download transactions directly from the bank.

Keep me posted if there's anything else you need. I'm always around here in the Intuit Community to help.

Thank you and stay safe!

Hi Mary,

Thank you for this. So just to double check, doing it via the bank downloaded transactions, we add each payroll payment as a cheque using the "Payment" liability account that QuickBooks has posted the payroll payments to, is that right?

It appears the payroll liabilities are being posted to several different accounts, for example PAYE liabilities, NI Liabilities, Pension Liabilities. When we add the HMRC payment do we just split it between these accounts? In QBDT all payroll liabilities went to a singe payroll liabilities account. Is it acceptable in QBO to change the default accounts all to a single payroll liability account or is it better to leave as separate liability accounts. The accounts we used in QBDT, while migrated to QBO and appearing in the chart of accounts, don't seem to appear in the list of accounts that can be selected as default payroll liability accounts, is that normal?

Thanks again,

Phill.

Hi there, @PhillB

Yes, you're correct. Add each payroll payment as a cheque using the payment liability account.

It also depends on you if want to use the same liability account or separate them. Follow these steps on how you can assign a liability account for each payroll item:

Please add another reply below if you need anything else.

Thank you, that’s great and makes sense.

I assume that as in the default account process we can’t change the account to our old Payroll Liabilities account from QBDT that the auto created QBO accounts have to be used for payroll liabilities do they or am I doing something wrong do you think? Ideally we would continue to post payroll liabilities to the payroll liability account migrated from QBDT.

Thanks again for all the help,

Phill.

Hello there, @PhillB.

Allow me to chime in for a moment and provide additional information about the accounts in QuickBooks Online.

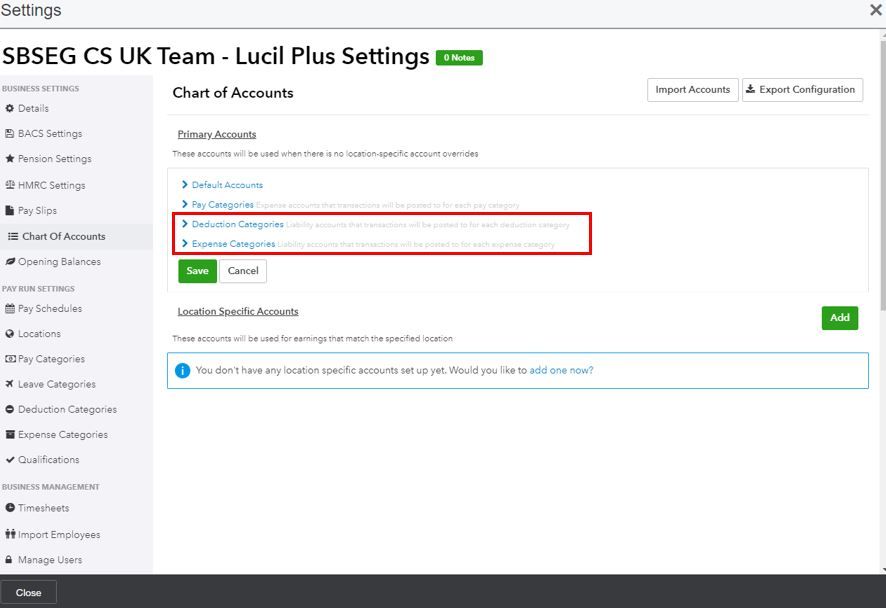

You can go to the Payroll Settings section to make changes to the default liability accounts.

Here's how:

In the meantime, you can check the following article for some links about the payroll tasks, as well as adding employer liabilities:

Adding employer liabilities to a pay run in QuickBooks Online Advanced Payroll.

Please know that I'm just a post away if you have any other questions. Have a great day ahead.

Thank you, will do. I think I’ll just leave the liability accounts as the default ones then and can just make the old payroll liability account inactive.

Thanks again,

Phill.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.