I got you covered, Yanti. In the sad event of an employee's death, please ensure that any outstanding pay is processed and recorded in QuickBooks Online Payroll. Here are some details about final pay with National Insurance Contributions (NIC) and tax.

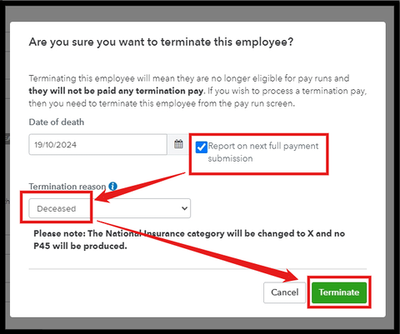

You must put the date they died into the ‘Date of leaving’ field in their next Full Payment Submission (FPS) and deduct tax using the deceased employee's existing tax code. Use category letter X so that they do not deduct National Insurance and do not produce a P45.

When an employee passes away, No NIC contributions should be deducted from any payments made after the date of death. For example, if date of death is recorded as 12/04/2012 and payment is made for the month on 26/04/2012, then no NIC should be deducted from that or any subsequent payment made in respect of the employee.

However, taxes should continue to be deducted as normal, however once the P45 has been generated, any subsequent payments should attract tax using an 0T tax code on a non-cumulative basis (for example, week 1/ month 1 basis).

Check out this article for a detailed guidance: How to process final pay for a deceased employee in QuickBooks Online Payroll

I'm also adding this resource in case you need help in managing your payroll in QuickBooks: QuickBooks Online Standard Payroll Hub.

You can find me here if you have any other concerns or questions managing your employees' taxes in QuickBooks. I'm always here to lend a helping hand. Take care!