Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I run a small record label, and I split the profit from each release 50/50 with the musician involved. I work out what the profit is on a spreadsheet, then pay the artist, they don't invoice me. How should I categorize these 'payments out' in QuickBooks?

Thanks Frances

Hello claypipeM, How are you recording the income from the releases? Are you recording the 100 percent income to the business? If so then in terms of profit and loss you would need to record the expense of paying the artist, in a sense you are paying them for a service. It would be a case of creating an expense category for this and then recording the expense in the +symbl>expense and setting the artist as the payee. That way on reports both things will show on the p and l and you can see them, If you are looking to record this a different way let us know

Thanks yes thats exactly how I was hoping to do it, I'm quite new to quickbooks but will look into your suggestions, and see if I can figure out how to set it all up.

One question could you let me know what you mean by +symbl>expense ?

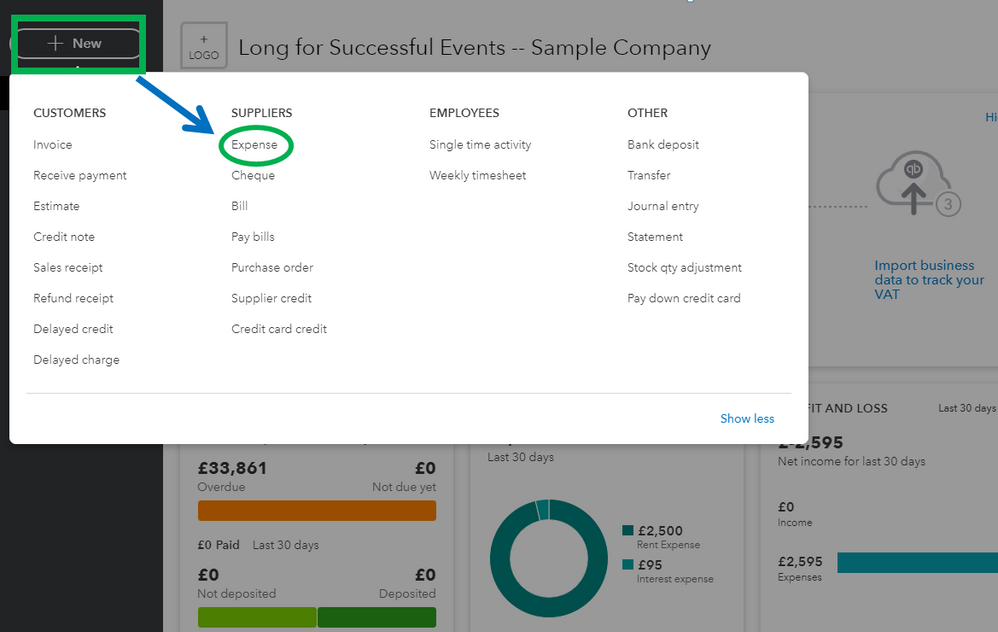

You'll find the plus (+) symbol when entering a transaction in your QuickBooks Online account and I'm here to show how to do it, claypipeM.

To create an expense, you'll have to start by clicking the + New symbol. Another way is to click the Expenses menu on the left menu. Moreover, you can follow the detailed steps below.

Please check this article in case you want to edit or delete an expense transaction: Enter, Edit, Or Delete Expenses In QuickBooks Online.

You'll want to check out these resources for your reference. This will guide you through the basic topics that you'll need to learn in QuickBooks Online: Get Started With QuickBooks Online.

Please let us know if you have any other concerns about expenses. I'll always be around if you need further assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.