- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Making Tax Digital

- :

- Re: UK Self Assessment - QB Income Tax report not showing Mileage

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

UK Self Assessment - QB Income Tax report not showing Mileage

I've used QB Self Employed for a few years now but I still only have basic understanding of it, I don't need many of its features but the ability to send invoices and keep track of payments is invaluable. Every year when I use the Income Tax section to help with my Self Assessment return I expect to see a increase in my business expenses due to the mileage I've been keeping track of but it is never there. Can someone tell me why?

From reading many other posts on this forum it looks like this could either be caused by an error in the system or that this part of QB isn't yet finished and you have to manually add another account with the total saving. Or I could have mis-understood how mileage allowance is calculate and that is just isn't applicable.

Solved! Go to Solution.

Labels:

0 Cheers

Best answer May 05, 2022

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

UK Self Assessment - QB Income Tax report not showing Mileage

Thanks for getting back here and sharing additional details, PeterHumphreys.

QuickBooks uses the simplified expense method to calculate your mileage allowance. It means that it counts the total miles per business trips and multiply it by 45p. Additional details about this calculation are discussed here: About Car, Van, and Travel Expenses.

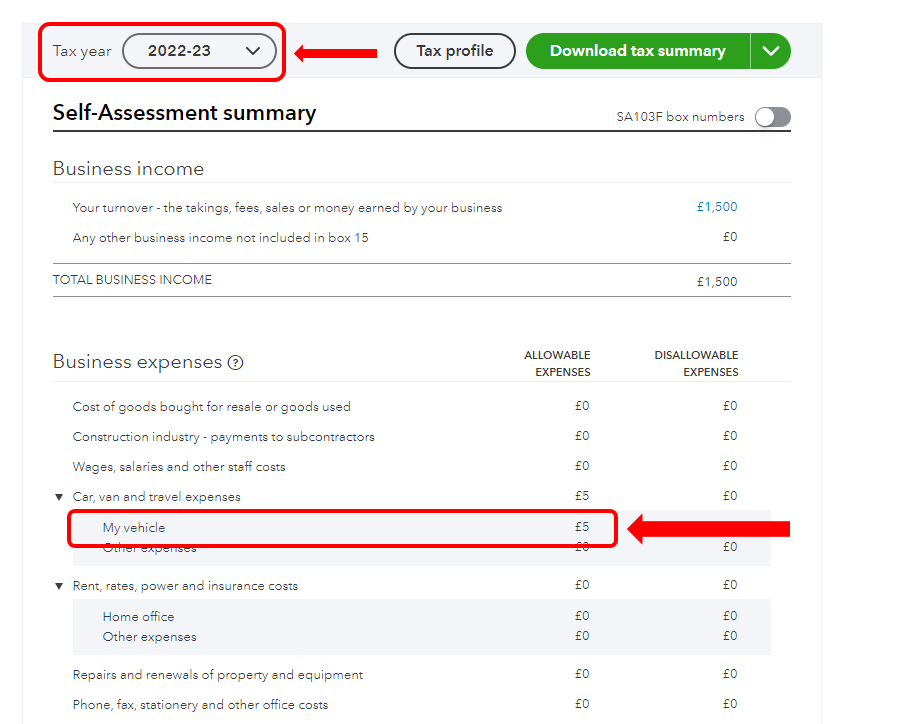

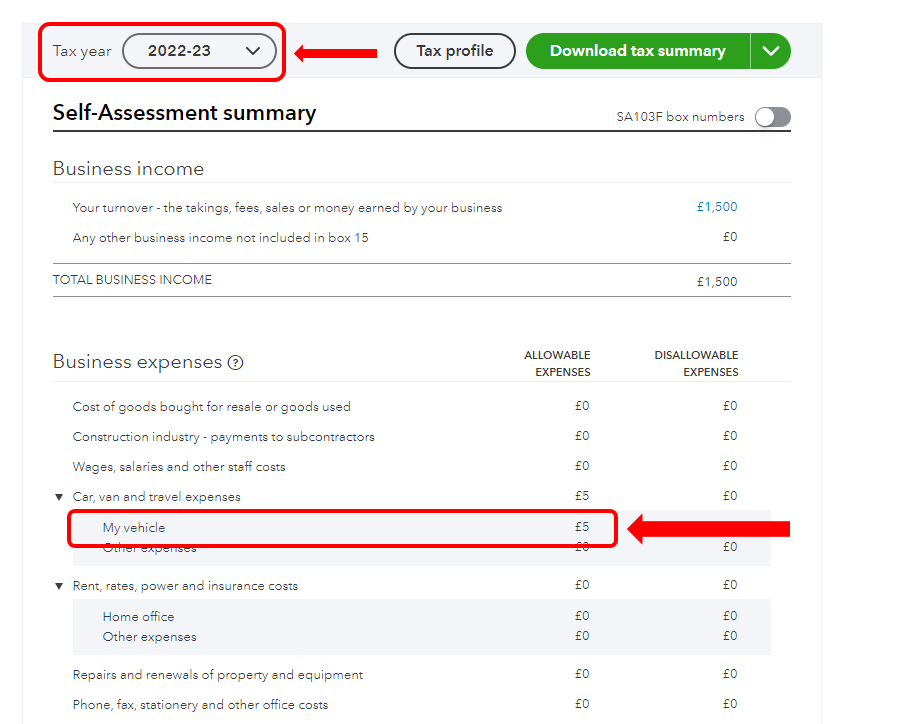

This business expense is reported under the My vehicle section. If you can't see it, click Car, van, and travel expenses to see more details.

From that you can calculate the amount and then create the expense and add it in.

Aside from that, you also need to make sure the Tax Year is the right one. Just click the drop-down list for Tax year and select 2022-23 if you're doing it for the current year.

We have more articles to share with you for additional references about tracking miles in QBSE:

- Three Tax Calculations to Help You at Tax Time

- Simplified Expenses Mileage Method (with flat rates) Versus Actual Costs for Vehicles

As always, feel free to ask follow-up questions give us another visit if you need anything else.

0 Cheers

3 REPLIES 3

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

UK Self Assessment - QB Income Tax report not showing Mileage

Thanks for sharing your concern with us today, PeterHumphreys.

I'd like to make sure we're on the same page so I can give you the exact information you need.

May I ask the workflow on how you record or track your mileage? Any details will help us provide the accurate steps to resolve this. Adding a screenshot would be a great help too.

You can also check out this article to learn more about manually tracking mileage in QuickBooks Self-Employed: Manually track mileage in QuickBooks Self-Employed.

I hope you can respond to me on this thread so we can work on your concern together. I'm always here to help. Stay safe!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

UK Self Assessment - QB Income Tax report not showing Mileage

Hi Kevin, thanks for your message.

I used to use the automatic mileage tracking in your app but it drains the battery on my phone too quickly so now I input the data manually on the website. I tried to attach a screen show but your website isn't letting me upload it however I believe I am entering the information correctly.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

UK Self Assessment - QB Income Tax report not showing Mileage

Thanks for getting back here and sharing additional details, PeterHumphreys.

QuickBooks uses the simplified expense method to calculate your mileage allowance. It means that it counts the total miles per business trips and multiply it by 45p. Additional details about this calculation are discussed here: About Car, Van, and Travel Expenses.

This business expense is reported under the My vehicle section. If you can't see it, click Car, van, and travel expenses to see more details.

From that you can calculate the amount and then create the expense and add it in.

Aside from that, you also need to make sure the Tax Year is the right one. Just click the drop-down list for Tax year and select 2022-23 if you're doing it for the current year.

We have more articles to share with you for additional references about tracking miles in QBSE:

- Three Tax Calculations to Help You at Tax Time

- Simplified Expenses Mileage Method (with flat rates) Versus Actual Costs for Vehicles

As always, feel free to ask follow-up questions give us another visit if you need anything else.

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...