Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Greetings I have set up CIS but I'm struggling to fill my sales invoices in the product box has the CIS option filled in and calculates the amounts but how do I enter the actual service I have provided

Solved! Go to Solution.

Hi Robin,

I'm guessing you are sorted on this now, but there is a fully recorded webinar that explains how the CIS feature works. You'll find within the 'on-demand' area.

https://quickbooks.intuit.com/uk/small-business-webinars/

CIS updates are expected very soon, so look out for those.

Ash.

Thanks for joining us here, robinbaitey.

You can open the invoice. Then, add the service you provided in the first line. You can then add the the CIS amount in the second line item.

More details on how to use this function are discussed here:

Let me know if you need anything else.

Greetings I still have an issue I've entered the service on the first line and the CIS on the second line but the CIS appears in the totals as just 20% of the second CIS line not 20% of the first .

Hi Rob,

CIS can only be applied to single transaction lines by using the applicable CIS category on the product/service drop-down, therefore you should enter the total CIS amount against this line and not the service line.

Please get back to us below if you have any questions on this,

Thanks :)

Greetings back to you!

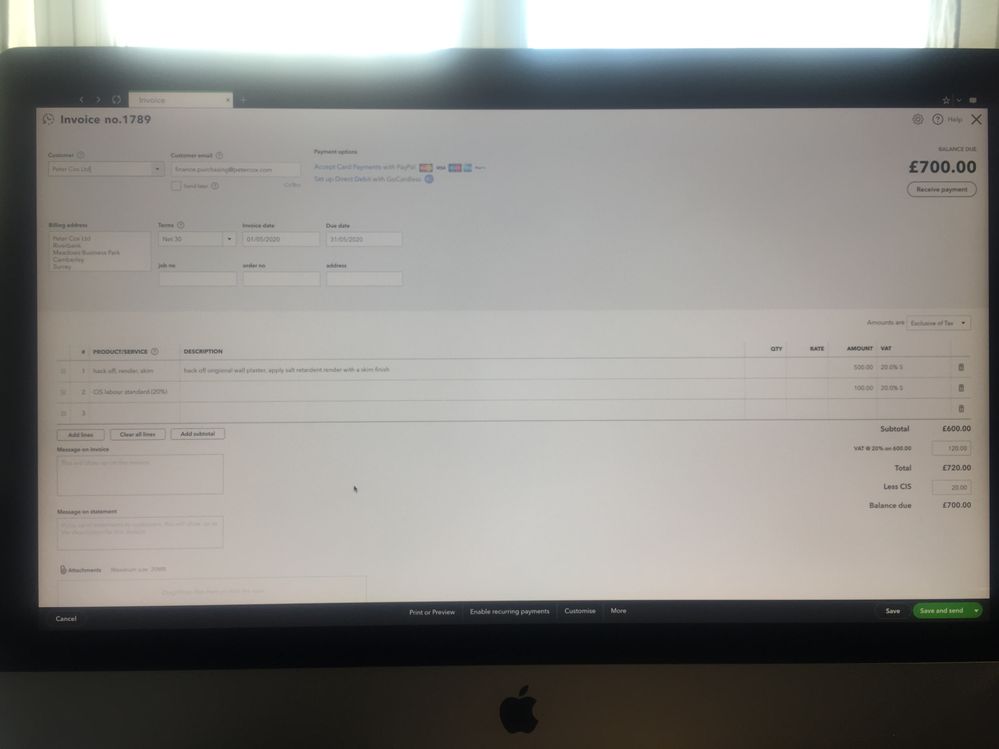

When entering CIS on an invoice you should select one of the QuickBooks CIS accounts listed below under the product/service drop-down, and then enter the total gross amount in the amount column. You'll then see the CIS deduction amount calculated under the subtotal area.

You can add multiple lines on the invoice if you wish to split the transaction using different CIS accounts, or if there are additional services that are not CIS-deductable you would enter those on a separate row by selecting a non-CIS account.

The income CIS accounts are:

CIS income gross (0%)

CIS income standard (20%)

CIS income higher (30%)

CIS supplies and materials reimbursed

You can view our CIS guide here for further tips, please get back to us below if you're still unsure at all!

Greetings Georgia thanks for your help but if I select CIS from the product/service column and enter the full gross amount it is indeed correct in the totals but the service I am providing will appear as CIS to my customer not ideal is there anyway around this .

Thanks for getting back to me Robin,

You would need to enter the CIS category in the product/service column however you can remove the product/service list from showing on the invoice by editing the invoice template.

To do this, go to the Cog Wheel > Custom Forms Styles > Edit > Content > Select the activity table > Untick 'category'. You can then enter the service name in the description field for the customer to see.

Let us know if you have any questions!

Greetings again Georgia just to confirm I enter CIS in the drop down product/service column but alter the template not to show the client this on the invoice then I manually type the product/service description this appears to work but does involve the manual typing not the end of the world but still a chore . Any bright ideas how to get around this .Many thanks Robin

Hello Robin!

The only other alternate options to this would be to edit the CIS chart of account itself, you can do this by going to Accounting > Chart of Accounts > Select edit on the drop-down beside the account.

You can either re-name this, which would then be how the CIS account shows on the product/service list on the invoice, or enter a description which will auto-populate on the invoice each time you select the account.

Thanks :)

Hi Robin,

I'm guessing you are sorted on this now, but there is a fully recorded webinar that explains how the CIS feature works. You'll find within the 'on-demand' area.

https://quickbooks.intuit.com/uk/small-business-webinars/

CIS updates are expected very soon, so look out for those.

Ash.

I have just been looking at this myself

Would it not have been better to have a line for the cis deduction rather than just a cis item for the full amount?

It has made the items list redundant and the ability to track items is lost

CIS should be deducted on labour only. After selecting the approriate item to record labour, the correct amount should be deducted in the total box. Adding other costs like materials, sundry expenses the CIS will not be effected. However, the CIS box is completely editable, so if sombody pays the incorrect amount and deducts too much or too little CIS, simply change this value so that the invoice balance agrees to the amount received.

CIS adjustments are held separately in the balance sheet and can be fully tracked and reconciled from there.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.