Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Both directors are set up identical except that the one that I cant enter a salary for has a pension from a 3rd party. I need to now enter a final salary amount for the last payroll run of 18/19 but QBO will not let me enter anything for this one director. It says I need to finish setting up this director, but all boxes are filled on the employees page except for the pension P60 details as he doesn't have them. Where am I going wrong? Is it the pension/other employer details that is stopping me from running the payroll? They haven't been paid anything to date from this company.

Solved! Go to Solution.

I appreciate you voicing out this concern, JEBCON1,

QuickBooks Online is compliant with what HMRC mandated. As this issue has been escalated, we will continue to work towards a solution and what options are for working around this issue.

If you've encountered the same challenges when changing status of your employee, then please let us know for us to further investigate. As a workaround, you can also set up a new employee instead.

If there's anything else you need help with, please feel free to visit us again. Have agreat day!

Hi there, JEBCON1.

Thanks for reaching out to us here in the Community. I want to ensure you can run payroll for the other director.

Just to clarify, are you using QBO Payroll or Paysuite? While waiting for the information, I have a few steps you can try to get past the error.

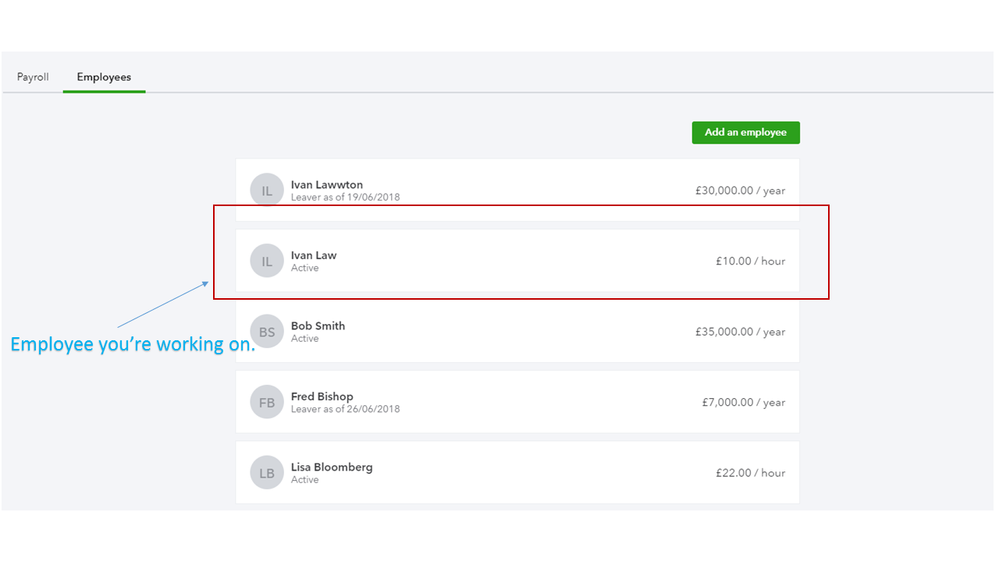

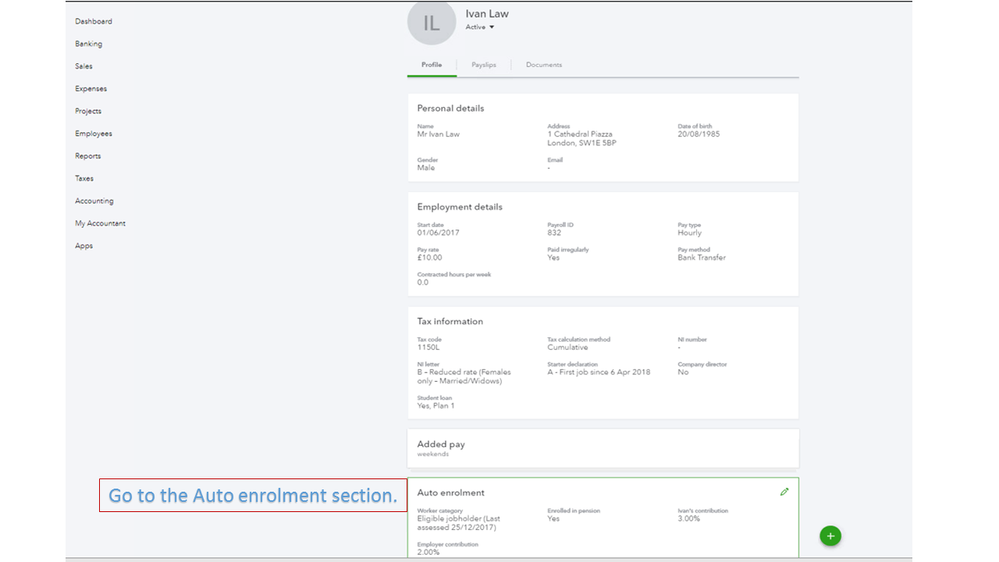

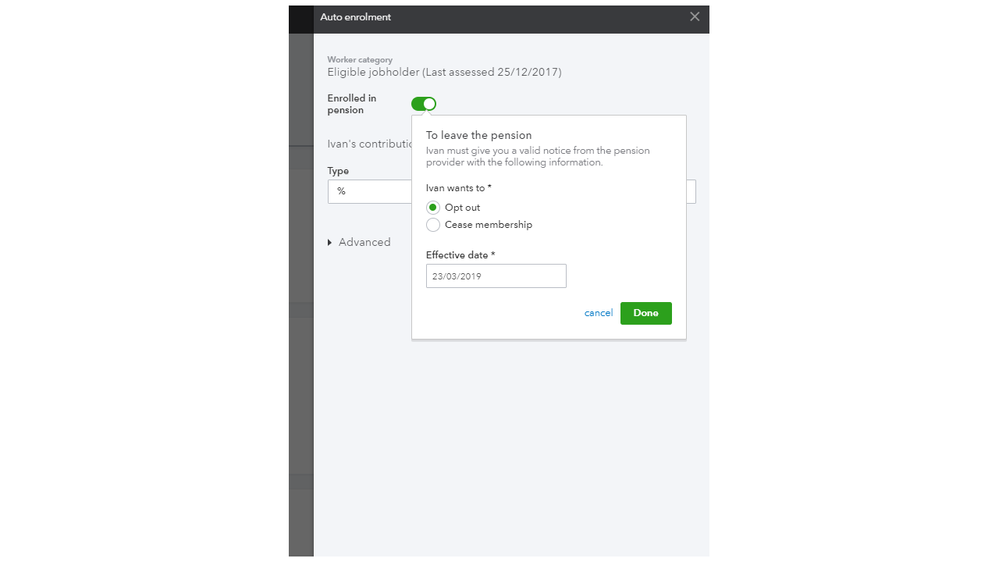

If you process payroll via QuickBooks Online Payroll, update the Auto-enrolment status to Opt Out to stop the message from showing up.

Here’s how:

In PaySuite, mark the director’s Auto-enrolment to Non‐eligible Jobholders, so you’ll no longer be prompted to finish the payroll setup. For more information, check out the Auto Enrolment for workplace pensions in PaySuite.

You can go directly to the What do I need to know about opting out? section. After updating the director’s information, you should now be able to process payroll seamlessly.

Let me know if you have additional questions about the process. Please know I’m always ready to answer them.

Hi Rasa-LilaM

Thank you for your info re autoenrolment pension although this wasnt the problem. Eventually we spoke with Quickbooks themselves and it turns out that because we changed the NI code from A to C during the year (which was correct), QBO would not let us enter a salary. As the amount we were wanting to pay was under the NIC thresholds we changed it back to A and it then allowed us to enter a salary. Apparently this is a problem with QBO, and we were assured that the software would be investigated further/changed. We cannot be the only company to have a director that becomes a pensioner during the year! We wonder if we will have the same problem if an employee changes status from apprentice rate to Table A or Under 21 to Apprentice etc?

I appreciate you voicing out this concern, JEBCON1,

QuickBooks Online is compliant with what HMRC mandated. As this issue has been escalated, we will continue to work towards a solution and what options are for working around this issue.

If you've encountered the same challenges when changing status of your employee, then please let us know for us to further investigate. As a workaround, you can also set up a new employee instead.

If there's anything else you need help with, please feel free to visit us again. Have agreat day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.