It's my priority to help you send the Employer Payment Submission (EPS) to HMRC, richardcarswell8.

Once you completed all the payroll for the tax month, you can send the EPS to the HMRC. This gives you a status of Overdue and the date that it was supposed to be sent under the Due Now section in the Payroll Tax Centre. You can also do it by the 19th of the following month if HMRC has to give you credit for what you owe from the EPS.

Just follow the steps on this article to submit EPS using your Standard Payroll service: Submit EPS to HMRC in QuickBooks Online Standard Payroll.

If you are using QuickBooks Advanced Payroll, just refer to Employer Payment Summary (EPS) in QuickBooks Online Advanced Payroll article.

For Paysuite, you can follow the instructions below:

- Click Company Cog and choose Employer Settings.

- In the Real-Time Information section, you'll notice an option to send an EPS.

- Select the EPS and view the details.

- Tap Submit. Then, enter your HMRC credentials if this is the first time you’re submitting to HMRC.

If the same thing happens after completing the payroll for the tax month, I'd suggest contacting our Payroll Support Team. They'll pull up your account in a secure environment and help you file your EPS to the HMRC.

Here's how to reach them:

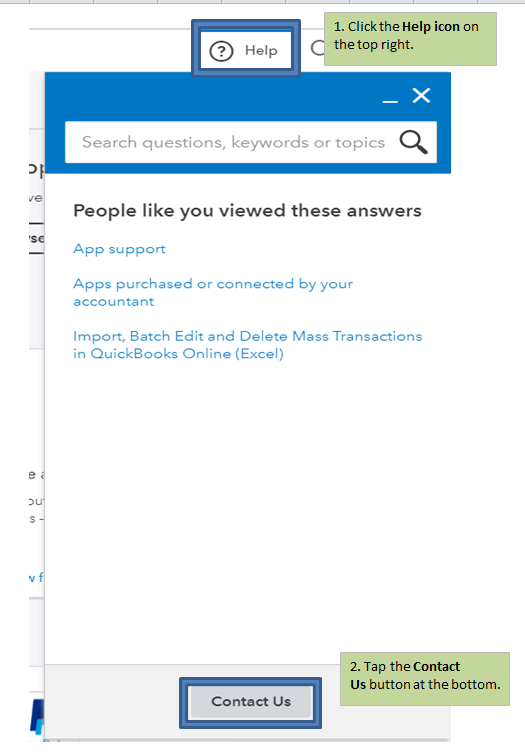

- Click the Help icon on the top right.

- Tap the Contact Us button at the bottom.

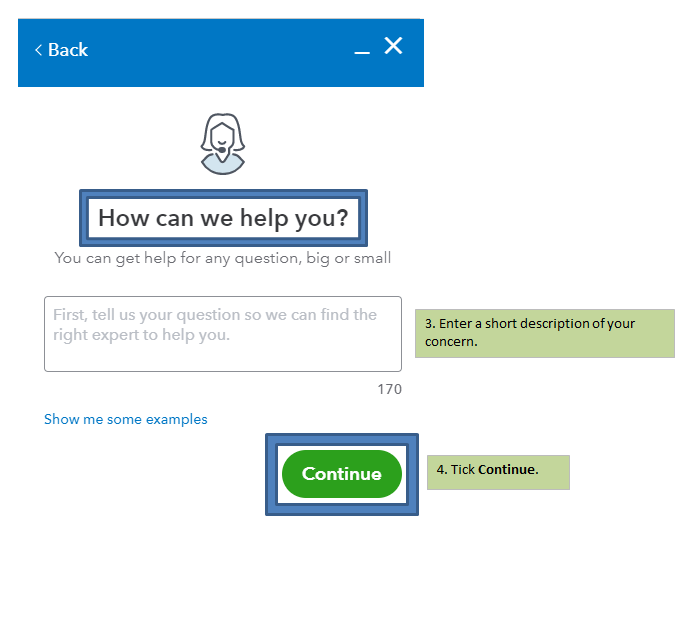

- Enter a short description of your concern.

- Tick Continue.

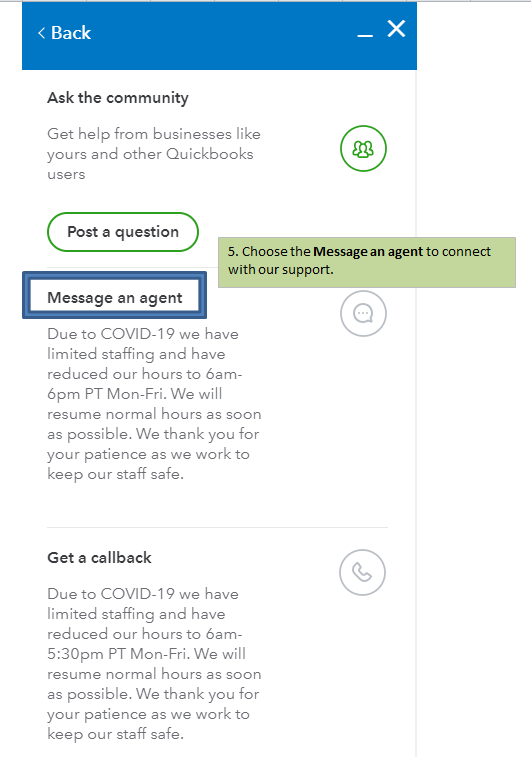

- Choose Message an agent to connect with our support.

Fill me in if you need anything else in QuickBooks Online. I'm happy to help you out. Keep safe and healthy.