You can record and show that you paid your tax at source on incoming payments by manually adding it as a line item, @joneselectrical.

To track your tax paid at source, simply add it as an item in your invoice. We’ll walk you through the process.

Here’s how:

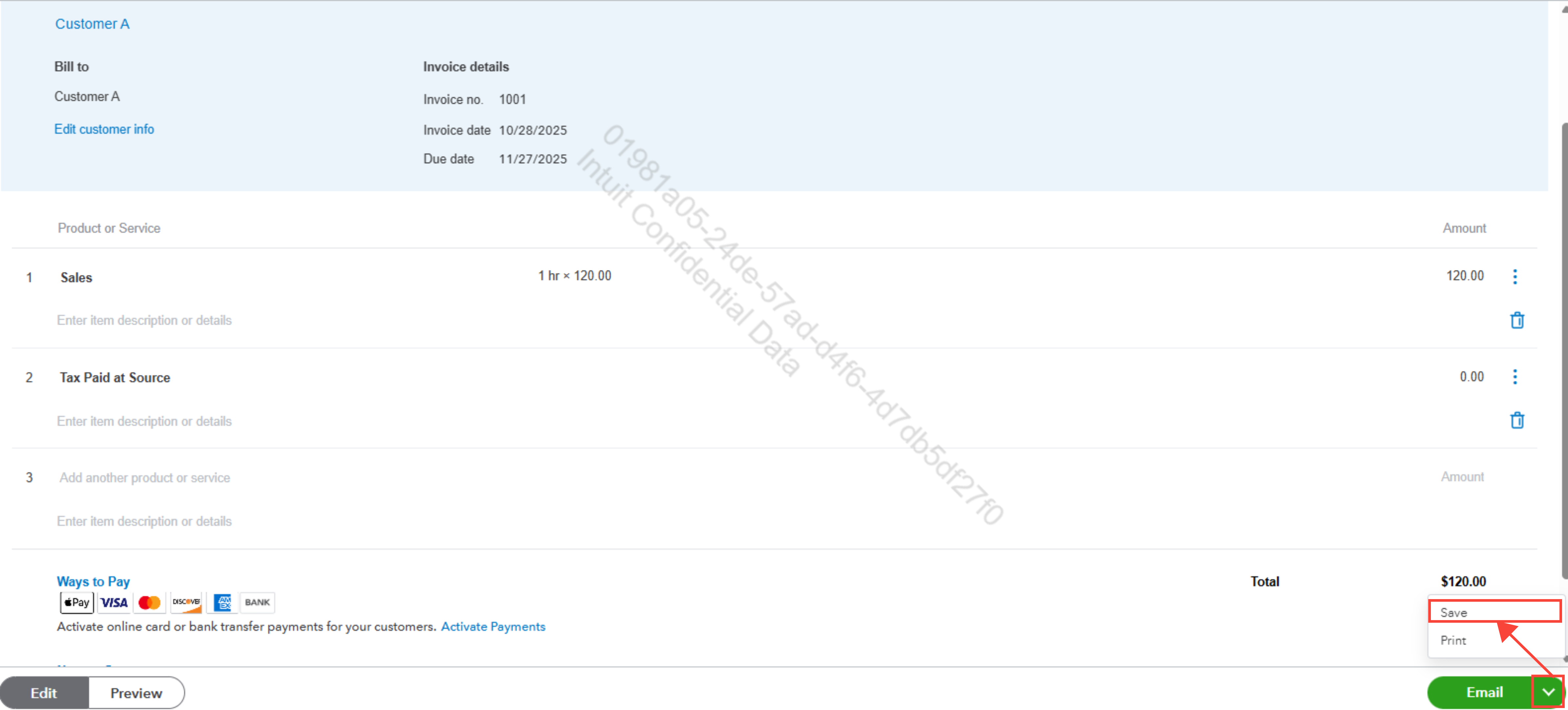

- Go to Invoices, then Create Invoice.

- Enter the Product or Service for which the incoming payments are being made, along with its Amount.

- On the next line, click on the Product or Service dropdown and select Add new.

- Set the name as “Tax Paid at Source”.

- Click Save.

- Enter the amount of tax paid at source in the Amount field.

- Select the dropdown menu next to Email, and then click Save.

Once full payment has been made and your bank is connected to your QuickBooks Self-Employed (QBSE) account, you’ll need to manually Add transaction in the Transactions tab for the tax payment.

If your bank isn’t connected, you’ll need to manually input both your actual income and the tax as separate entries. For accurate records, be sure to assign the correct category to each transaction.

You are encouraged to reply to this thread if you have further concerns and questions regarding QBSE.