Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have produced 2 invoices on different occasions and chose 20% VAT rate but the VAT amount shows as £0. Why is this happening? Anyone else experiencing this?

The VAT amount will show as zero if you selected the 20.0% RC CIS VAT on an invoice, as it is a reverse charge, @EmmaV1.

In QuickBooks Online, there are two 20% VAT codes applicable for sales, such as 20.0% RC CIS VAT and 20.0% S VAT. The 20.0% RC CIS VAT is not charged on the invoice, as your customer is responsible for accounting for the VAT directly to HMRC. If you mean to use the standard 20% rate, select 20.0% S VAT on your transaction for accurate calculation.

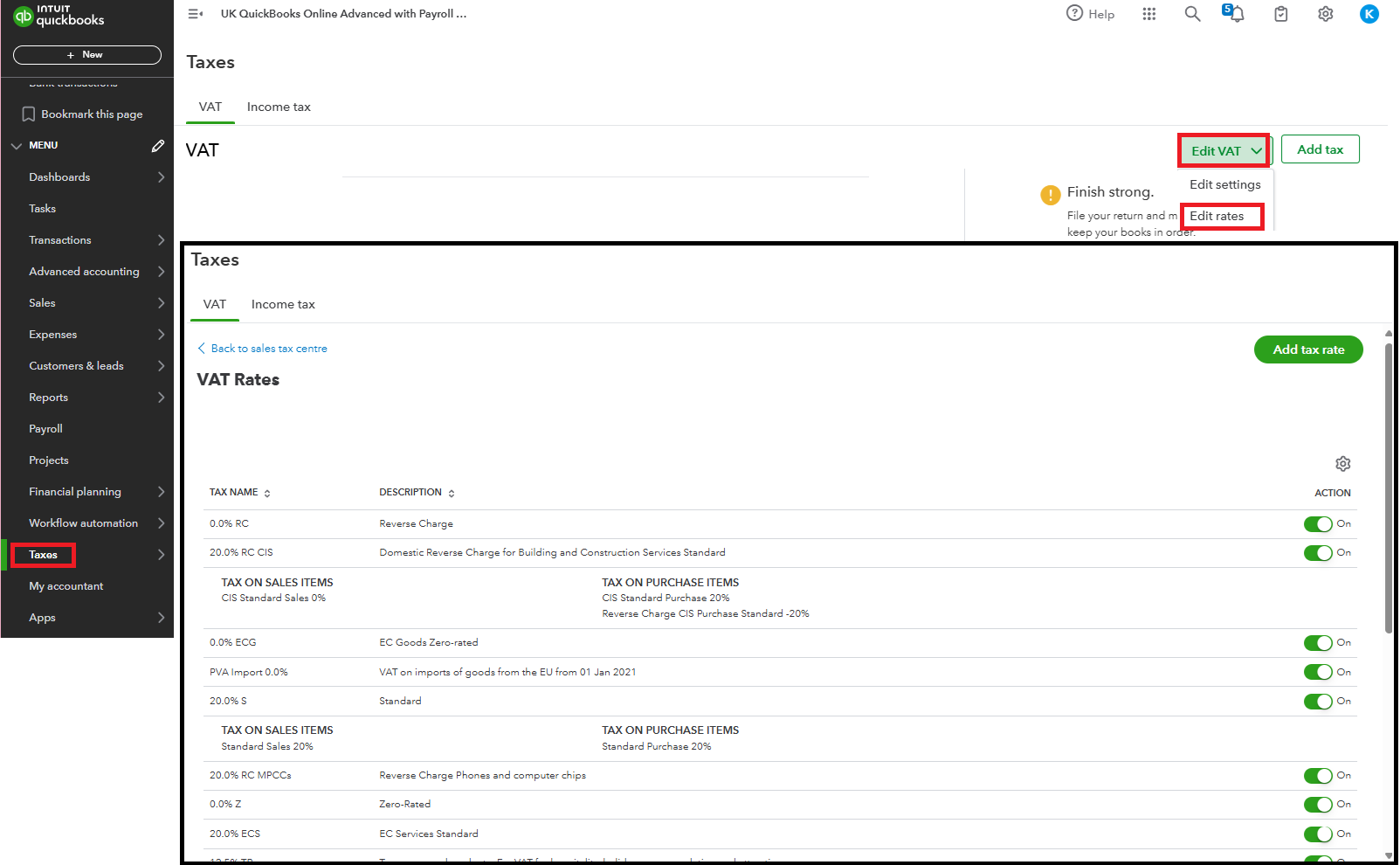

Also, you can review your Tax page in QuickBooks to better understand how each of them is calculated. Here's how:

If the correct VAT code is selected and the VAT amount still shows as zero, I suggest troubleshooting your browser to resolve unexpected issues caused by corrupted data. If the behavior continues, you can switch to a different supported and updated browser. It can help resolve problems that are specific to the browser you're currently using.

If you mean something else, hit the Reply button below. We're here to assist you in any way we can.

If you're facing issues with incorrect VAT amounts in QuickBooks, it could be due to incorrect VAT codes applied to transactions, errors in VAT adjustments, or display issues with invoice previews. To resolve this, ensure the correct VAT codes are used, review any VAT adjustments, and consult QuickBooks support if the problem persists.

Hi

Definitely not applying an incorrect VAT code. I checked and double checked this.

I'm not sure how to troubleshoot the browser.

Someone mentioned that there may be display issues with invoice previews.

1 - I am not able to preview invoices.

2 - I printed the invoice and the VAT amount was showing as 0.00 even though 20% VAT was applied.

This has only happened twice in approximately 2 months.

I look forward to any help / thoughts.

I appreciate your effort in double-checking the VAT code, Emma. I'll route you to our Live Support team to assist you with the issue regarding the incorrect amount and invoices.

They can provide real-time assistance by accessing your account to diagnose the root cause of the VAT display issue and ensure your invoices reflect the correct VAT amounts moving forward.

Here's how to connect with them:

I'd also suggest checking the support hours to know the best time to contact them at your convenience.

If you have additional questions, please leave a reply below. The Community is always here for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.