I'm happy to see you here in the Community, @Arpad Attila Csibi.

I've got information to share on what are the ways to pay a director in QuickBooks Online.

If you're required to deduct taxes for your salary and wanted it to be calculated automatically, then you'll need to add your self as an employee. That said, you have to subscribe to a payroll service so you can start running your paychecks.

Please scan through these links attached for more details about the subscriptions that we offer:

Add or remove a company director in QuickBooks Online Standard Payroll

Pay your employees in QuickBooks Online Standard Payroll

On the other hand, you can also create an expense or a cheque to record your salary.

Please first make sure to create another payroll expense account on the Chart of Accounts menu. Then, set a name to use this category when creating the transactions.

However, I'd suggest consulting your accountant to check which account and detail types are appropriate for this situation. Once verified, you can perform the steps below:

- Go to Accounting from the left menu.

- Select Chart of Accounts.

- Choose New at the upper right.

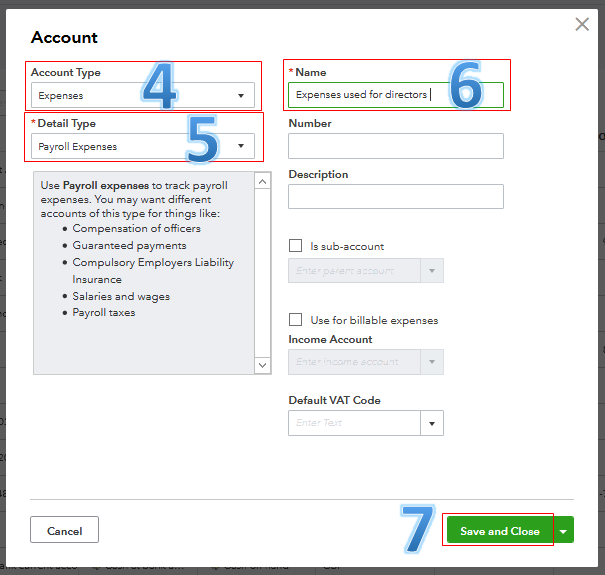

- Select the correct Account Type.

- Choose the Detail Type.

- Then, enter an identifiable name used for the directors' payroll.

- Click Save and Close.

A sample screenshot below serves as your visual reference for the last four steps.

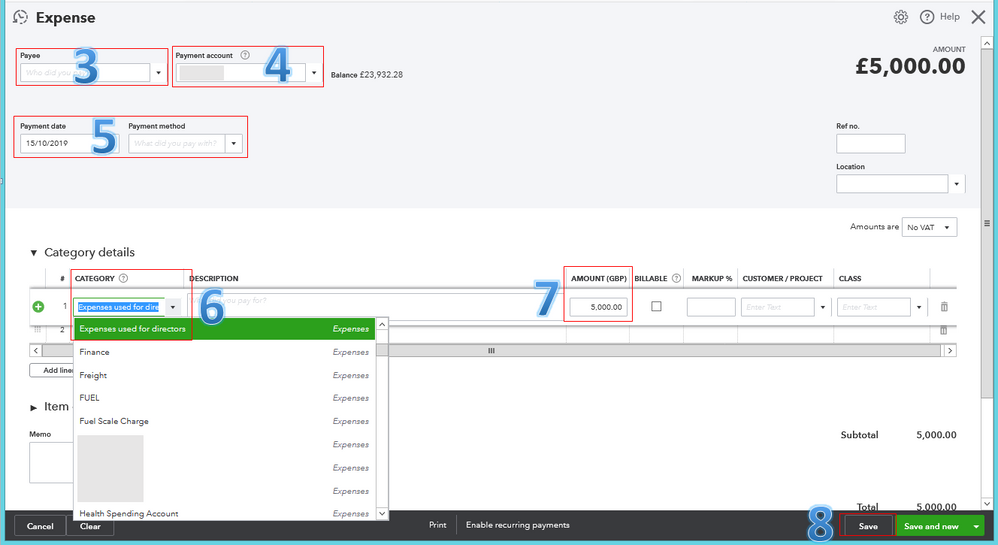

When you're ready, you can assign the new category on the transactions. If you choose to record an expense, here are the steps:

- Go to the Create (+) icon at the upper right.

- Select Expense under Suppliers.

- Leave the Payee field blank.

- Choose the Payment account.

- Select the Payment date and Payment method.

- From the Category drop-down menu, choose the new category you've just created.

- Enter the amount.

- Click Save.

The screenshot below shows you the last six steps.

After that, you'll need to manually file your taxes to the HMRC. You can visit this website: HMRC. In this link, you can learn more about the methods in reporting directors’ pay and deductions to the national agency.

Please get back to me if you have any other concerns, Arpad. I'll be around to provide further assistance. Have a nice day!