That’s a great step to ensure everything is accurate by comparing your bank statement to your expenses, Marden.

To view the list of expenses for your VAT return, you can check the VAT details report. Here’s how to do it:

- In the tax section, locate the relevant VAT return for the period you are reviewing and click Prepare return.

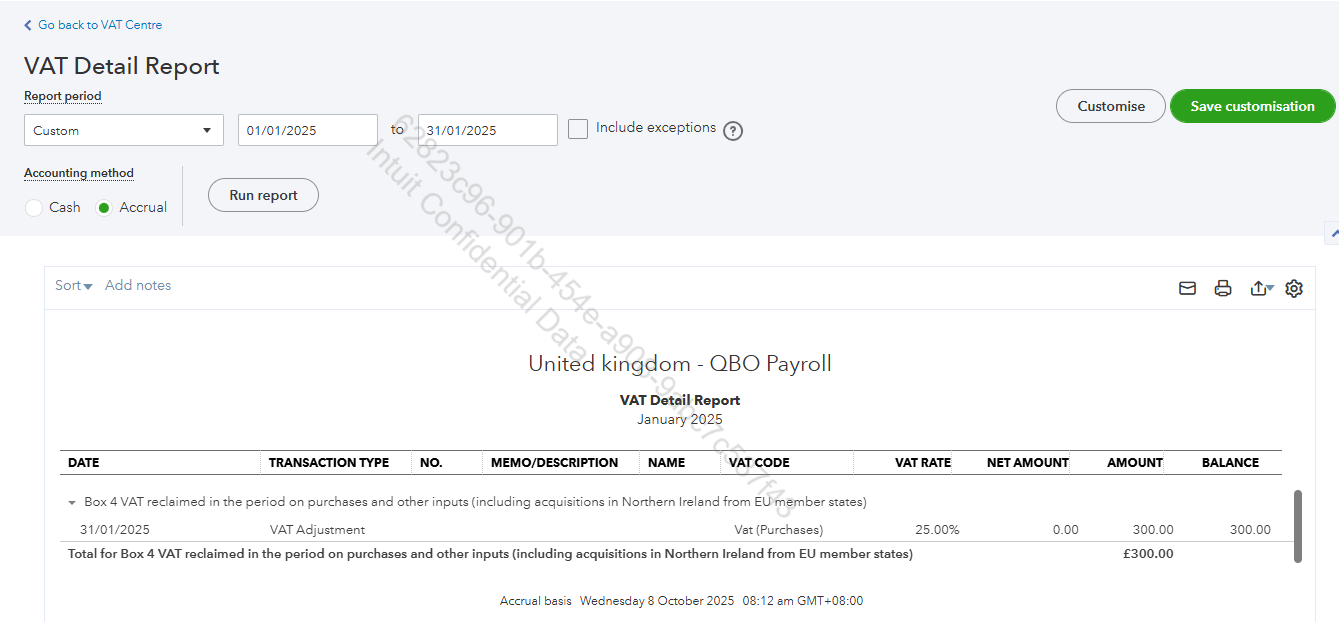

- Under Box 4 (Input VAT from Purchases), locate the total amount and click on it. This will generate the VAT Detail Report, showing all transactions contributing to your VAT return.

Please see the screenshot below:

If you notice any missing transactions, it’s possible that QuickBooks did not include them in Box 4 because they were assigned a No VAT code or a VAT code that is not eligible for Box 4. In that case, locate the transaction, edit it, and apply the correct VAT code.

Please leave a comment below if you have further questions or need assistance.