Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi I am new to quickbooks I am using simple start and would appreciate help on "daily sales"

I am wanting to enter my ebay sales receipts as a "daily sale" but am unsure of how to do it - the payment that goes into the bank (daily) includes ebay fees example - 500.00 paid into the bank made up of 400.00 sales and 100.00 fees.

thanks in advance!

Solved! Go to Solution.

HI Spsue:waving_hand:, Thanks for reaching out and welcome to the Community! What you can do if you are looking for a match to appear on the banking is record a sales receipt(in the + symbol> create a customer called daily sale for example) add the 500.00 sales on the sales receipt but make sure where it has deposit to you select undepositied funds(if that does not appear as an option you can create it under current assets in accounting>chart of accounts>new). Once done go to the + symbol again bank deposit|>put a tick by that receipt in select payments included in this deposit>go to add funds to this deposit >select payee if needed in account select expense account for the fees and then in amount add the amount 100.00 but put a minus symbol in front so -100.00 and fill in the rest and then in total you will see you are only banking the 400.00 but have recorded the sale of 500.00(in the sales receipt and then the fee as well. Once all that is done go to banking and you will see a match. Any queries on this let us know:smiling_face_with_smiling_eyes:

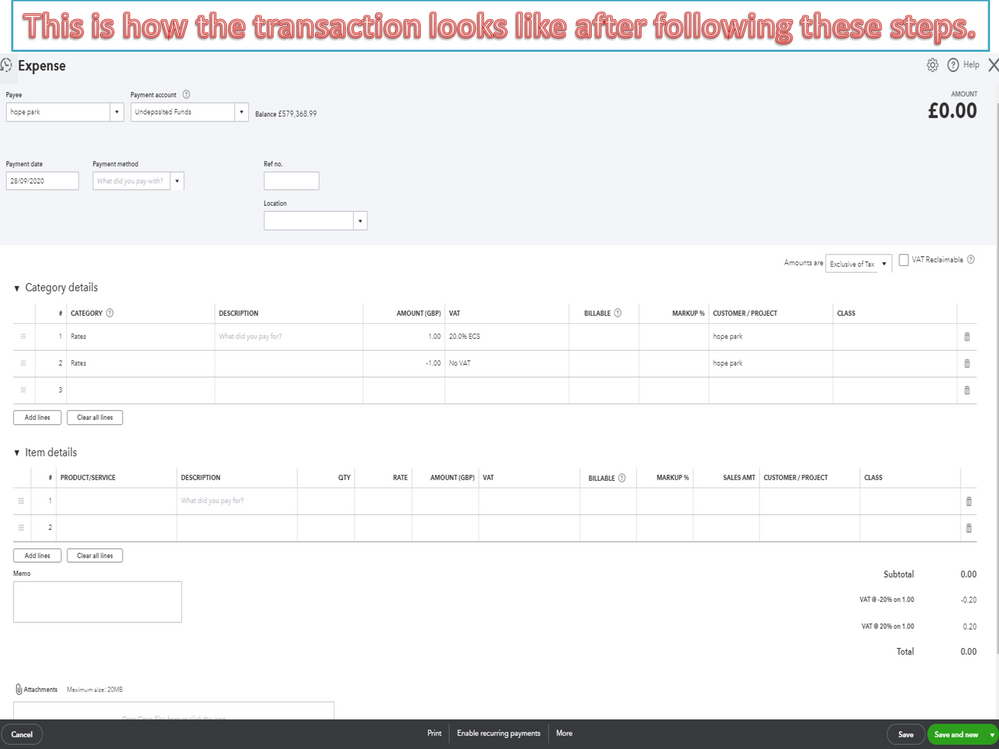

You have two options

You can either do a 100% vat transactions

To do this, click on the + sign and select the transaction type that you need so an expense.

One the first transaction, choose the account you want to use. For the rate, enter £1, and for the VAT code, select the 20% Standard code.

On the second line, select the same account. For the rate, enter -£1, and choose an Exempt code.

The total of the invoice will be 0. You can then edit the amount in the VAT box to whatever you need it to be.

or you can change the vat code on the transaction when you get the statement

If you use the NO VAT for it initially then your box 7 figure will be wrong but once you put the right vat code in when you get your statement then the box 7 will show correct afterwards.

HI Spsue:waving_hand:, Thanks for reaching out and welcome to the Community! What you can do if you are looking for a match to appear on the banking is record a sales receipt(in the + symbol> create a customer called daily sale for example) add the 500.00 sales on the sales receipt but make sure where it has deposit to you select undepositied funds(if that does not appear as an option you can create it under current assets in accounting>chart of accounts>new). Once done go to the + symbol again bank deposit|>put a tick by that receipt in select payments included in this deposit>go to add funds to this deposit >select payee if needed in account select expense account for the fees and then in amount add the amount 100.00 but put a minus symbol in front so -100.00 and fill in the rest and then in total you will see you are only banking the 400.00 but have recorded the sale of 500.00(in the sales receipt and then the fee as well. Once all that is done go to banking and you will see a match. Any queries on this let us know:smiling_face_with_smiling_eyes:

As another option, you may integrate eBay with QBO via a connector. Once set up is done, the app will synchronize data from your eBay account with all the detailed information right in QBO. You can enjoy seamless synchronization.

Hello Spsue, If the eBay fees have got vat on them as well you should just add it on another line and put the correct vat code against it so it calculates the vat for you.

Can I enter my ebay fees without the vat and at the end of the month when I receive a tax summary from ebay enter the vat amount that I can claim back

You have two options

You can either do a 100% vat transactions

To do this, click on the + sign and select the transaction type that you need so an expense.

One the first transaction, choose the account you want to use. For the rate, enter £1, and for the VAT code, select the 20% Standard code.

On the second line, select the same account. For the rate, enter -£1, and choose an Exempt code.

The total of the invoice will be 0. You can then edit the amount in the VAT box to whatever you need it to be.

or you can change the vat code on the transaction when you get the statement

If you use the NO VAT for it initially then your box 7 figure will be wrong but once you put the right vat code in when you get your statement then the box 7 will show correct afterwards.

thank you very much, it makes sense now!!

Thank you

Hi again, sorry I've just tried to enter the vat as a 100% vat transaction from the ebay fees that I have already entered as "no vat" but it is asking which bank account I want to use, is it going to put the amount that I post into the bank account?

Hi

I have entered 17 separate transactions of ebay fees totalling 1106.34 all with no vat and now I have my tax summary from ebay saying I can claim 222.32 on these fees. How do I post the 222.32 as a 100% vat transaction without it putting 222.32 into a bank account.

thanks

Thanks for coming back to the Community, spsue.

I appreciate following the resolution shared by my colleague and its result. Let’s create an expense to post a 100% VAT transaction.

Here’s a guide that contains links that can help keep your tax return, payments, and records correct: VAT: Getting Started.

Alternatively, use the Undeposited Funds as the posting account. This way, you can record the transaction. I still recommend consulting with an accountant for further assistance. They can advise on how to track the fees without using a bank.

Click the Reply button if you have any other questions or concerns about QBO. I’ll be right here to answer them for you. Enjoy the rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.