- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Reports and Accounting

- :

- Historic Bank Transactions for Pay not giving the option of Match to Journal Entry. Help! Do I need to delete Payrol Runs and start over?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Historic Bank Transactions for Pay not giving the option of Match to Journal Entry. Help! Do I need to delete Payrol Runs and start over?

I have messed up, and I can't remember how or why! Basically, I have net salary payments coming through in Banking that are not allowing me to Match to the Journal Entries. I am wondering if I need to delete the Payroll Runs and start again so it comes through on Banking as Match to Journal. Also, mid-way through the year, I started paying our employee on the Friday of the working week rather than a week in arrears. My journal dates still show a week in arrears so doesn't match the pay date through the bank - does that matter? Please help. I can't get anything to match up!

Solved! Go to Solution.

Labels:

0 Cheers

Best answer April 16, 2021

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Historic Bank Transactions for Pay not giving the option of Match to Journal Entry. Help! Do I need to delete Payrol Runs and start over?

I thank you for sharing the troubleshooting steps you've performed and their results, @Gary Cruse.

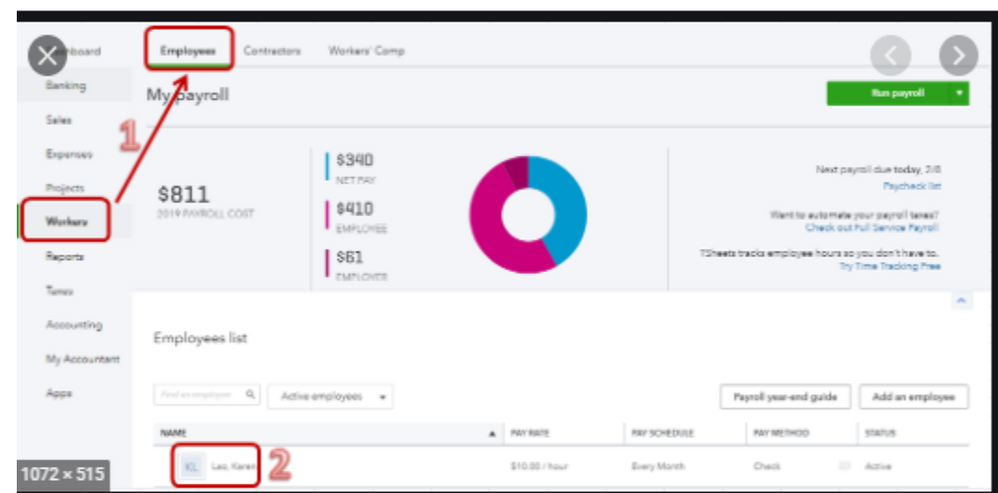

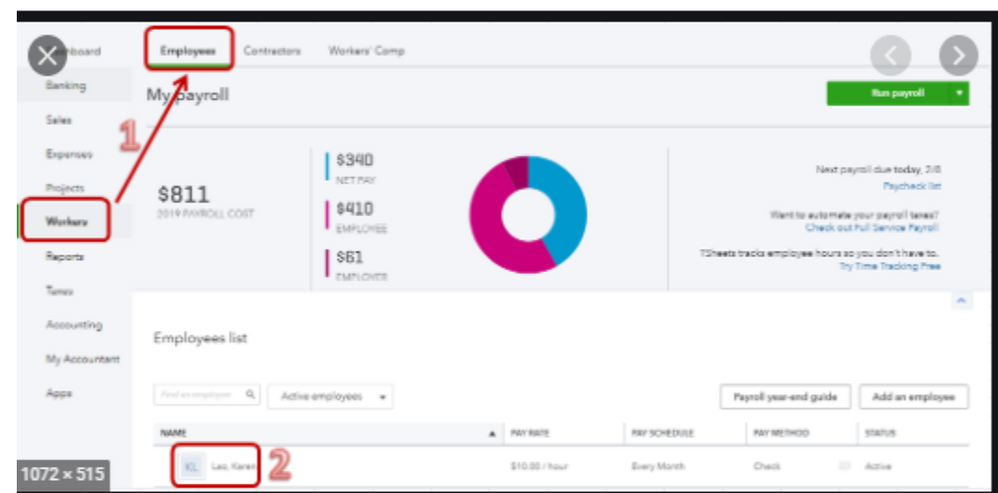

Linking the manual journal entry to your payroll system is unavailable. As a workaround, you'll have to recreate the payroll from the Workers menu so it will appear correctly. Let me show you how.

- Go to the Employees or Payroll menu.

- In the Payroll History section, select the most recent period.

- On the Payroll details page, click Actions and select Delete Payroll.

- Type Yes in the box, then click Delete.

- Repeat for any additional pay runs you require.

To recreate the paycheck.

- Go to Workers and select Employees.

- Select Run Payroll.

- Choose the employees you'd like to pay then enter the hours and memos based on the deleted ones.

- Select Save and review to see a summary of this payroll.

- Select Confirm and submit to create the pay run in QuickBooks.

I've got these articles for additional information on how to create and edit paycheck in QuickBooks:

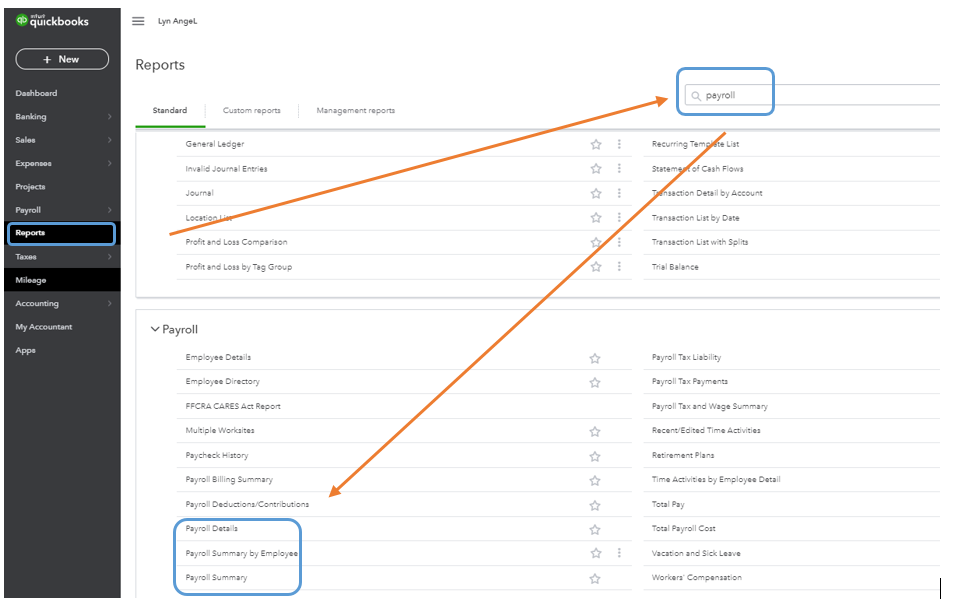

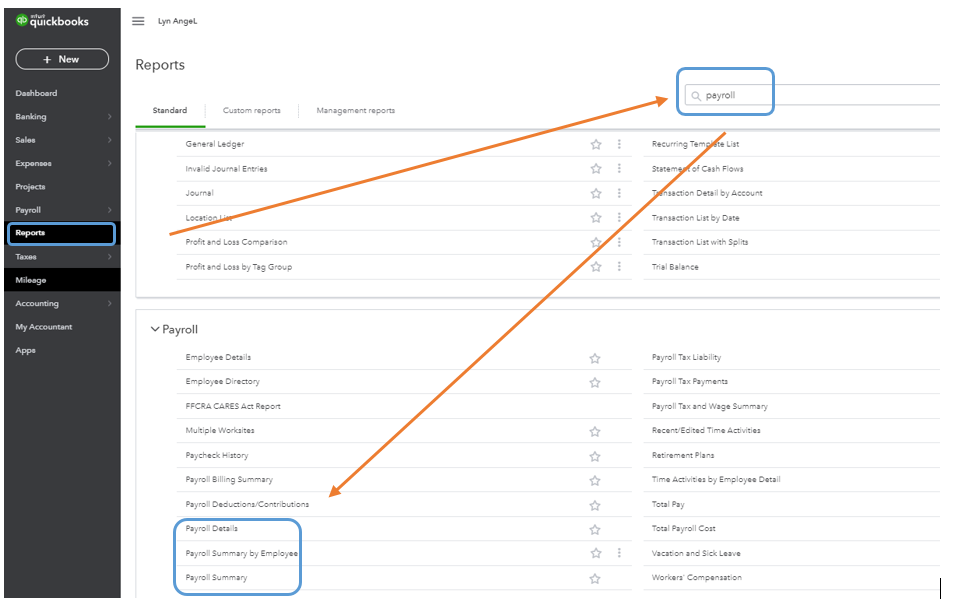

Also, to make sure the amounts are accurate, you can run a payroll report (Payroll Summary, Payroll Summary by Employee, or Payroll Details) for reference. To know more about the Payroll reports that you can run in QuickBooks, see the below articles:

If you wish to personalize them, browse this resource for detailed instructions. To ensure you save the current customization settings, you can simply memorize them.

If you have follow-up questions on this or any QuickBooks concerns, don't hesitate to let me know. I'll be here to help you further. Take good care.

0 Cheers

6 REPLIES 6

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Historic Bank Transactions for Pay not giving the option of Match to Journal Entry. Help! Do I need to delete Payrol Runs and start over?

Hi there, Gary Cruse.

Welcome back to QuickBooks Community. I'll make sure to provide details on how banking transactions work in QuickBooks Onlne.

QuickBooks will automatically match your transactions once it detects entries with similar amounts and details. Since the net salary payments from the Banking are not allowing to match the journal entries, I suggest making sure that the JE created by the payroll are categorized to the correct Bank account. To do that, you can run the Journal report and find the created one to review the details.

Here's how:

- Click the Reports menu on the left panel.

- Choose Journal in the search bar.

- Click the Customise button. Then, go to the Filters drop-down arrow.

- Checkmark the Transaction Type box and select Journal Entry.

- Hit Run report.

For additional details on how you can customise reports to show specific accounts or customers, or format the layout so the right data shows up in the right place, you can click this article: Customise reports in QuickBooks Online.

Please refer to this article to see different details on how to review downloaded bank and credit card transactions by matching and adding them and how it goes: Categorise and match online bank transactions in QuickBooks Online.

I'm always here if you need more help with your transactions. Let me know in the Reply section below. Take care and have a wonderful day!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Historic Bank Transactions for Pay not giving the option of Match to Journal Entry. Help! Do I need to delete Payrol Runs and start over?

They are definitely matched to correct bank account. Basically I think I unmatched them on the journal entry (can't remember why) and now they are coming through on Banking with odd expense categories such as Travelling Expenses!! Could I create a new matching journal entry, then delete the original one and see if they come through correctly on banking (with Match to Journal)?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Historic Bank Transactions for Pay not giving the option of Match to Journal Entry. Help! Do I need to delete Payrol Runs and start over?

I excluded the payments from Banking and this meant everything was then balanced.

I then found the Journal for the first excluded payment. I "copied" the entry (by clicking on More and Copy at bottom of Journal Entry). I changed the date of the "copy" to the date of payment. I went back to Banking and clicked on Undo on the Excluded payment, so it moved back to Review. It then gave me the option to Match the payment to the "copy" Journal Entry. I then went back and deleted the original Journal Entry, so everything balanced again.

However, by deleting the original Journal Entry it is now showing as a Missing Transaction when I go to Payroll for that week. How can I now link Payroll to the "copy" Journal Entry? Any ideas please?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Historic Bank Transactions for Pay not giving the option of Match to Journal Entry. Help! Do I need to delete Payrol Runs and start over?

I thank you for sharing the troubleshooting steps you've performed and their results, @Gary Cruse.

Linking the manual journal entry to your payroll system is unavailable. As a workaround, you'll have to recreate the payroll from the Workers menu so it will appear correctly. Let me show you how.

- Go to the Employees or Payroll menu.

- In the Payroll History section, select the most recent period.

- On the Payroll details page, click Actions and select Delete Payroll.

- Type Yes in the box, then click Delete.

- Repeat for any additional pay runs you require.

To recreate the paycheck.

- Go to Workers and select Employees.

- Select Run Payroll.

- Choose the employees you'd like to pay then enter the hours and memos based on the deleted ones.

- Select Save and review to see a summary of this payroll.

- Select Confirm and submit to create the pay run in QuickBooks.

I've got these articles for additional information on how to create and edit paycheck in QuickBooks:

Also, to make sure the amounts are accurate, you can run a payroll report (Payroll Summary, Payroll Summary by Employee, or Payroll Details) for reference. To know more about the Payroll reports that you can run in QuickBooks, see the below articles:

If you wish to personalize them, browse this resource for detailed instructions. To ensure you save the current customization settings, you can simply memorize them.

If you have follow-up questions on this or any QuickBooks concerns, don't hesitate to let me know. I'll be here to help you further. Take good care.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Historic Bank Transactions for Pay not giving the option of Match to Journal Entry. Help! Do I need to delete Payrol Runs and start over?

Hello again. So I went back to the most recent pay run I wanted to delete - this was week commencing 18 Jan. However, it won't let me delete it. When I tried to, I got an alert which said: We had a problem rolling back your tax year. We can't delete this pay run run because you still have pay runs in the 2021/2022 tax year. Please delete these before continuing."

How do I resolve please?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Historic Bank Transactions for Pay not giving the option of Match to Journal Entry. Help! Do I need to delete Payrol Runs and start over?

I appreciate the update that you gave, @Gary Cruse.

I want to ensure that you'll be guided accordingly in deleting your pay run so you can keep your records accurate.

The system is unable to delete paychecks that has been processed already. However, to help you in deleting your paychecks, I'd recommend reaching out to our Customer Care Team. They have the necessary tools that can delete your pay run.

To do that:

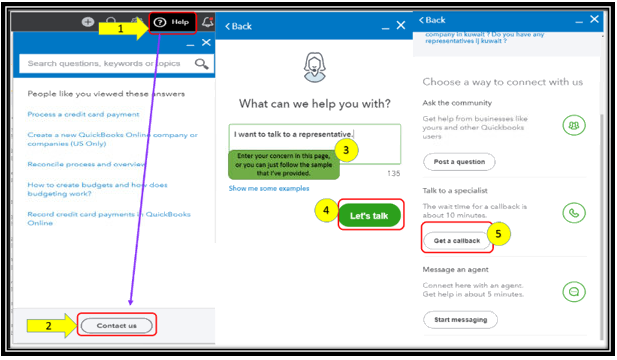

- Click on Help at the top menu bar.

- Hit on the Contact Us button.

- Enter a brief description of the issue in the What can we help you with? box.

- Press on Let's talk.

- Select on Get a callback.

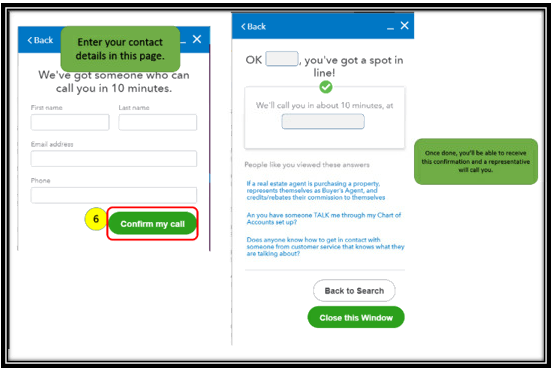

- Key in your contact details, then tap on Confirm my call.

You can also check out this reference to give you more insights on what will happen if you delete your pay run in the system: Delete a pay run in QuickBooks Online Standard Payroll.

Reach out to me if you have additional questions about payroll or with QBO. Please know I’m always ready to assist further. Wishing you the best.

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...