Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hello Andrew-malkin-co,

Thanks for coming back to us here,

So the usual way this is done is via a journal entry from where the profit is currently sitting then put the money in the directors drawing account then journal that or if it is in the drawing account you then post it to the directors account and that is all you need to do. We'd recommend speaking to an accountant for advice on this. They can advice on end of year journals as well which is when a lot of users zero out the profit for the financial year and add the amount to the retained earnings profit balance forward chart of account(equity)

Hello @andrew-malkin-co,

Thanks for dropping by here in the Community. I'm here to share some details about how you can allocate the profit in QuickBooks Online.

The Profit and Loss report shows your income, expenses, and net profit or loss over a specific period. To allocate a portion to the director's account, I recommend creating a journal entry.

If you're unsure of the accounts to debit and credit, please consult an accountant. They'll be able to provide expert advice on how to record it in QuickBooks and ensure your books are error-free.

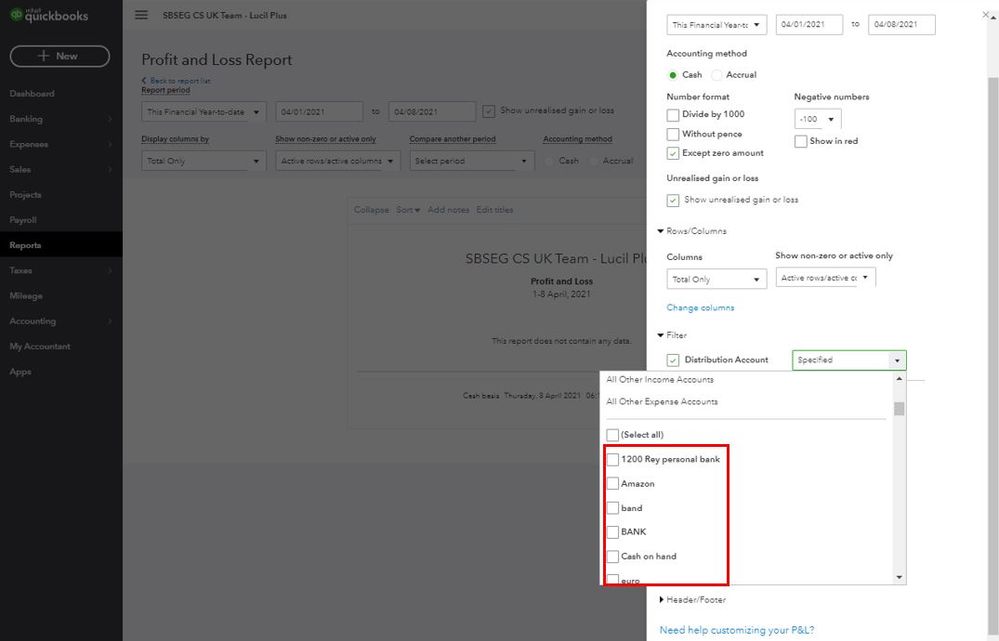

To reduce profit in the report, you can exclude the specific income account. You have the option to customize the filter and choose which accounts you want to reflect.

Here's how:

For more information about reports, like how to personalize and create custom financial data in QuickBooks, I recommend the following article: Customize reports in QuickBooks Online.

Fill me in if you have additional questions about the financial report in QBO. I'm always here to help. Take care always.

Thank you,

I selected ALL. I think the problem instead is how to allocate a proportion of the currently shown profit to directors drawings crediting my directors account. This should show the reduction of same amount in P&L. How do i do this though is the question if you know that would be great.

Hello Andrew-malkin-co,

Thanks for coming back to us here,

So the usual way this is done is via a journal entry from where the profit is currently sitting then put the money in the directors drawing account then journal that or if it is in the drawing account you then post it to the directors account and that is all you need to do. We'd recommend speaking to an accountant for advice on this. They can advice on end of year journals as well which is when a lot of users zero out the profit for the financial year and add the amount to the retained earnings profit balance forward chart of account(equity)

Thanks for this, what account does the profit sit in on QBO, for example i can see i could journal it to retained earnings or directors c/a but from which account? Sorry it doesnt seem obv.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.