Hi there, @at8.

Allow me to provide some insights about running reports in QuickBooks Self-Employed (QBSE).

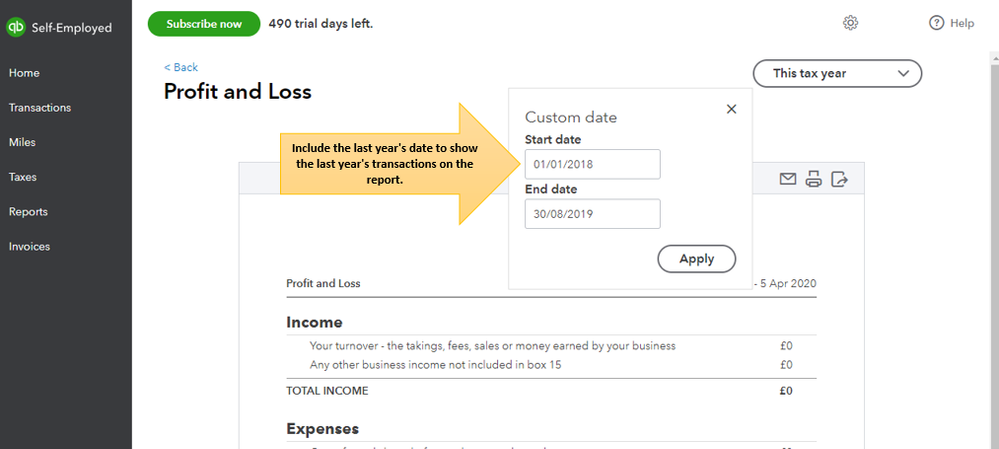

If you're referring to the transactions that are showing up when running the Profit and Loss report, these transactions usually depend on the report period you've selected.

If you wish to include the last year's transactions to the current tax year, you have to customize the report's date to the last year's starting date and the current year's end date.

You can see attached screenshots for additional reference.

In case you have any other QuickBooks concerns in the future, you can always check our help articles: Help articles for QuickBooks Self-Employed.

Let me know if you have any other questions and if you're referring to something else. I'm just here available to help!