Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Let me show you how to link them, einssn.

You can go directly to the Pay bills page to see the journal entry and existing bill.

Also, I've added this link to know more about the uses of a clearing account.

Please leave a comment again if you have more questions. I'll be here!

hiu,

i have been following what you said below. but my billing payment window ask me to input the payment account. i don't want it to hit the bank account. i just want to clear the account.

Also when i have done my bank recs i have posted payment on the account on the supplier account. how do i match the bills with the expense?

thanks rebecca

Thanks for joining this thread, @rkorang.

I also appreciate you for going through the steps provided by my colleague AlexV above.

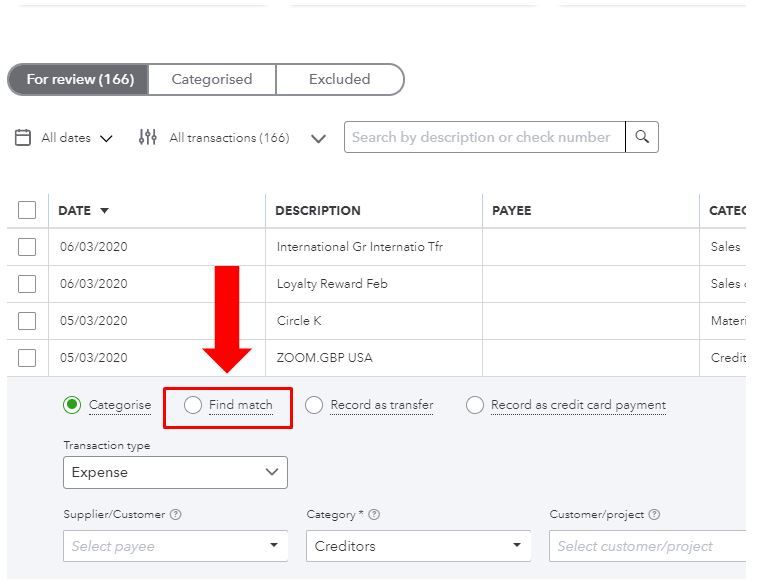

Allow me to share some details on how to clear your account. If your bank account is connected to your QuickBooks Online (QBO) account, you’ll want to go to the For review tab and match the bill from there. Let me show you how:

You can also check out this article for additional details: Add and match downloaded bank transactions [Video].

However, if your account is not connected to your QBO account, I recommend creating a Journal Entry (JE) to clear your account. To learn which account to use, I suggest reaching out to your accountant. They can guide you in choosing the right accounts and ensure your books is well accounted for.

Let me also share this article that you can read for additional reference in reconciling your accounts effectively: Reconcile an account in QuickBooks Online.

In case you have other concerns about managing your accounts in QBO, you can always leave a reply in this thread. I'll be around to help you. Keep safe.

That happen if the supplier's balance in A/P is a journal entry. How do I clear that out to zero?

Thanks.

Hello there, @LJAB.

When your supplier's balance in A/P is a journal entry (JE) (regardless if it's an opening balance or not), you can create a matching JE to clear or zero it out. However, it'll also be best to consult with your accountant to be guided further on what's best for you and your business.

Once ready, here's how:

I've attached a screenshot below that shows the last two steps.

After that, I'd recommend pulling up the Supplier Balance Detail report. This to check that the JE you've created is applied accordingly. Just go to the What you owe section from the Reports menu's Standard tab.

Please keep me posted on how it goes. Let me know if you have follow-up concerns about managing supplier and journal entry transactions in QBO or other inquires. I'm just around to help. Keep safe always, @LJAB.

Thanks a lot for your answer. After I made an entry, how do I apply the new entry to the old entry? Because there are 2 entries there and the client's name in shows on A/P list although the total balance is zero. Thanks you.

Thanks for coming back to the Community, LJAB.

I appreciate for following the steps shared by my peer and its result. Let’s create a dummy bill and make a payment to clear the entries.

Here's how:

For tips and resources on how to handle supplier and customer’s transactions, check out the following articles.

Don’t hesitate to visit the Community again if you have any other concerns. I’ll be right here to answer them for you. Have a great rest of the day.

Thanks for your answer again. It worked. Appreciate your help. Have a nice holiday! Be safe!

after paying these old bills, my clearing account has now a negative balance. is that right or should it be 0 balance always?

Hello, John Naddour.

I'll give a short overview on handling the clearing account's balances. I'm also on the case to assist you in correcting this.

The clearing account should have zero balance after moving the funds and paying the bills.

It's possible that the funds weren't enough or there were bills that aren't supposed to be paid with the clearing account.

First, you'll want to check the transaction that was used to fund the account. Here's how:

Second, check the bills that were paid. To locate them easily, you'll want to pull up the Bills and Applied Payments report. Simply go to the Reports page, then type Bills and Applied Payments in the search box.

Adjust the reporting date when needed. If there's a bill that was incorrectly included in the payments, you'll want to delete the payment transaction to correct this

Here's how:

If multiple bills are included in a single payment transaction, simply uncheck the correct one and adjust the amount.

Since these are old bills and you're using a clearing account, I recommend contacting an accountant. They can guide you with the corrections and ensure your books are accurate.

Do you also use the Online Banking feature? If you need help managing your other transactions, you can check this article for a guide: Categorise and match online bank transactions in QuickBooks Online.

I'll be on the look out for your reply if you have more questions about the processes in QuickBooks. I'll see you around in the Community space.

Can you help with trying to journal entry an accounts payable balance from 2018. I cant change the original records and the amounts were paid just not applied properly. Now I have to fix it and I am not quite sure how to do that. Any help would be greatly appreciated.

Thanks.

I'd be glad to help create a journal entry to clear the A/P balance, MM20221.

Although, I would recommend reaching out to your accountant before making any changes since this will affect your accounting records.

Here are the steps on how to create a journal entry:

More details about this feature are provided in this article: Create a Journal Entry in QuickBooks Online.

I'd also want to give you some of our articles as additional references in case you might need these:

Don't hesitate to ask more questions if you need anything else. I'd be glad to offer my help again.

I have old Accounts Payable balances that I need to clear off using discount received account. I tried using Supplier credit to move it to Profit and loss account into Discount Received A/c and then link the Discount received with the outstanding balances from the bill. The ledger balances shows 0 and my Profit & Loss account is also credited. However, if i check my Balance sheet, such supplier still shows the outstanding balance of exact amount. though the transaction is there but it seems to be having no effect.

I also tried to use journal to move Trade payable balance to discount received and then link the journal with the bill. Again it does reduce my liability and credit my Profit & Loss account by equal amount. Yet it still shows as open balance in Trade payables for the Supplier though the total liability is reduced by such amount.

I desperately need your expertise.

We'll have to investigate this problem safely, anjum.

I appreciate all the steps you've taken so far to resolve the supplier balances. I'll make sure that the opening balance will fix without a moment's delay.

It looks like you've already done the actions to clear off the Accounts Payable in your QuickBooks Online. Based on all the steps you take, you should no longer have an open balance in the accounts payable.

With this, I'd recommend contacting our Customer Care Team. Our experts can initiate screen sharing to view your account securely and help you from there. They are available Monday -Friday, from 8:00 AM to 10:00 PM, and Saturday -Sunday, from 8:00 AM to 6:00 PM. Make sure to contact them within business hours to ensure a swift response.

Here's how:

For more insights about managing supplier credits in QuickBooks, please refer to these articles below:

Let me know if you have any other questions or concerns by leaving a comment below. I'll be more than happy to help. Don't work to hard, anjum.

Thank You for your response.

After having a nightmare and an almost anxiety attack, here is what I found. so we have two trade payables accounts. While the Invoice is being recorded in, say, Trade payable (1), The offsetting Entry is adjusted in the other Trade payable Account(2). So if i check the Net trade payable (1) for the supplier it is Positive balance and if i Check Net trade payable (2) is shows Negative balance of the same Supplier.

Now i tried to look for location tracking of the supplier but i dont have that feature... Which sucks.

Now i need your expertise in this area as how to reflect the double entry through a single Trade payable account.

Really appreciate your quick response.

Hey Team,

Here's what i have discovered-

I simply made the payment through Clearing account and passed a journal entry from clearing account to discount received(Profit & Loss Account).

This seems to have cleared the problem for now of two trade payables being affected rather than one.

Let's hope it is correct by accounting principles as well.

Will keep you posted if anything else comes up!

Thank You for your assistance.

and yes your suggestion are welcome.

Hello,

Good point! Yes, it clears the supplier balance from A/P but not the clearing account. I thought that the whole point of a clearing account was that the balance should be zero after the transactions have been entered properly. Can't see the answer in this thread, but if anyone had the answer, it would be appreciated. Cheers, Bill

Thanks for following this thread, @user16100.

Since you've already done most of the shared steps to clear off the Accounts Payable in your QuickBooks Online, I'd recommend reaching out to your accountant. They can help ensure your books are accurate.

You also want to contact our Customer Care team to take at the issue through screen sharing session to help resolve it.

You're always welcome here if you have any further concerns. I'm always willing to lend a hand.

I am following these directions only when I select “set credits” in bill pay. It is blank? How do I apply the JE?

Hello Denielle, thanks for posting on this thread, so it should show up for you as long as one of the lines on the journal is to the accounts payable and the name of the supplier is on the journal then it can be used like a supplier credit not to then pay of the bill. So you need to check that that information is showing up and correct for you.

What happens to the amount left in the clearing account? Does that stay there into perpetuity or does it get adjusted into Retained Earnings at year end?

Let me address your inquiries and share some information. Kelly159.

A Clearing account hold funds until they can be transferred from one account to another when you cannot move the money directly. To use the account effectively, you should keep the balance at zero.

Amounts on the clearing account will be moved to the retained earnings account at year end. Since this account should have a zero balance, I recommend getting in touch with your accountant. They can assist you in making sure your books are accurate.

Additionally, I've included the resources listed below to assist you in tracking and managing specific tasks in QuickBooks Online:

You're welcome to post again if you have further questions or concerns in QuickBooks. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.