Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi mike,

Let me help you handle over payment from your customer in QuickBooks Online.

We can either leave the over payment as is and apply it the customer's future invoices, or create a refund for the over payment.

Here's how to record the over payment for your customer's invoice:

You can also check out this article on how we can create a customer refund: https://community.intuit.com/articles/1145640.

If you have further questions, please let me know. I'm here to help.

Hi mike,

Let me help you handle over payment from your customer in QuickBooks Online.

We can either leave the over payment as is and apply it the customer's future invoices, or create a refund for the over payment.

Here's how to record the over payment for your customer's invoice:

You can also check out this article on how we can create a customer refund: https://community.intuit.com/articles/1145640.

If you have further questions, please let me know. I'm here to help.

WIldWaynesLLC you can always book a general entry that credits income and an offsetting debit to the Accounts Receivable for the tip amount. You should then be able to go back to the payment where you received excess and apply the tip amount to the customer. Hope that helps

@JamesDuanT wroteYou can also check out this article on how we can create a customer refund: https://community.intuit.com/articles/1145640.

If you have further questions, please let me know. I'm here to help.

The link in your answer does not exist. I received the payment and overage. How do I issue a payment in the form of a check to the customer.

It would help if you gave the complete answer to the question including a way to issue a payment.

Thanks for joining this thread, @BoxesNearMe1.

I'll help ensure you're able to issue a check when receiving your customer's overpayment.

Using check to record the refund reduces your bank's balance and offsets your customer's overpayment. Here's how:

Once done, you can pair the check with the credit or overpayment. Here are the steps:

For the link provided by my peer above that isn't working, here's the helpful article you can refer to: Refund A Customer for Open Credit, Prepayment, or Overpayment.

The steps above will help you issue a payment in the form of a customer's check, @BoxesNearMe1.

I'll be around to help if you need further assistance. Have a good day.

I had a similar issue in Quickbooks Online

The Invoice amount was 1000, customer paid a check of 1200 by mistake. So the customer account shows that 200 as unaccounted. They have asked for a refund, and we paid by cash amt 200.

To record this, what i have chosen is

1 Created an expense by clicking "Expense" tab in under suppliers.

2 Selected the customer as "Payee"

3 In the category detail - chosen "Accounts Receivable (A/R)" and entered the amount by giving

the description "Excess payment returned"

4 Selected the "customer" also the same customer

It worked, in the customer details, it shows as an expense account and the balances are tallied.

i have tried to do this and when i enter the amount paid it just defaults and auto corrects it to the full invoice amount and doesnt allow me to include the over payment.

i have selected the automatically apply credit function in my settings

Hi abdecor_bex

We would be grateful if you can de-select all the automation from within the advanced settings.

You should then be able to receive payment on the invoice and overwrite the amount received box to the actual amount the customer paid, this will then create a credit on the customers account.

Are you intending to refund the customer the amount or leave it as a credit to use against a subsequent invoice?

Hi ,

I was just going to leave the payment on the account as the client is hopeless and always under paying/ overpaying almost every invoice !!

I have managed to do it, it allowed me to enter the full amount paid including the over payment when matching to invoice in the banking tab ( I had been trying previously to do it just from the customer view/invoice list)

I can now see the credit showing and the client total owed has reduced by the amount overpaid.

Thnak you

I am having the same issue as Mike, but even when I turn off all automation it will still repopulate the initial invoice amount. Please help!

Cheers,

Bronwen

Hi Launchfire,

Sorry to see you're having the same issue. Could you try clearing the cache of the browser you are on to remove stored data, and then create the invoice.

You can see how to clear the cache on the browser you are using here.

Let me know if this works for you!

Hello,

QBO does not let me record the exact amount received. It keeps reverting back to the invoice amount vs the amount I manually entered. The system is set up to automatically create credits. Any ideas on how it will allow me to record the actual amount?

Hi there, @HoD1.

You can only enter the exact or partial amount in the Payment field. In order to record the excess, the total amount paid should be entered in the Amount received field.

Here's how:

In case you want to create a recurring invoice which gives your customers options on when to pay and how much, you can check the following article to create and manage these transactions: How to create a recurring invoice and manage recurring transactions.

We’re always here if you have other questions about QuickBooks.

I have the exact same problem. It would be very helpful if QBO allowed you to post an enter for the overpayment to an income account at the same time and on the same input screen the payment was applied to the invoice.

Steve

We found this simple work-a-round to handle gratuities . . .

1. We setup a new product called "Tips"

2. When tips are received, we edit the appropriate invoice to include the amount of the tip

3. Finally, the payment amount is applied to the appropriate invoice.

This works for us, hope you find it helpful as well!

This doesn't help at all. You say in the first step to "go to the upper right hand corner and click "Create". But the upper right hand corner of what? What page are you on? Where is this "Create"? I couldn't get an further than step 1, so I'm still stuck.

It would be nice if you would give more detailed instructions rather than assuming I know where you're starting and where everything is in QB.

I can help you in handling overpayment, @usercleanairlawncare.

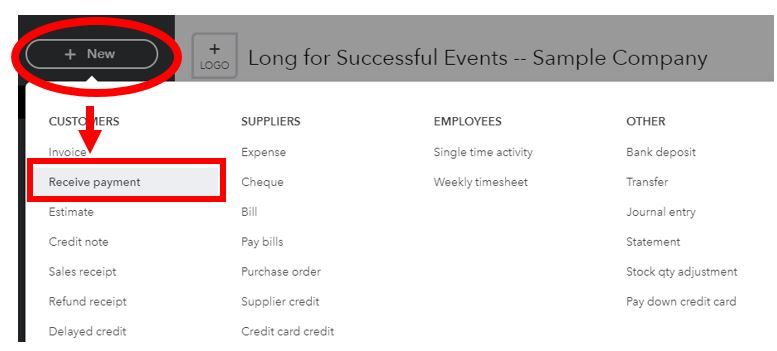

Are you referring to the steps provided by my colleague on how to handle overpayment? If so, the Create (+) button is already removed and is now called the + New button.

You can follow the steps below on how to apply the credit to the invoice that you've created:

You can check this article for more information: Handle a customer credit or overpayment in QuickBooks Online.

Also, you may consider recording a customer refund in QuickBooks Online if you need to return your customer's money.

Let me know if you still need further guidance in recording the overpayment. I'm always here to help. Have a wonderful day!

I tried to follow the solution but the system says I must resolve the difference which creates an expense for the difference?

What if the first payment was received a month prior and the customer asked that the check be put into their account for future orders?

Hello there, Yasi15.

I'll help you handle the first or advance payment received from your customer.

When your customers pay you in advance, you can utilize the Bank deposit feature to record it to the Accounts Receivable (A/R) account. This increases the Customer balance until you raise to enter the final invoice or future orders.

Once done, click Save and close. You can repeat these steps for each payment received from the Customer in advance. If the item or product is ready, you can enter an invoice and apply the prepayments to the invoice. For more details, you can check our guide: Record Customer prepayments.

If there's anything else you need, please post them here. The Community is always open for help. Take care.

I'm having the same issue as above, and it doesn't seem like anyone every posted an answer. Could someone please help? Thank you.

I'm here to assist you, 5QF.

I'd like to know more about this, though. What specific concern are you about? It'll help me provide the right answer or steps to your concern.

Any information is highly appreciated. Feel free to get back to this thread with more details. Thank you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.