Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We are a UK LTD company working in the construction industry.

Some contractors we invoice keep a retention amount until the job is completed which we then have to apply to be released at a later date... is it possible to show this amount on an invoice as it is issued or as payment is made? or possibly to issue an invoice at a later date solely to release the retention?

Solved! Go to Solution.

Hi acousticceilings!

I’ve got the steps to help you add a retention amount on your invoices. And yes, it’s possible to show the amount when you issue them. I’m glad to show you how.

Setting up retainage tracking:

a. Click the Gear icon.

b. From the drop-down menu, select Chart of Accounts.

c. In the Chart of Accounts, click New.

d. For Category Type, select Other Current Assets.

e. For Detail Type, select Retainage.

f. For the Name, enter Retainage Receivable.

g. Click Save.

a. Click the Gear icon.

b. From the drop-down menu within the Lists section, select Products and Services.

c. In the Products and Services window, click New.

d. Enter a Name for the item (i.e. Retainage).

e. Under Sales Information, place a check-mark next to I sell this product/service to my customers.

f. Select the Retainage Receivable account from the Income Account drop-down.

g. Click Save.

Withholding retainage from an invoice:

In case you need a report in the future, you can follow these steps:

You can save this report, so you won't have to do a lot of customisation when you need it in the future. For instructions, you can refer to the Memorised Reports article.

Feel free to come back here if you need anything else. Thanks!

Hi acousticceilings!

I’ve got the steps to help you add a retention amount on your invoices. And yes, it’s possible to show the amount when you issue them. I’m glad to show you how.

Setting up retainage tracking:

a. Click the Gear icon.

b. From the drop-down menu, select Chart of Accounts.

c. In the Chart of Accounts, click New.

d. For Category Type, select Other Current Assets.

e. For Detail Type, select Retainage.

f. For the Name, enter Retainage Receivable.

g. Click Save.

a. Click the Gear icon.

b. From the drop-down menu within the Lists section, select Products and Services.

c. In the Products and Services window, click New.

d. Enter a Name for the item (i.e. Retainage).

e. Under Sales Information, place a check-mark next to I sell this product/service to my customers.

f. Select the Retainage Receivable account from the Income Account drop-down.

g. Click Save.

Withholding retainage from an invoice:

In case you need a report in the future, you can follow these steps:

You can save this report, so you won't have to do a lot of customisation when you need it in the future. For instructions, you can refer to the Memorised Reports article.

Feel free to come back here if you need anything else. Thanks!

It may be worth noting that before these procedures can be followed, that it is necessary to switch 'discount' to On within the Sales Form Content section, this is in the Sales page in Account & Settings chosen from the Gear Icon

What do you do when it is time to receive payment for the retainage? It is sitting in the "other asset" but has not really been billed since the invoice total is lowered by the negative amount entered. Thanks.

Hi, kg2020.

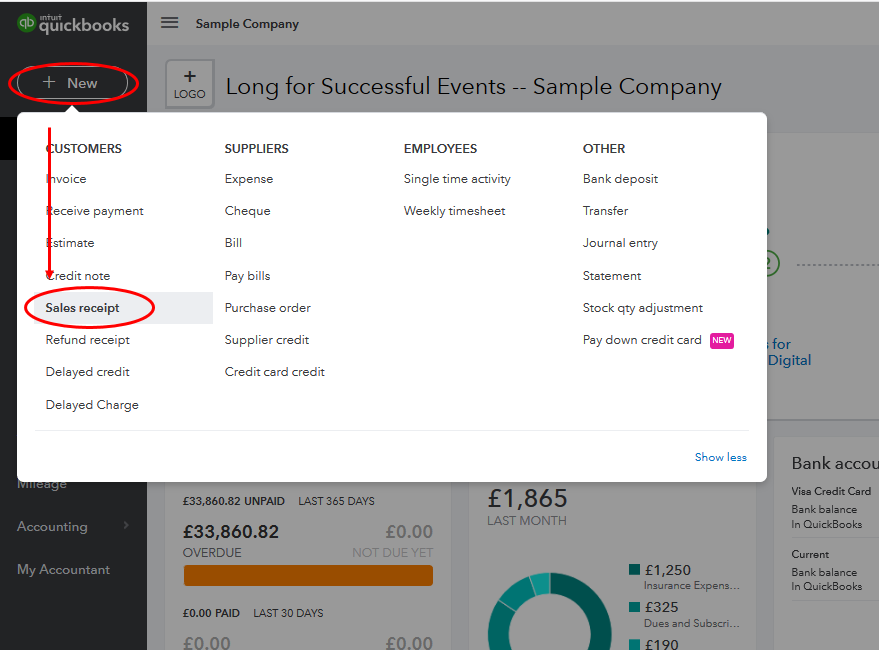

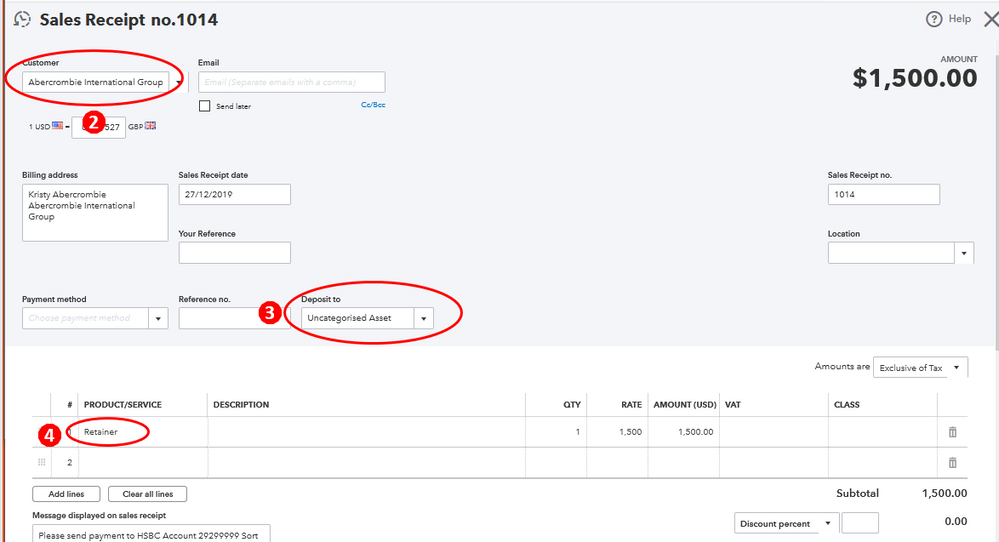

To change the posting account of the retainage, you can create a Sales Receipt or apply it to an open invoice.

Below are the steps to complete the process:

For detailed information and additional recommended steps (proceed to Step 4), check out this article: Record a retainer or deposit.

Also, I'm including this article for your other reference: How to view Retained Earnings account details.

I appreciate your time today. Please know that I've got your back if you need help with QuickBooks.

Should you choose a "class" for retainage? I've been using revenue, but that can't be correct, any help would be appreciated.

How do I receive the retainage when the customer pays it. How come the retainage does not show up in the customers account as money owed?

Hello there, @Mary102.

You'd want to create a retainage payable account on your Chart of Accounts. Let me show you how:

Once completed, you can create a retainer service item. You can use it in creating a sales receipt or an invoice to record the amount you've received from your customers. Here's:

You can read through this article for more detailed steps: Record a retainer or deposit.

Leave a comment below if you have other questions or concerns about tracking your income and expense transactions. I'm always here to help.

The Retainage Receivable account is not showing a balance once I run a report. this is using QBO. please help

I'd be delighted to share some insights on how to get isolate this issue and get the balance of your Retainage Receivable account, @kmorris1117.

You'll want to ensure you filter the date range of the report accurately to show the balance of your account. Otherwise, you can access your QuickBooks Online (QBO) account in a private or incognito window.

This way, we can verify if this is a browser cache issue. Too much data stored cache from the browser can affect the views and performance of your account.

Using a private window help us isolate the issue as this doesn't save any data files. To open an incognito mode, you can refer to these keyboard shortcuts

If you’re able to view the balance of your account when running a report, I’d suggest clearing your regular browser's cache. If the issue remains, I recommend using other supported browsers. This way, we can check if this is a browser-specific issue.

I've also collected these resources that you can read for reference in managing your reports and accounts:

I'll be around whenever you have other follow-up questions about your reports and accounts. Just add them in your reply and I'll take care of them for you. Stay safe!

I was hoping to find a better solution to what I do, but I don't see anything. My solution isn't ideal by any means, but it works. I create my invoice with 100% of the billed amount. Then I add item discount and enter 10% (or whatever the retainage is). I send that invoice to my customer. Then I delete the retainage discount line for my records so it back to billed at 100%. When the payout comes, I apply to the invoice and it will show that 10% balance until it is paid. There is no remembering to move the retainage from different accounts which is a big deal when you wait a year or more for the final payment. It would be spectacular if someone had a better way.

Best Solution so far!

Thank you!

Hi, we do retention exactly this way however, when a $10,000 invoice with -$1,000 retention gets paid $9,000, on the income statement it shows we received the full $10,000 when we only received $9,000. Why is that? Now I am wondering if we have been over reporting income all these years and overpaying income taxes. I've tried to look to see if the income statement deducts it elsewhere but it does not.

Please help very urgent matter

Why would you have to turn discount on when that's a separate field entirely and not a line item?

when i input a sale invoice into QB that has retention on it you enter the full amount on the invoice under service and on the 2nd line you enter Retention in the category box but when t comes to the amount you minus the retention and that then shows up on your balance sheet, i also create a spreadsheet with all my outstanding retentions on for guild and so that i don't forget to claim them back.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.