- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Transactions

- :

- How to enter a retainer/prepayment for a CASH BASIS business, future service is non taxable, so that it shows as income on the P&L. Using Quickbooks Desktop

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to enter a retainer/prepayment for a CASH BASIS business, future service is non taxable, so that it shows as income on the P&L. Using Quickbooks Desktop

This question has been asked many times, but none of the responses apply. I'm using Quickbooks Desktop. Our CPA wants the funds to show as Income, not a liability. We were just applying a payment without an invoice which would reflect that the customer had a credit balance, but it doesn't show as income on P&L, so income is skewed. With many retainers against many clients, this is problematic as it is difficult to get a clear read as to the companies actual income. This has been an ongoing issue and I need to get it resolved in order to go back and adjust for the 10 or so retainers we have on account which are not being represented as income. Thanks!

Labels:

0 Cheers

5 REPLIES 5

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to enter a retainer/prepayment for a CASH BASIS business, future service is non taxable, so that it shows as income on the P&L. Using Quickbooks Desktop

I've come to help and guide you on how you can enter a retainer/prepayment in QuickBooks Desktop (QBDT), @sescarpa1. This way, you're able to manage your sales and income accordingly.

With QBDT, you'll have to enter bank deposits to show money received from customers and record them to the Accounts Receivable (A/R) account. This increases the customer balance until you enter the final invoice. Please note that you'll have to consult your accountant for this process since they may have a preferred method of recording these transactions.

Whenever you're ready, you'll first have to enter cheques/payments made. There'll be no VAT codes used since the future service is non-taxable. Here's how:

- Go to the Banking menu.

- Choose the Make Deposits option.

- Select the account the money is received in the Deposit To field and the payment date.

- Enter all the necessary prepayment details (i.e., Received From and Amount).

- Click Save & Close or Save & New for recording additional prepayments.

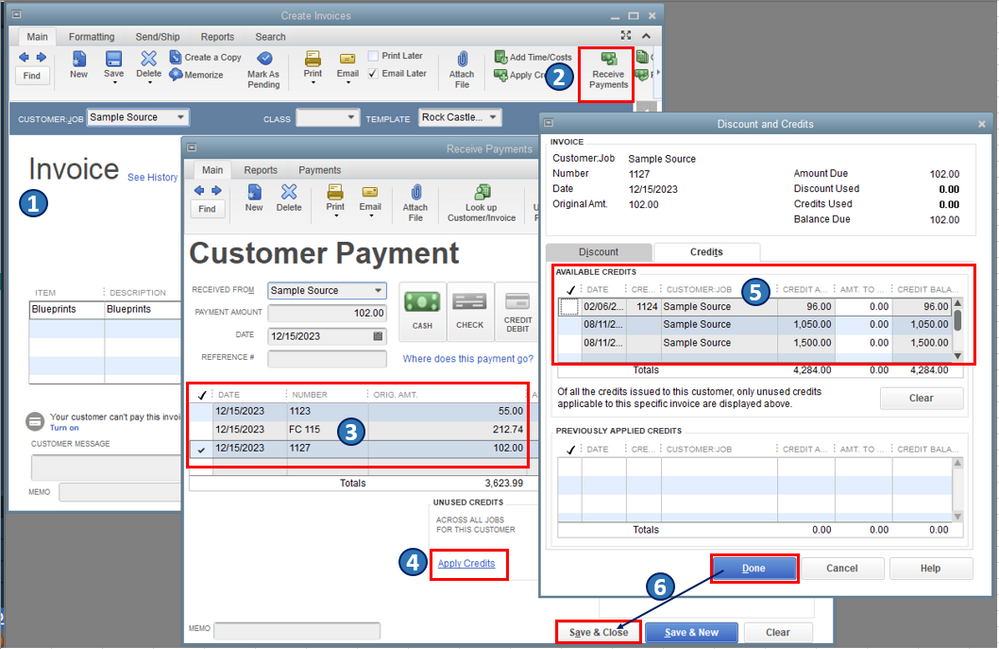

After that, you can enter the invoice. Then, you'll have to apply the prepayments to your invoice. To do this, here's how:

- Locate and open the invoice.

- Click the Receive Payments option above.

- Tick the invoice you want to associate with the prepayments.

- Select the Apply Credits link under the Unused Credits section.

- In the Credits tab, select the relevant payments created

- Click Done, then Save & Close.

I've attached a screenshot below for your reference.

Once done, I'd recommend pulling up your customer prepayment account's QuickReport. This is to identify the number of prepayments made by your designated customers. To do this, just visit the Chart of Accounts window and find the appropriate account. From there, right-click and select QuickReport: [name or account].

Let me know how it goes in the comments below. If you have other concerns about recording and monitoring retainers/prepayments in QBDT, I'm just around to help. Take care always.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to enter a retainer/prepayment for a CASH BASIS business, future service is non taxable, so that it shows as income on the P&L. Using Quickbooks Desktop

Hi - as you outlined above, I have been posting a payment without an invoice to the customer's account, which creates a negative balance owed in A/R. Then, I apply the credit from the overpayment to the future invoice. This makes the Customer Balance Detail report okay, but the income isn't reported on the P&L, so in actuality, the Income Statement is skewed -- it doesn't show this $$$ as received as income. Our CPA does not want the $$$ as a liability, as we are a cash basis and will be taxed when the cash is received, not when it is earned.

So your resolution above doesn't fulfil the Income piece ......

This is actually something that happens within every cash basis business out there .... and it should be fully addressed in QBDT tutorials in order that earnings reports are accurate.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to enter a retainer/prepayment for a CASH BASIS business, future service is non taxable, so that it shows as income on the P&L. Using Quickbooks Desktop

Let me help you, Sescarpa1.

The payments are upfront deposits or retainers. You'll have to create a liability account to record it. The reason for this is because these deposits are liabilities, not income, even the money is already deposited into your bank account.

I know your accountant doesn't want it to be a liability. However, upfront deposits are treated that way. You can refer to this article on how to manage retainers: Manage upfront deposits or retainers.

Reach out to us again if you have other questions. We're just one comment away. Take care!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to enter a retainer/prepayment for a CASH BASIS business, future service is non taxable, so that it shows as income on the P&L. Using Quickbooks Desktop

Hello Kristine,

Thank you for your reply. We are at an impasse here. My CPA specifically requested that we NOT enter retainers as a liability. As the retainers generally carry over between fiscal years, the retainer funds received are taxable in the year we receive them. Simple quarterly reviews to determine estimated taxes due can be considerably skewed if there are $75k of taxable retainer funds sitting as a liability. How am I the only person having this issue? Or, am I completely missing something?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How to enter a retainer/prepayment for a CASH BASIS business, future service is non taxable, so that it shows as income on the P&L. Using Quickbooks Desktop

You're not and I have the same problem!

0 Cheers

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...