Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I had a supplier who took an incorrect direct debit for £1576.13, our invoice payable was £126.

I have resolved the issue with the supplier, and they have refunded £1450.13.

I now have 2 transactions that I can't match to anything. How do I record this in QBO?

thanks :)

Solved! Go to Solution.

Yes, ALKS. You've got it exactly right. The Payment Account should be your Current Account because that's where the refund from your supplier was deposited.

By selecting this account, you're connecting everything and letting QuickBooks know that the refund you received is being used to "pay off" the credit you recorded in the journal entry.

This final step clears everything out and correctly reflects that the supplier's bill has been settled.

Please don’t hesitate to leave a post below if you still need further assistance.

We know a way on how to record the incorrect direct debit that was partially refunded in QuickBooks Online (QBO), ALKS.

The first thing we need to do is correct the original bill. Since the direct debit was incorrect, we can create a new bill for the correct amount of the original invoice (which is £126). This creates a record of what you actually owe. For more details on this, you can check out this article: Enter and manage bills and bill payments in QuickBooks Online.

Next, create a journal entry to handle the incorrect direct debit and the partial refund. This will help adjust your accounts and clear these transactions from your bank feed. Please ask your accountant which account to use. Here’s how:

Finally, we'll match these transactions to what's in your bank feed yo clear everything up and ensure your accounts are accurate. Here's how:

This process will clear both transactions from your bank feed and correctly record them in your accounts. If you want to learn more about this, you can read this article: Categorise online bank transactions in QuickBooks.

If you have further questions about managing supplier transactions or require assistance with QuickBooks, please feel free to revisit this thread.

HI, I've gone through all the steps and it's all worked but when I get to "6. Match the refund to the other side of the journal entry" there is nothing to match it to - I have checked I have journal entries in the record type and the dates are set to include all the transactions. Is there something I am missing?

Allow me to weigh in on this discussion, ALKS.

Once a recorded transaction is linked to a bank transaction in QuickBooks Online (QBO), it cannot be matched again. Thus, the reason why step six is not applicable.

Instead, you can categorize the £1,450.13 refund by posting it to Accounts Payable and selecting the correct vendor. Then, use the Pay Bills feature to link the Journal Entry and the categorized transaction to close the open credit.

Feel free to reach out with any additional questions about managing your supplier's refund. The Community is always here to assist you.

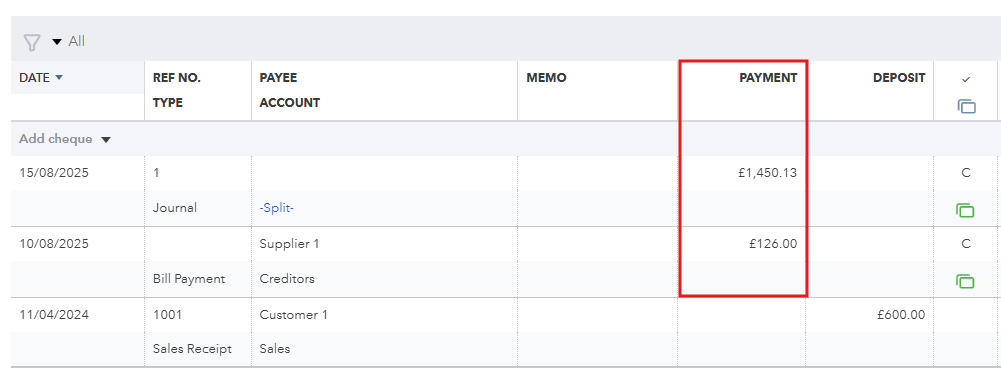

Thanks - When I look at the transaction in the register it is showing as a payment (already marked as "C"), no deposit anywhere. Is this correct? I don't want to exclude it from the transactions if it is incorrectly recorded

Yes, you're already on the right track with matching these transactions, ALKS. Let's break it down clearly to ensure we don't miss anything.

I can see that you've successfully matched the journal entry (£1450.13) and the affected invoice payable (£126) to the bank transaction (£1576.13). This part is now correct.

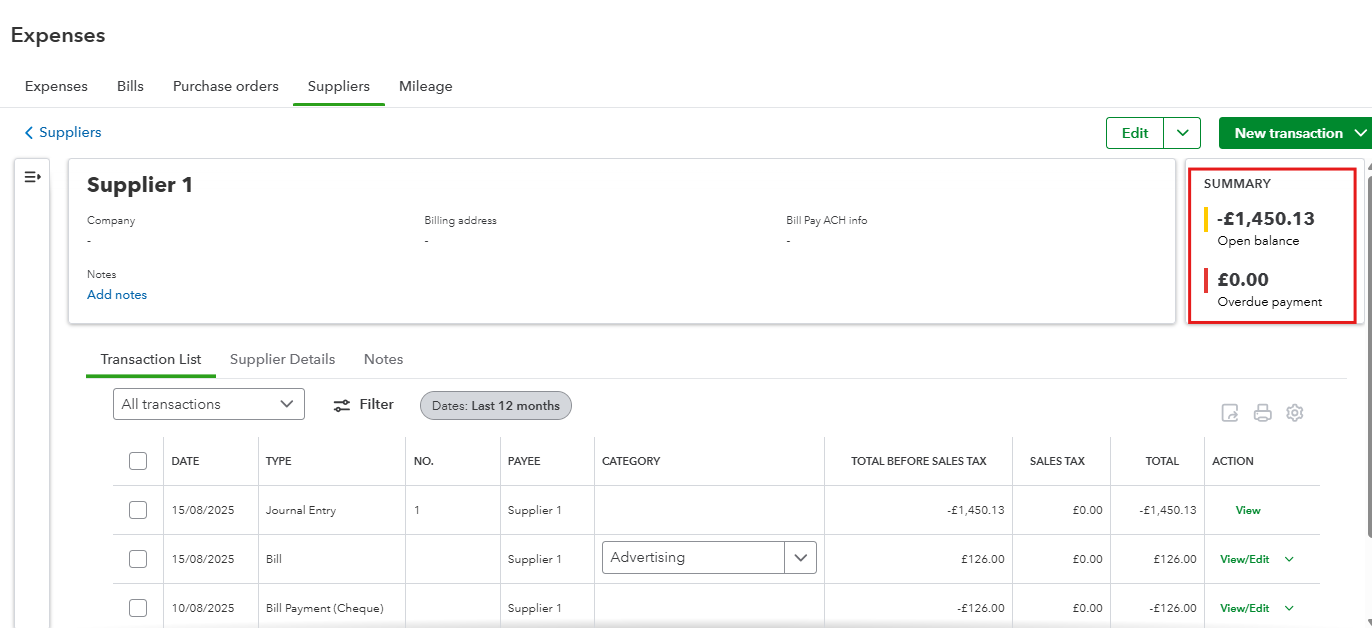

The journal entry was set up to represent the overpayment (£1450.13), which is why only Cleared payments appear in your register. This amount corresponds to the bank transaction (£1576.13). Additionally, the journal entry creates a negative Open balance in your supplier's profile, which serves as a credit.

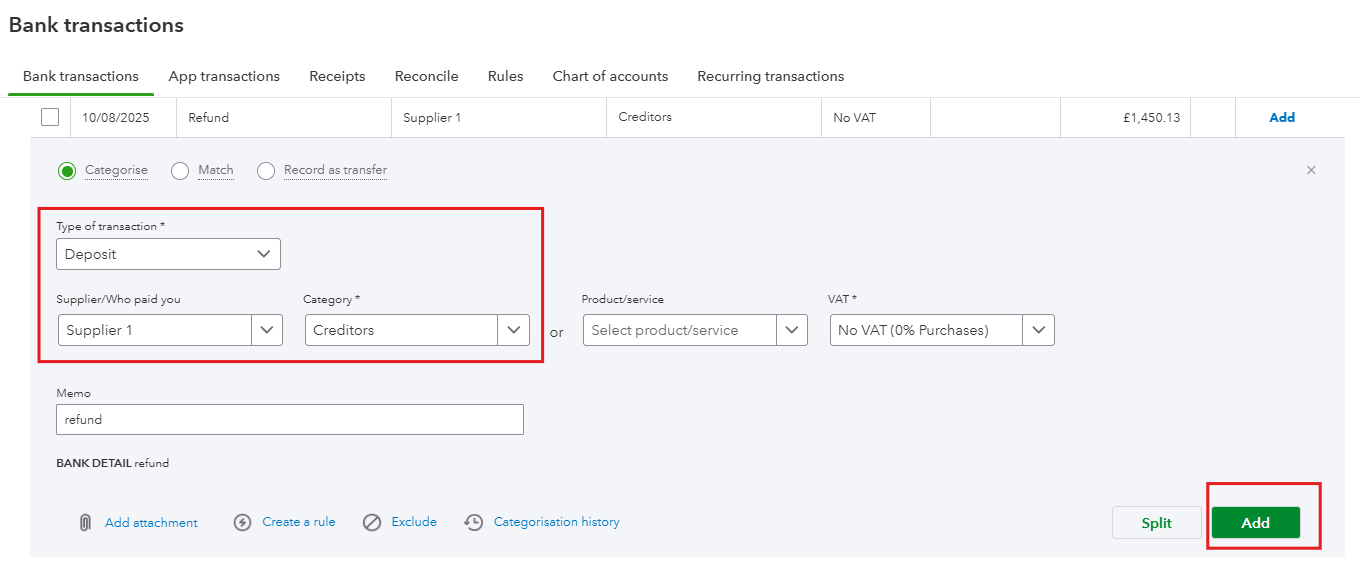

Now, let's return to the Banking (Bank transactions) page. You'll notice that the bank transaction (£1450.13) is still sitting under the RECEIVED column, awaiting categorization.

The next step is to categorize this transaction to your supplier and select Creditors as the Category. Once selected, hit the Add button.

After this, you can go back to your register and supplier's account to confirm that everything is balanced. The refund should now appear in your register, and your supplier's account balance should be £0.00.

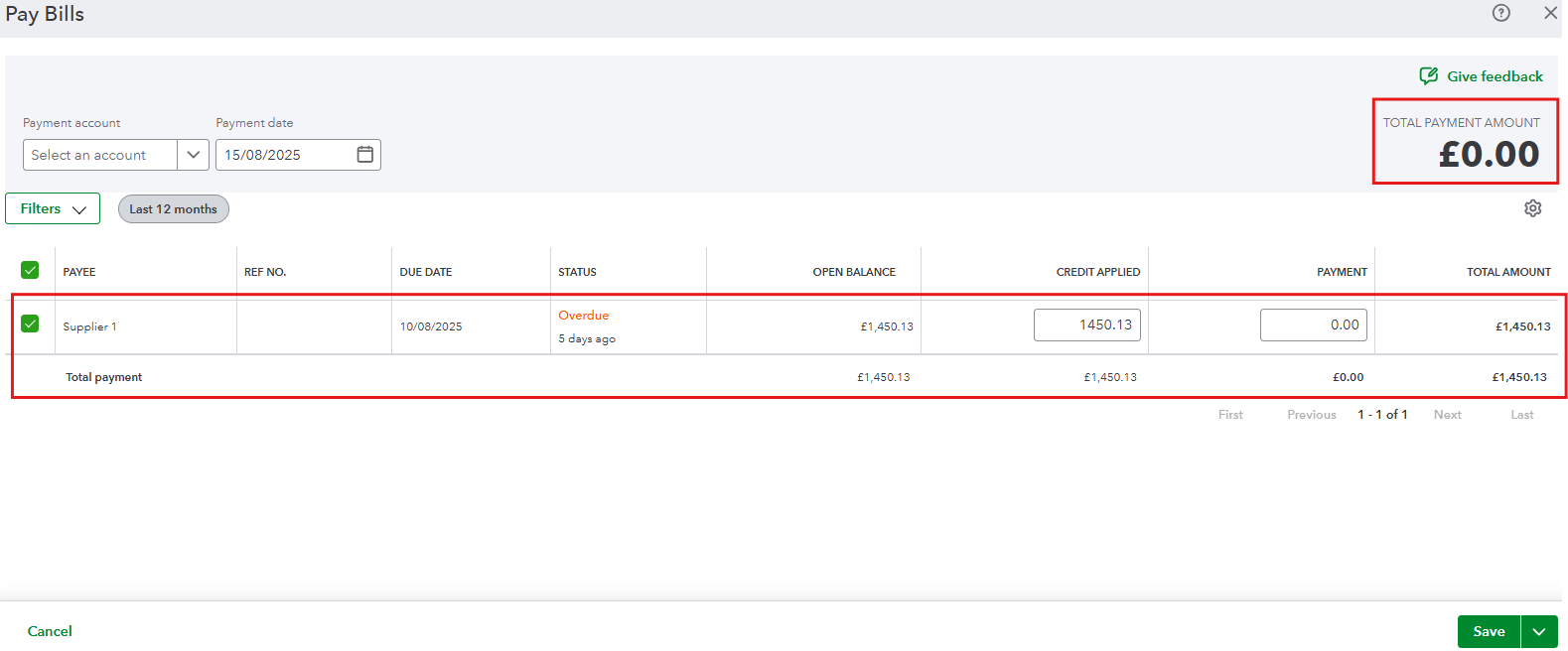

The final step is to link the refund and the journal entry on the Pay Bills page:

This process will clarify all transactions without needing to exclude any of them.

Don't hesitate to get back to us if you need further guidance or if you have any other concerns.

I'm nearly there, thank you! Just one more thing - when I try the final part of linking the Journal Entry on the pay bills page, it is asking that I put in the payment account at the top - is this simply the account that the refund was paid into? (current account)

Yes, ALKS. You've got it exactly right. The Payment Account should be your Current Account because that's where the refund from your supplier was deposited.

By selecting this account, you're connecting everything and letting QuickBooks know that the refund you received is being used to "pay off" the credit you recorded in the journal entry.

This final step clears everything out and correctly reflects that the supplier's bill has been settled.

Please don’t hesitate to leave a post below if you still need further assistance.

You’re always welcome, ALKS! We truly appreciate you taking the time to share your positive feedback with us.

We’re delighted to hear that the information above helped you balance your accounts. Your insights are incredibly valuable to us, and you can rest assured that we remain committed to delivering the highest level of support.

If you have any other questions, whether about QuickBooks Online or anything else, we’d love to hear from you again. Don’t hesitate to share your thoughts or concerns by dropping us a message below!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.