It’s great to see you in the Community, usercurtisturff.

QuickBooks Self-Employed uses the simplified in calculating your taxes. Let’s classify your running vehicle cost as travel expense to claim for fuel and repair. This also ensures it’s tracked as allowable expenses.

Here’s how:

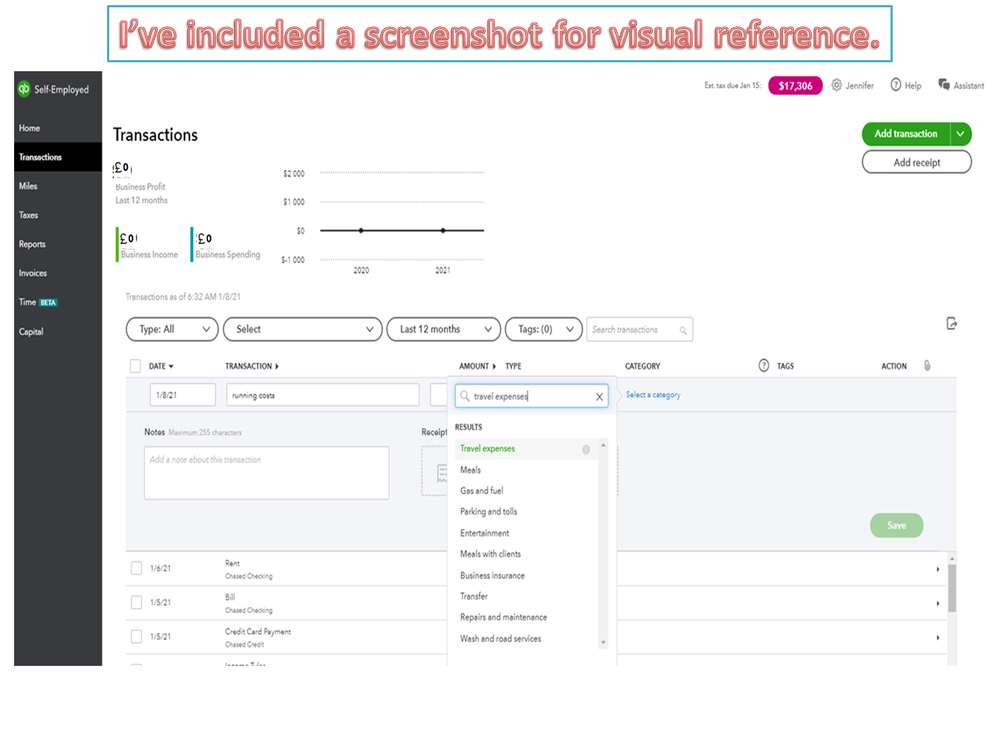

- Press the Transactions tab on the left panel and click the Add transaction button to add a line item.

- From there, fill in the field boxes with the appropriate information.

- Tap the Select a category link in the Category column to choose Travel Expenses.

- Click Save to keep the entry.

The following articles provide an overview of the categories you can use to properly account for transactions.

Feel free to reach out to me again if you have any other concerns. I’ll be glad to lend a helping hand. Have a great day ahead.