I’m glad to see you in the Community, info-thecleaning.

Based on the scenario, let’s a create service item for the percentage and use the expense account to track it. Then, create a credit note and apply it to the invoice.

I’m here to help and guide you through the process. With just a few clicks you can accomplish this task.

To add the service:

- Go to the Sales menu and click Product and services.

- Tap the New menu to choose Service.

- Enter the appropriate details in the boxes.

- In the Income account drop-down, select an expense account.

- Fill in the remaining fields.

- Hit Save and close.

To create a credit note:

- Click the New menu and pick Credit note under Customers.

- Press the Customer drop-down and choose the correct name.

- In the Product/Service column, key in the service item previously created.

- Enter the appropriate information in the boxes.

- In the Amount column, type the figure based on the percentage taken out by your estate agent.

- Hit Save and close.

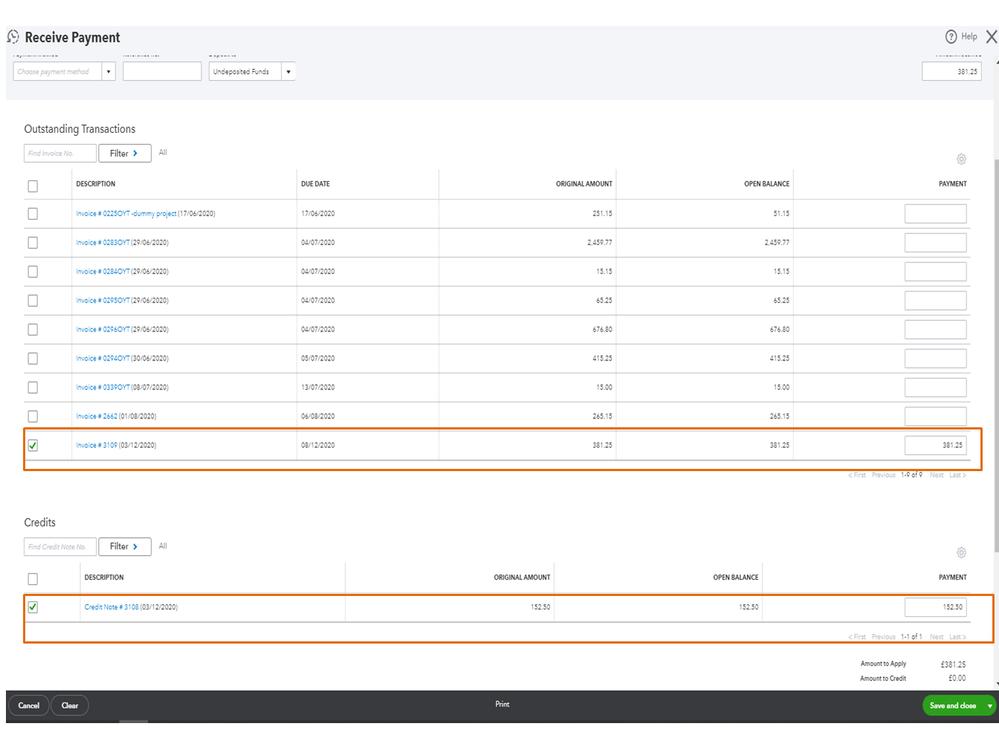

To apply the credit note to the invoice:

- Hit the New menu at the top and choose Receive Payment.

- Enter the necessary information in the Receive Payment window.

- Locate the invoice you’re working on and mark the box.

- In the Credits section, tick the box for the credit note.

- Click Save and close.

For more insights into the process, check out the Create and apply credit notes or delayed credits in QuickBooks Online guide. Additionally, these articles will guide you on how to perform the following tasks in your company.

Feel free to click the Reply button if you have other questions about the product. I'm here to lend a helping hand. Have a great day!