Welcome to the Community space, karenevans40. I've got your back, and I'll walk you through so you can mark your invoices as paid in QuickBooks Online (QBO).

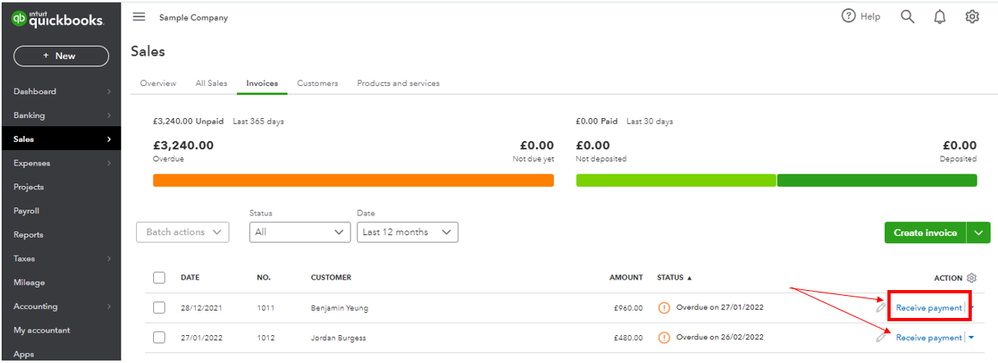

Before anything else, I'd like to congratulate you for choosing QuickBooks for your business. There are a few different ways to mark an invoice as paid. You can go to the Sales tab and click the Invoices or create a Receive Payment to mark it as paid in QuickBooks. Let me show you how:

- Access your QuickBooks Online company.

- On the left navigational bar, go to the Sales tab.

- Select Invoices.

- Choose the invoice, and then from the Action column, click the Receive payment button.

- Make sure the amount is correct, then hit Save and close.

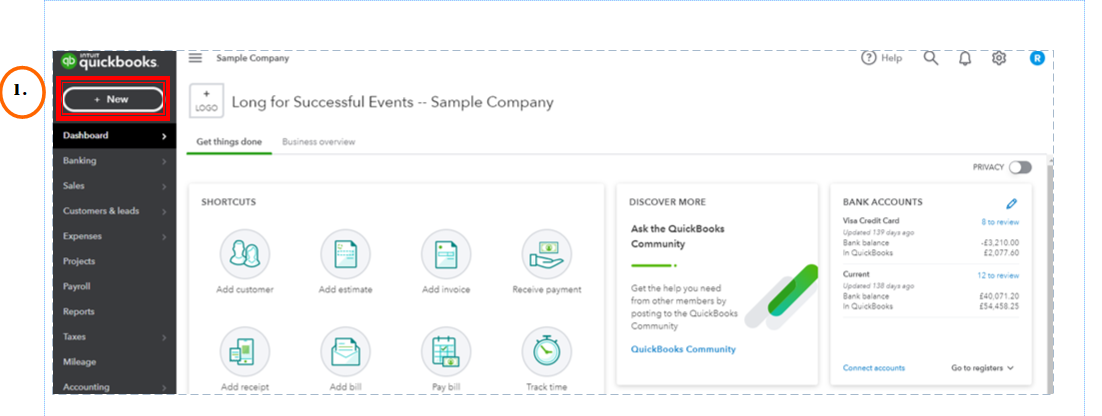

To manually mark the invoice as paid in QBO, you'll want to go to the Receive Payment section, which you can find if you click the +New button on the left navigational bar. I'll input the steps below so you can proceed. Here's how:

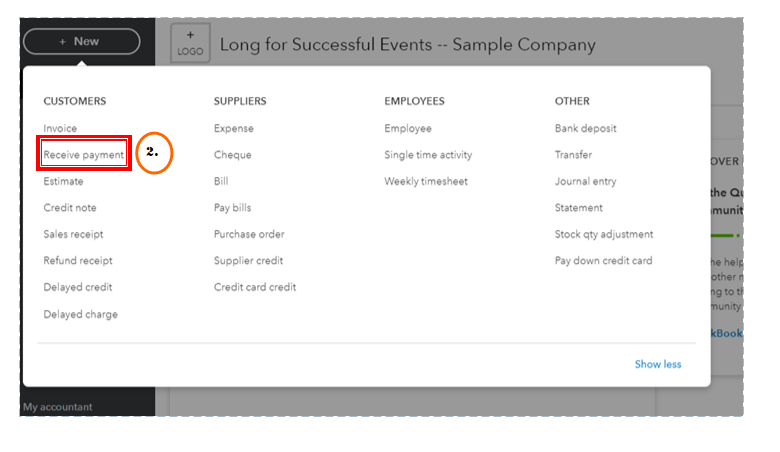

- Click + New, then select Receive payment.

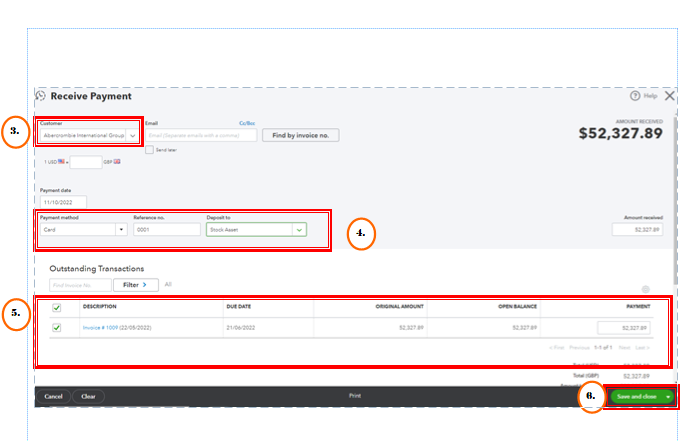

- From the Customer drop-down, select the name of the customer.

- From the Payment method drop-down, select the payment method.

- From the Deposit drop-down, select the account you put the payment into.

- From the Outstanding Transactions section, mark all open invoices of the customer.

- Click Save and close.

For visual reference, see the screenshots that I've attached.

For more information, check this article: Record invoice payments in QuickBooks Online. Once done go to the All Sales tab to verify the invoices that are paid.

I'm also sharing a link to learn when to record or use the Bank deposit feature in QBO for guidance: Record and make bank deposits in QuickBooks Online.

In addition, I've got you these articles in case you'd like to customize your sales forms and reconcile your accounts in QBO:

If you have any other questions or concerns besides marking invoices as paid, please don’t hesitate to drop a comment below. I’ll be here to assist you. Take care!