Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Glad to see you in the Community, lorraine10.

Yes, you can change the original invoice if you haven’t filed the tax return. Manually open each one and then enter the correct labour code.

Here's how:

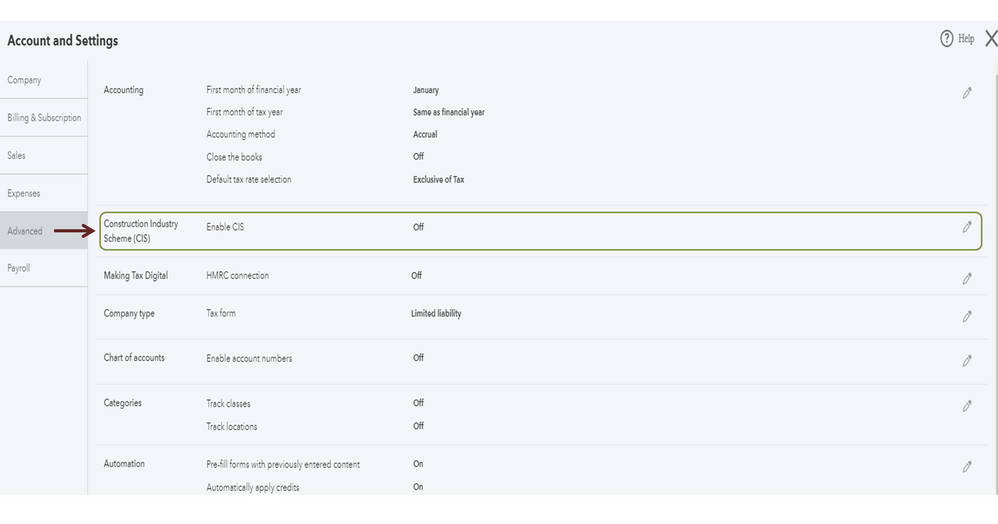

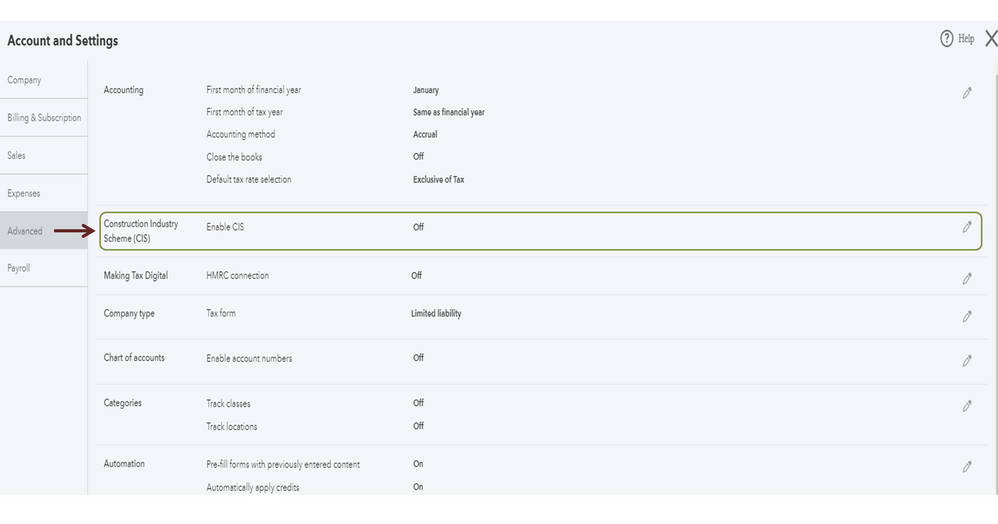

If you haven’t activated the CIS, let’s go to the Account and Settings page to perform the task. This is to ensure you can track transactions using the correct code.

Here’s how:

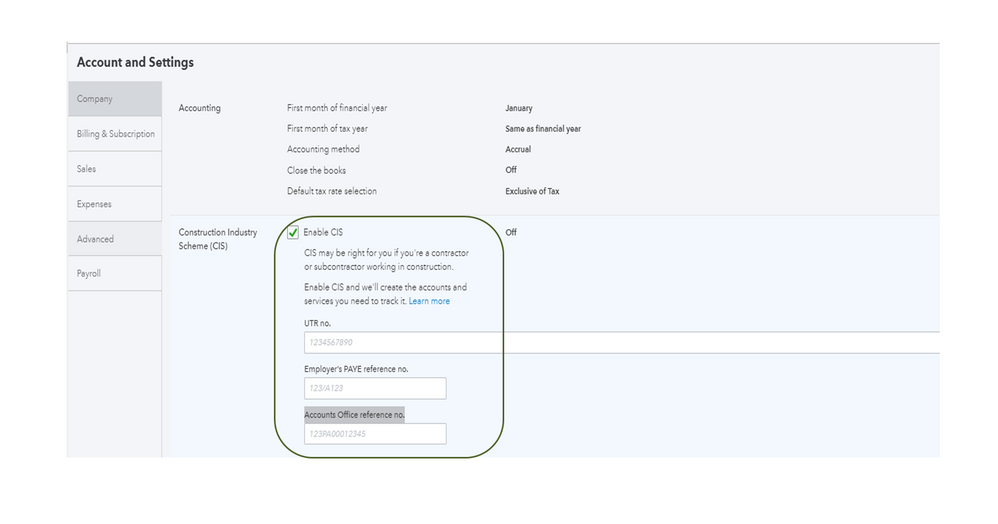

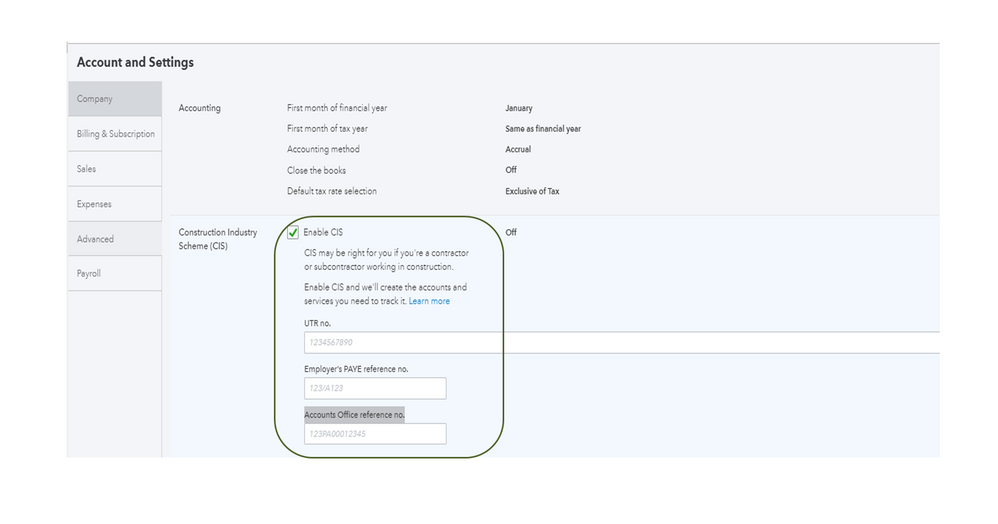

After turning on the Construction Industry Scheme, you’ll see the following information in QBO.

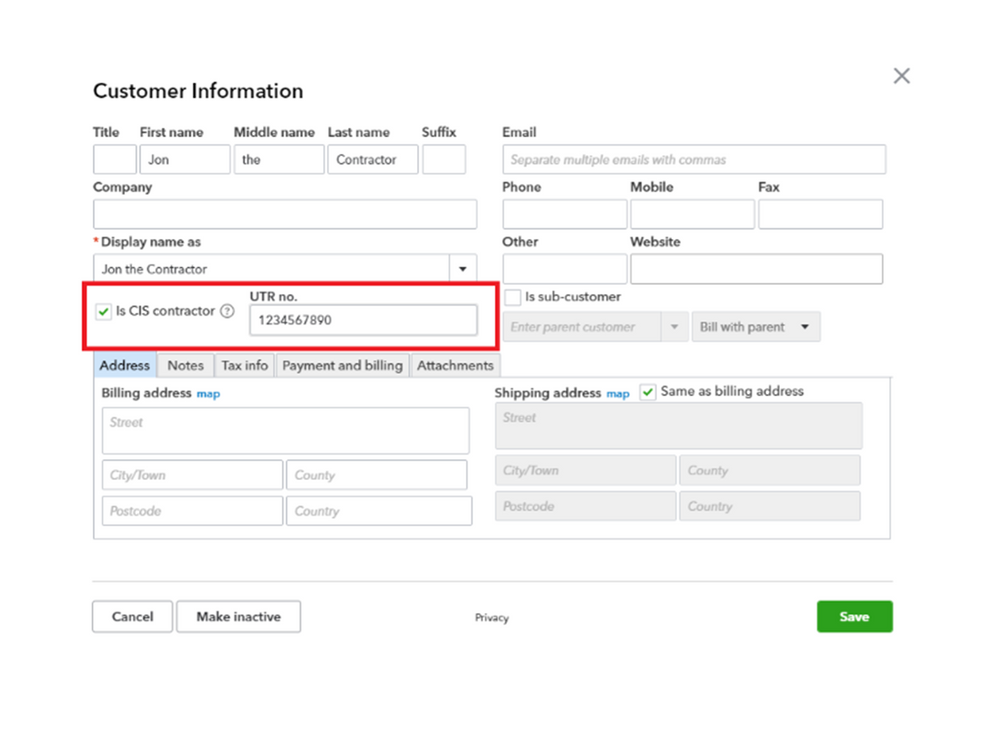

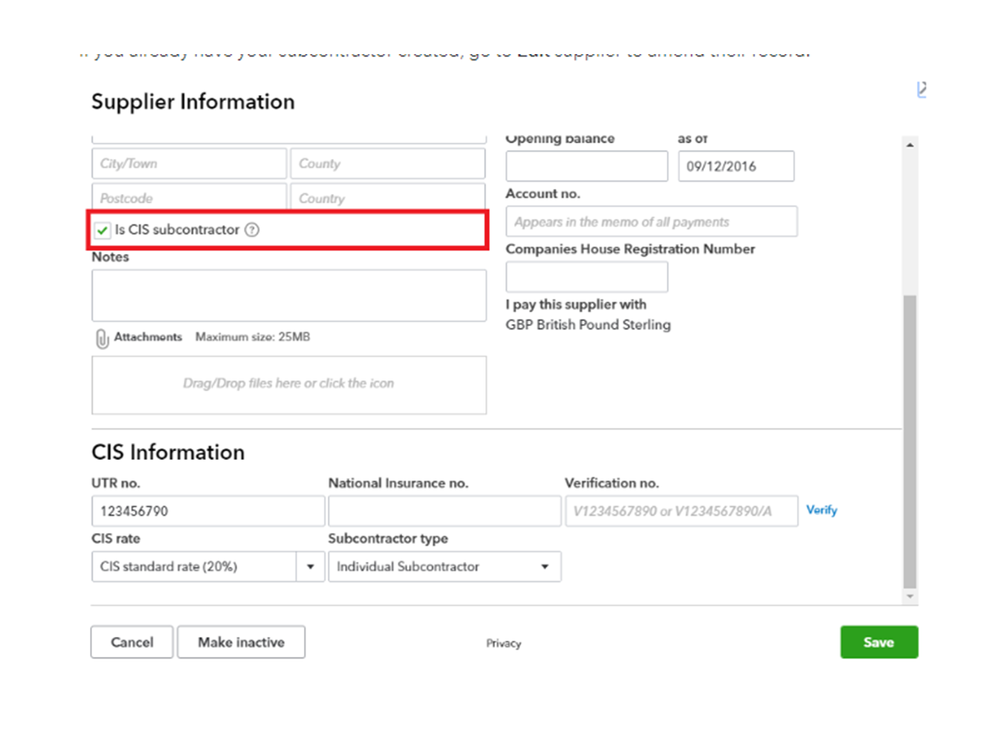

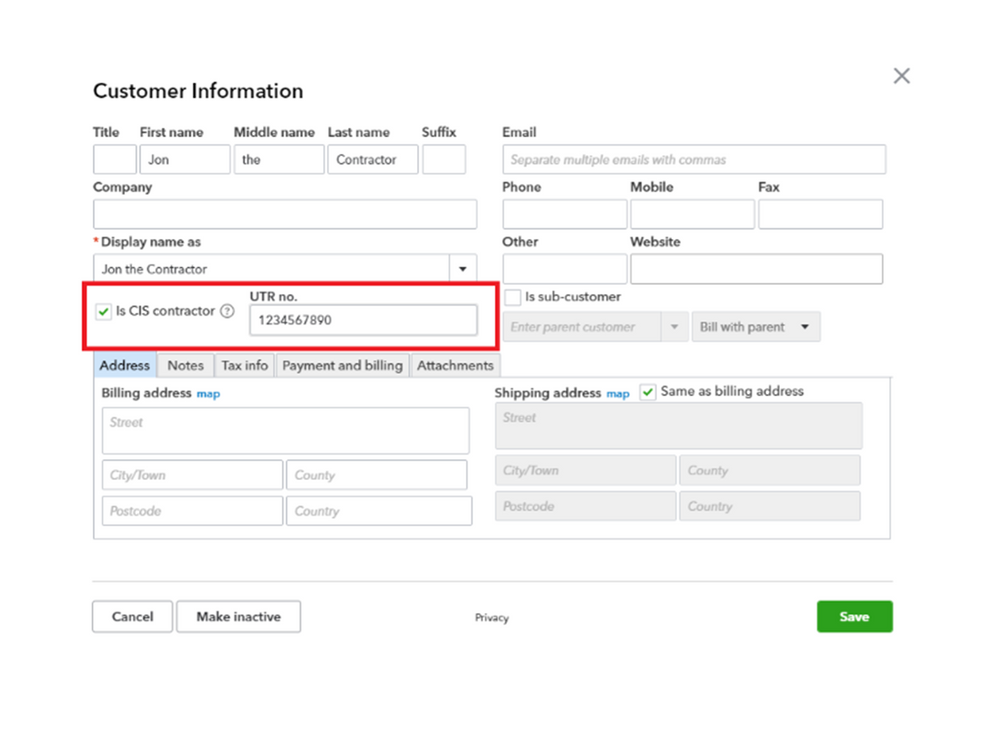

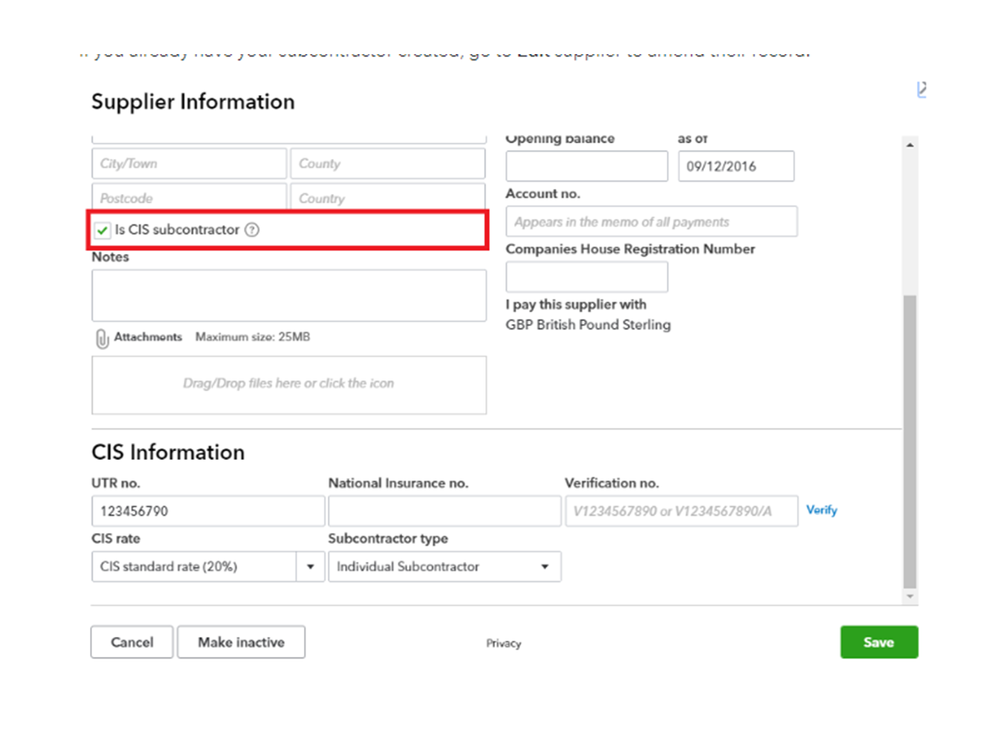

Then, add a contractor or subcontractor. Let me show the step by step process.

To set up a contractor:

To add a subcontractor:

However, if the suppliers and customers are already added in QBO, edit the information and make sure each one is set to track the CIS. Check out the following Already using CIS in QuickBooks article and go directly to the Add a contractor and Add a subcontractor section for detailed steps.

If you’ve submitted the tax form, I suggest contacting our QBO Care Team. One of our agents, we'll assist in unfiling the form to make sure you’ll submit the correct one.

Here’s how:

You can bookmark the CIS in QuickBooks Online article for future reference. It outlines the instructions on how to create CIS transactions. Aside from that, it contains information about paying subcontractors, receiving payments, or creating transactions using the bank feeds.

Stay in touch if you have any other concerns or questions. I’ll be right here to answer them for you. Enjoy the rest of the day.

Glad to see you in the Community, lorraine10.

Yes, you can change the original invoice if you haven’t filed the tax return. Manually open each one and then enter the correct labour code.

Here's how:

If you haven’t activated the CIS, let’s go to the Account and Settings page to perform the task. This is to ensure you can track transactions using the correct code.

Here’s how:

After turning on the Construction Industry Scheme, you’ll see the following information in QBO.

Then, add a contractor or subcontractor. Let me show the step by step process.

To set up a contractor:

To add a subcontractor:

However, if the suppliers and customers are already added in QBO, edit the information and make sure each one is set to track the CIS. Check out the following Already using CIS in QuickBooks article and go directly to the Add a contractor and Add a subcontractor section for detailed steps.

If you’ve submitted the tax form, I suggest contacting our QBO Care Team. One of our agents, we'll assist in unfiling the form to make sure you’ll submit the correct one.

Here’s how:

You can bookmark the CIS in QuickBooks Online article for future reference. It outlines the instructions on how to create CIS transactions. Aside from that, it contains information about paying subcontractors, receiving payments, or creating transactions using the bank feeds.

Stay in touch if you have any other concerns or questions. I’ll be right here to answer them for you. Enjoy the rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.