Hi,

How are UK QBO users recording PayPal fees using the bank feed? Everything I watch on Youtube has one line and the fees just automatically get sent to a PP fee account.

On my UK QBO I have one entry for the full payment into paypal and a second line for the fee. No matter what I do I cant figure out how to record the two transactions correctly.

Can any humans help?? No bot replies please. Thank you

Hi, HM2019. I'd be delighted to assist you in recording your PayPal payments and their associated fee accordingly.

There are multiple ways to record bank feed fees in QuickBooks Online (QBO). The process relies on your bank statement and who is responsible for the fee. With this, you can accurately track and account for bank feed fees in QBO.

If you charge your clients for the fees, you can include them when tracking their invoices. To start, create an expense account to allocate the bank feeds to, then set up a service item through the Products and Services window.

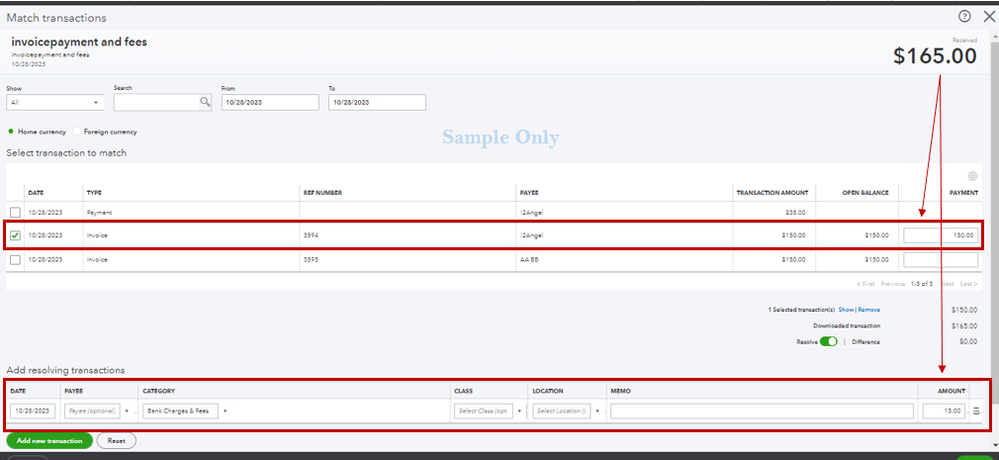

Once done, add the fee to the next line item on your invoices. I'm adding this screenshot as your visual reference.

On the other hand, if you pay for the bank fees, you should record your invoices as they are and track the fee when making a deposit.

Once your PayPal payments are downloaded to QuickBooks, match them to your manually added entries to avoid duplicate transactions. You may utilize the resolve difference feature if needed.

If you have follow-up questions while tracking PayPal fees in our system, let me know by leaving a comment below. I'm just a few clicks away to help you again. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.