It's great to have you here in the Community, homesafe1. I recognize how important it is to accurately record your invoice in QuickBooks. I'm here to help you with that.

We can add the 12% as a second line item on the invoice and then enter the amount as a negative. This way, the amount will not be reported as income.

Before proceeding, we'll have to create an expense account and a Service item. I'll show you how:

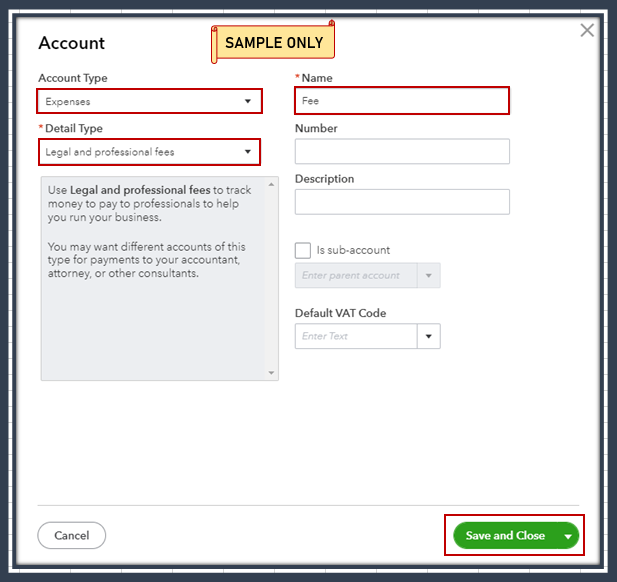

Create an account:

- Go to the Gear icon and then select Chart of Accounts.

- Click on Add new.

- Select Expenses under the Account Type section, choose the detail type, then add the account's name.

- Once done, click on Save and close.

I also recommend reaching out to your accountant in choosing the right expense account to avoid confusion and discrepancies.

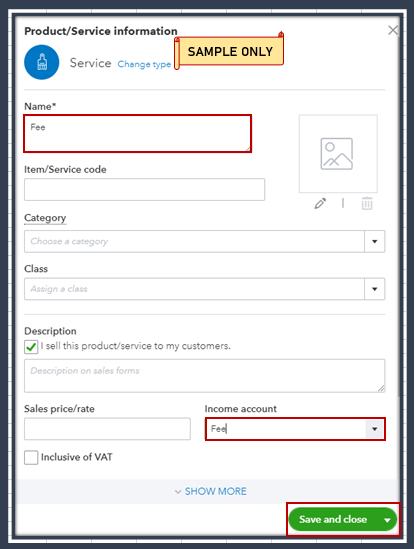

Add a service item:

- From the Gear icon, select Products and Services.

- Choose New, then Service.

- Add the necessary information.

- On the Income account section, choose the account created.

- Click Save and close.

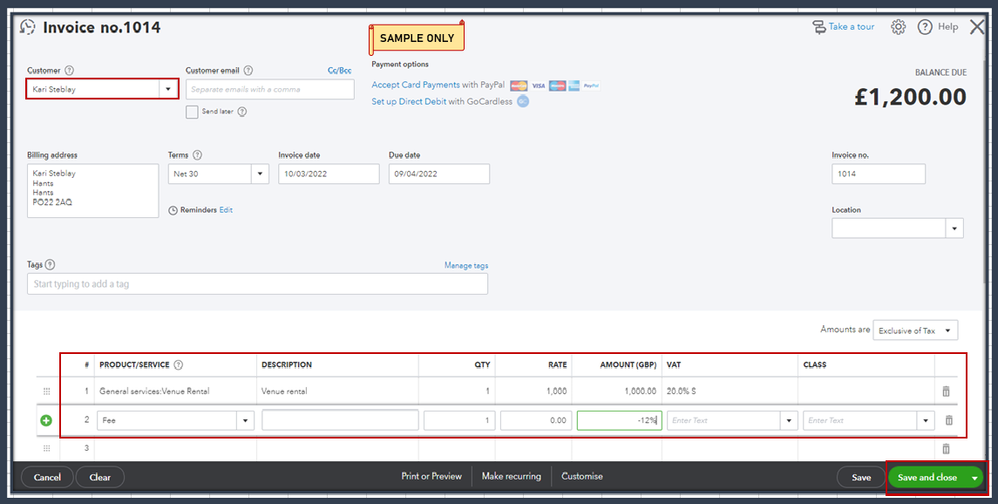

After that, we can now create an invoice. Here's how:

- Go to the + New menu.

- Select the customer's name.

- Add the necessary details to the invoice.

- On the second line item, select the service item then add the -12%.

- Once done, click on Save and close.

Additionally, I've included an article that'll help you track all the invoices that are due on a particular day or date range. This ensures all the transactions are paid on time: Pull up a Transaction Detail By Account Report.

I'm only a few clicks away if you need assistance with your other QuickBooks tasks, homesafe1. It's always my pleasure to help you out again.