Good to see you here in the Community space, welderwatkins. I'll share insights on how to ensure that your customers pay the invoice correctly in QuickBooks.

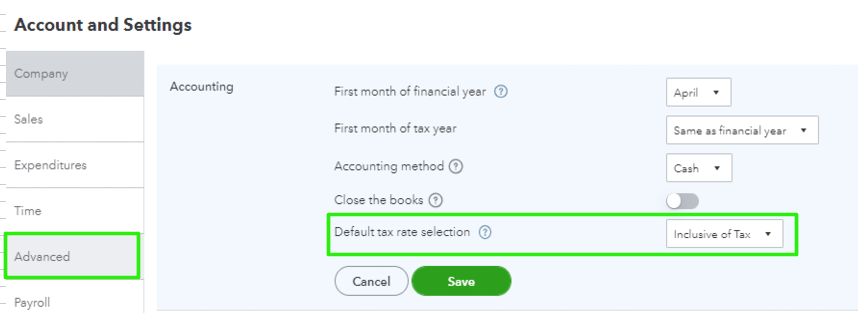

Ensure the default tax rate is set to Inclusive of Tax in the Account and Settings when creating invoices. This way, the inclusive tax will appear on your invoices, as the invoice layout will display the vat required when you send it to your customer.

To make it default, follow the steps below:

- Go to the Gear icon in the upper-right corner and select Account and Settings.

- Select the Advanced tab and go to the Accounting section.

- Choose Inclusive of Tax in the Default tax rate selection field.

- Click Save and Done.

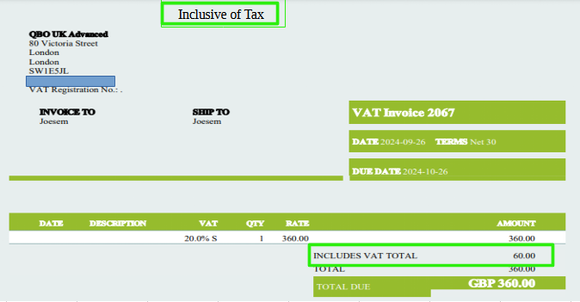

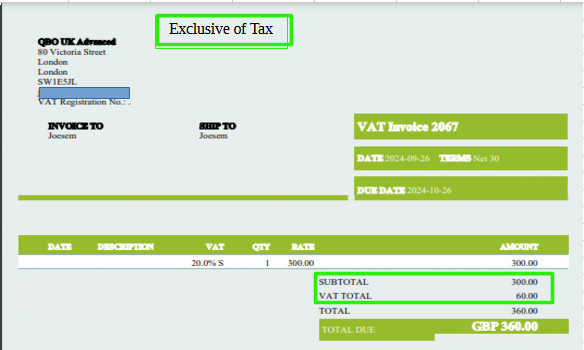

Also, inclusive tax indicates that the Value-Added Tax (VAT) is already included in the price, while exclusive tax means it's not included and will be added to the pre-tax selling price.

In addition, here's an article that you can check if you want to edit tax rates and how to personalise your sales forms in QBO:

If you have any other questions about your taxes or need help with QBO, just hit the Reply button below. I’m here to assist. Looking forward to helping you soon!