Hey there, keithhaxton.

Let me welcome you first to the Online Community. Yes, you can still track reimbursable transactions in the Essentials version.

To accomplish this, create an expense and then record a bank deposit to offset the amount. Here's how:

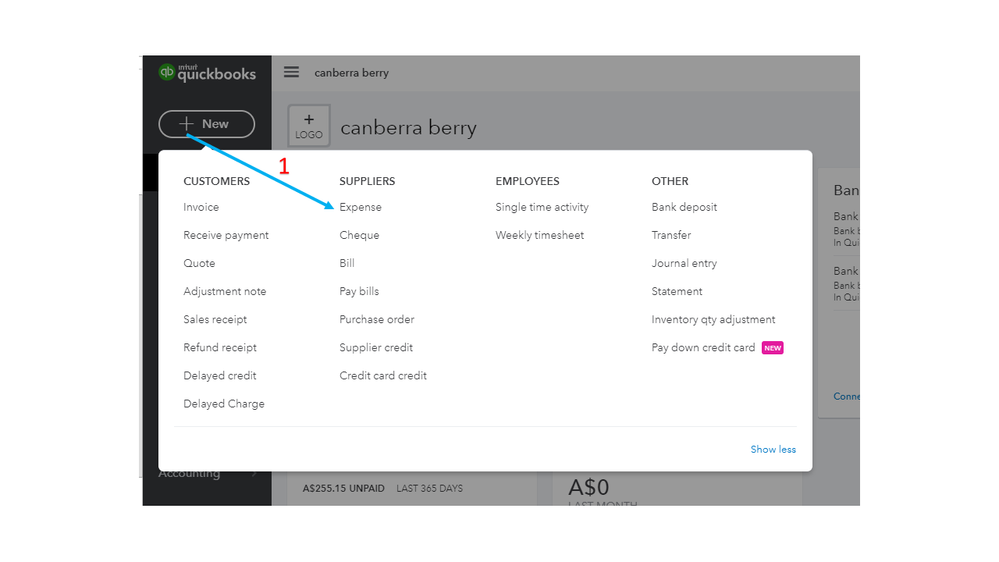

- In the upper left panel of your company, tap the New menu to choose Expense.

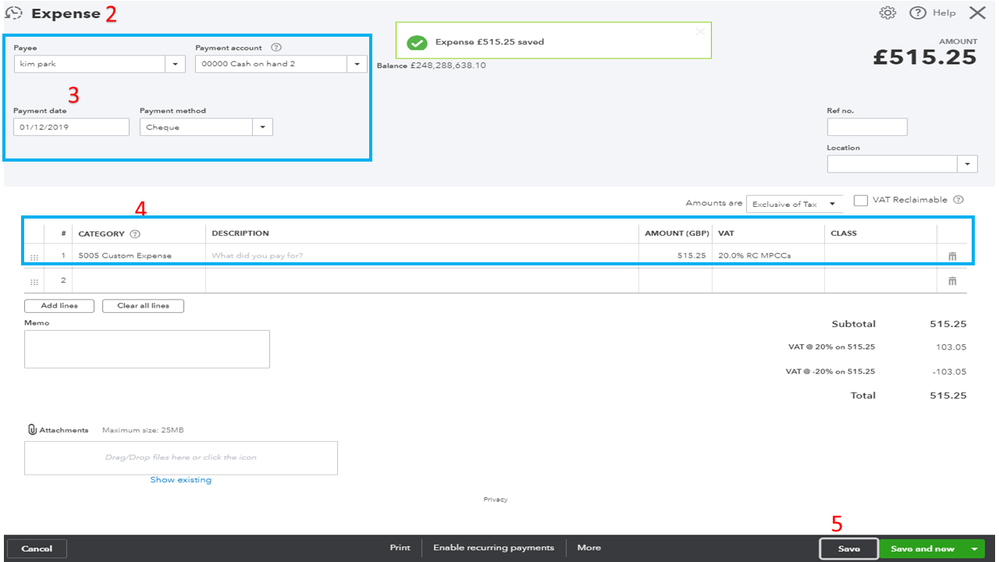

- Selecting these actions will open the Expense page.

- From there, input the customer's name in the Payee box, date and payment method in the appropriate fields.

- Enter the correct posting account under the Category column and amount.

- Click Save to keep the entry.

Here's how to track a bank deposit:

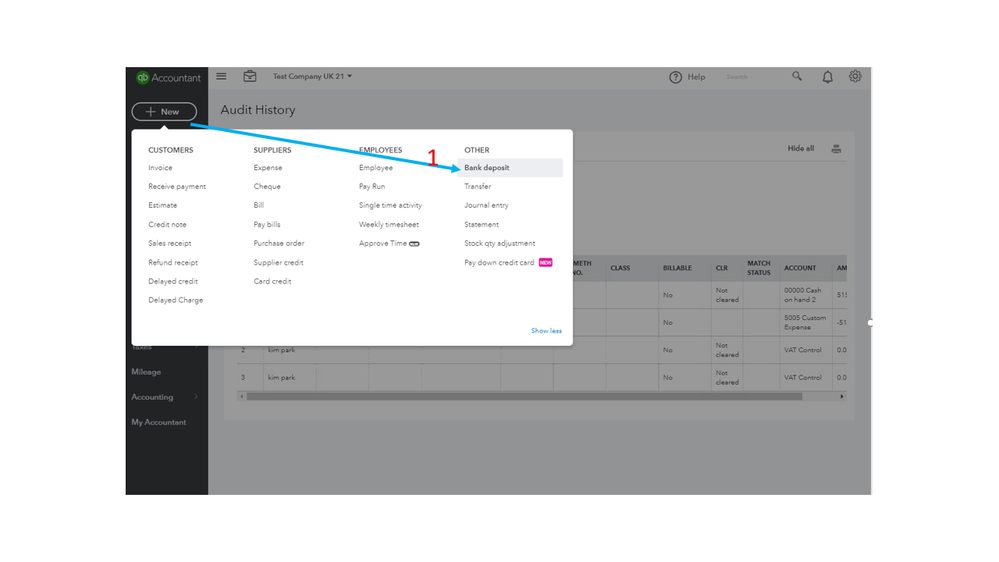

- Tap the New menu in the left panel and pick Deposit under the Other section.

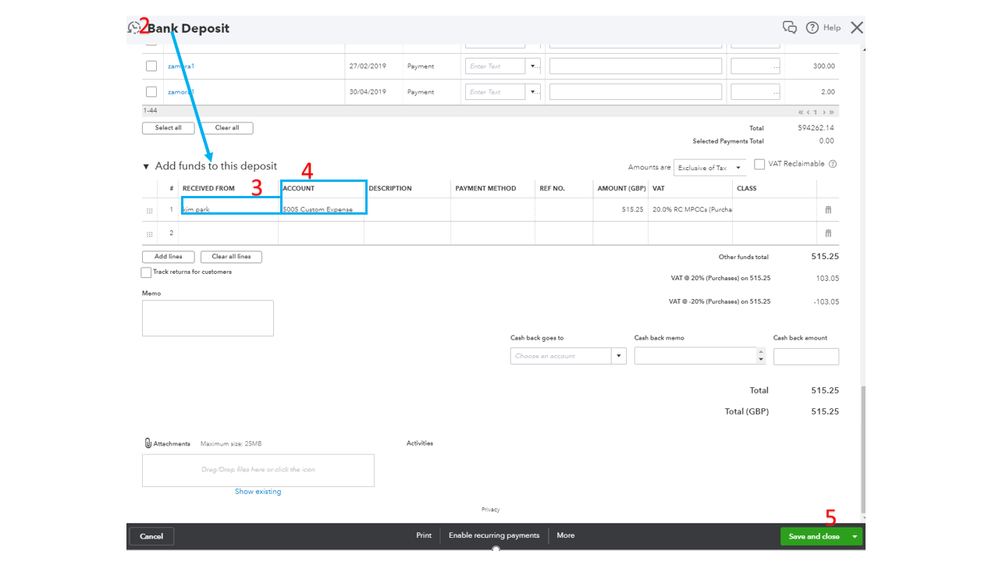

- On the Bank Deposit page, scroll down to the Add funds to this deposit section.

- Click the drop-down under the Received From column and enter the correct payee.

- Next, type in the same account you used for the expense in the Account column and the appropriate amount.

- Once done, press the Save and close button.

I’m also adding an article containing links that will guide you on how to easily manage the business using QuickBooks. Simply click the topic to view the complete details: How do I?

Reach out to me whenever you have any other concerns or further questions about QuickBooks. I’ll be right here to help you. Enjoy the rest of the day.