Hi, HM2019. I'd be delighted to assist you in recording your PayPal payments and their associated fee accordingly.

There are multiple ways to record bank feed fees in QuickBooks Online (QBO). The process relies on your bank statement and who is responsible for the fee. With this, you can accurately track and account for bank feed fees in QBO.

If you charge your clients for the fees, you can include them when tracking their invoices. To start, create an expense account to allocate the bank feeds to, then set up a service item through the Products and Services window.

- Tap on Products and Services from the Gear icon.

- Select New on the right-hand side.

- Choose Service, then name it Bank Fees.

- Select the Expense Account you just created under Income Account.

- Tap Save.

Once done, add the fee to the next line item on your invoices. I'm adding this screenshot as your visual reference.

On the other hand, if you pay for the bank fees, you should record your invoices as they are and track the fee when making a deposit.

- Record an invoice payment under Undeposited Funds.

- Make a deposit.

- Go to the +New icon, then Bank Deposit.

- Select the undeposited amount under Select the payments included in this deposit.

- Enter the fees under the Add funds to this deposit section.

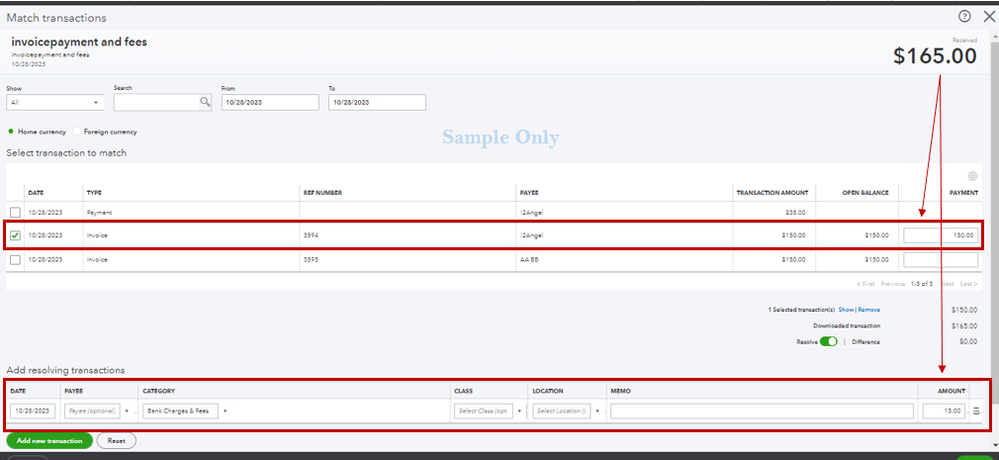

Once your PayPal payments are downloaded to QuickBooks, match them to your manually added entries to avoid duplicate transactions. You may utilize the resolve difference feature if needed.

If you have follow-up questions while tracking PayPal fees in our system, let me know by leaving a comment below. I'm just a few clicks away to help you again. Have a good one!